Please use a PC Browser to access Register-Tadawul

Assessing PJT Partners (PJT) Valuation After Strong Multi Year Shareholder Returns

PJT Partners, Inc. Class A PJT | 151.63 | -0.76% |

PJT Partners (PJT) has drawn investor attention after recent gains over the past week, with the stock closing at US$179.53. That move comes alongside recent revenue of US$1,657.789 million.

The latest weekly gain fits into a steadier picture, with a 90 day share price return of 4.99% and a 1 year total shareholder return of 16.81% pointing to building momentum, supported by a very large 3 year total shareholder return of 132.94%.

If PJT Partners has you rethinking opportunities in financials, this could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With PJT Partners trading close to its analyst price target and carrying a low value score, the key question is whether recent growth and returns leave much upside or whether the market is already pricing in future gains.

Price-to-Earnings of 24.5x: Is it justified?

On a P/E of 24.5x at a last close of US$179.53, PJT Partners screens as more expensive than its peer group average and above our modelled fair value.

The P/E multiple compares the current share price to the company’s earnings, so it effectively tells you how much investors are paying for each dollar of profit. For an advisory focused investment bank like PJT Partners, this is a common yardstick because earnings quality, return on equity and growth expectations tend to drive how much investors are willing to pay.

According to the SWS DCF model, PJT Partners is trading well above an estimated fair value of US$91.85, suggesting the market is placing a premium on its earnings that is not reflected in that cash flow based estimate. At the same time, the company’s P/E of 24.5x is higher than the peer average of 16.8x, which points to investors assigning a richer multiple than comparable names even though its revenue growth is forecast at 9.5% per year and slower than both the US market and the 20% high growth threshold.

Against the broader US Capital Markets industry, PJT Partners looks slightly cheaper, with its 24.5x P/E sitting below the sector average of 25.9x. So while the shares look expensive relative to close peers and the SWS DCF estimate, they do not stand out as stretched when set against the wider industry where similar earnings based valuations are common.

Result: Price-to-Earnings of 24.5x (OVERVALUED)

However, you also need to weigh risks such as any slowdown in advisory deal activity and the possibility that a rich P/E multiple contracts if sentiment cools.

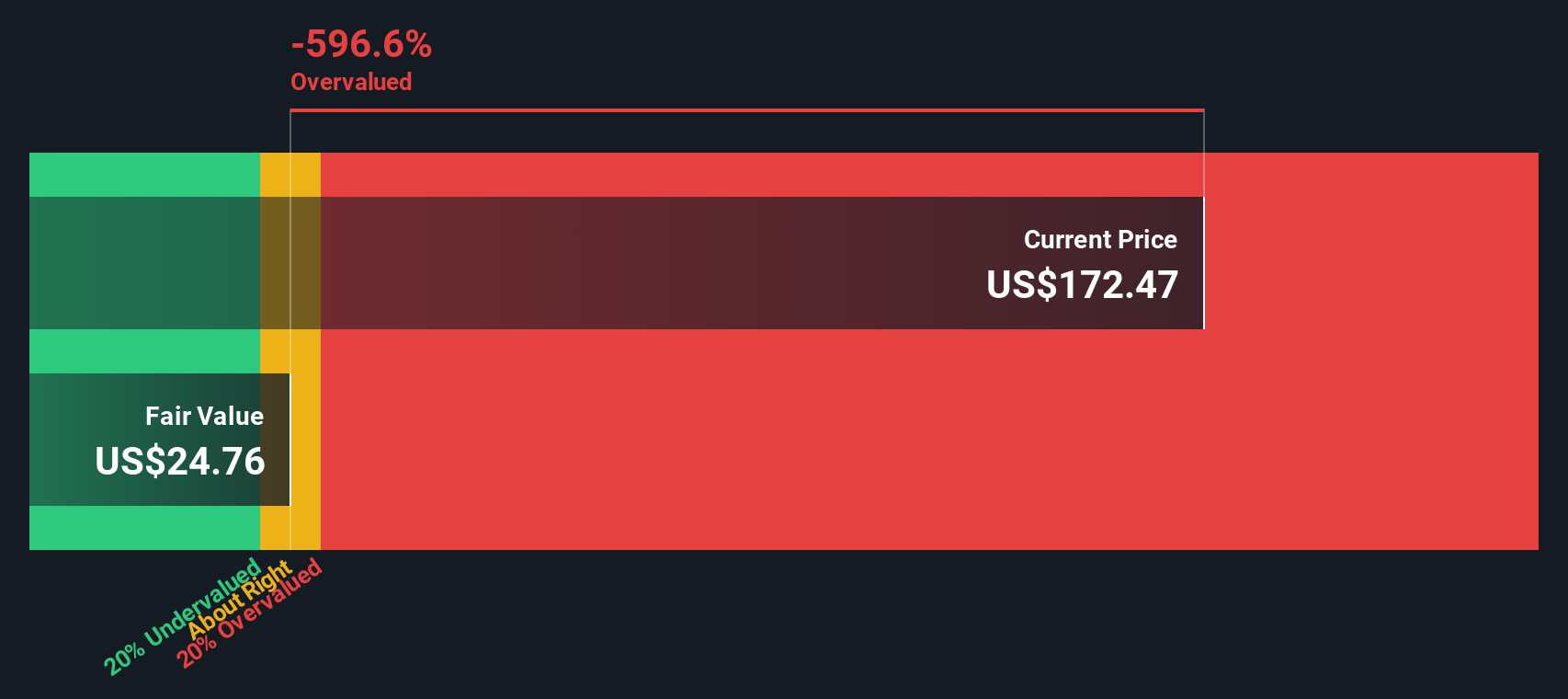

Another View: DCF Points to a Very Different Price

While the 24.5x P/E suggests PJT Partners is only slightly rich compared to many Capital Markets names, the SWS DCF model paints a sharper picture. With a fair value estimate of US$91.85 versus a share price of US$179.53, the stock screens as clearly overvalued on this method.

That gap implies limited room for error if business conditions or sentiment weaken, because expectations already look high in the cash flow model. It leaves you weighing a simple question: do you trust the earnings multiple more, or the DCF signal that the market might be running ahead of itself?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PJT Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PJT Partners Narrative

If you see the numbers differently or simply prefer to test your own view against the data, you can build a personalised thesis in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding PJT Partners.

Looking for more investment ideas?

If PJT Partners has sharpened your thinking, do not stop here. The best opportunities often sit just outside your current watchlist, so keep widening your search.

- Target potential value by scanning these 879 undervalued stocks based on cash flows that may offer prices below what their cash flows suggest.

- Tap into cutting edge tech trends with these 28 AI penny stocks that are connected to artificial intelligence themes.

- Boost your income focus by checking out these 11 dividend stocks with yields > 3% that might suit a yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.