Please use a PC Browser to access Register-Tadawul

Assessing Precigen (PGEN) Valuation After PAPZIMEOS Commercial Momentum And EMA Milestone

Precigen Inc PGEN | 4.93 | +4.01% |

Why the latest PAPZIMEOS update matters for Precigen (PGEN)

Precigen (PGEN) just highlighted rapid commercialization momentum for PAPZIMEOS, the only FDA approved therapy for adults with recurrent respiratory papillomatosis, alongside expanding US payer coverage and a validated European Medicines Agency filing.

The PAPZIMEOS update lands after a mixed stretch of trading, with a 1 day share price return of 5.76% and a 30 day share price return of 15.75% lifting the stock to $4.41. The 1 year total shareholder return of 290.27% points to strong momentum despite more modest year to date share price performance of 3.04%.

If PAPZIMEOS has put Precigen on your radar, it might be a good time to broaden your watchlist with other healthcare stocks that are trying to reshape patient care.

With Precigen trading at US$4.41 and the average analyst price target cited at US$8.50, the key question for you is simple: is there still mispricing here, or is the market already baking in future growth?

Price to Book of 37.3x: Is it justified?

Precigen trades at a P/B of 37.3x, which sits well above its last close price context and points to a rich valuation relative to book value.

The P/B ratio compares the company’s market value to its net assets on the balance sheet. It is a common check for asset heavy or early stage biotech names where earnings are still negative.

For Precigen, this high P/B suggests the market is placing a sizeable premium on its pipeline, platforms and revenue potential, rather than on current net assets or reported profitability. With the company still loss making and recording a net loss of US$425.9m on revenue of US$6.3m, that gap between book value and market value is significant.

The contrast becomes clearer when you compare that 37.3x P/B with the peer average of 4.6x and the broader US Biotechs industry average of 2.7x. This indicates investors are paying a multiple that is many times higher than typical sector levels.

Result: Price to book of 37.3x (OVERVALUED)

However, you also need to weigh the large US$425.9m loss against the very high 37.3x P/B, as well as the clinical, regulatory and commercialization hurdles still ahead.

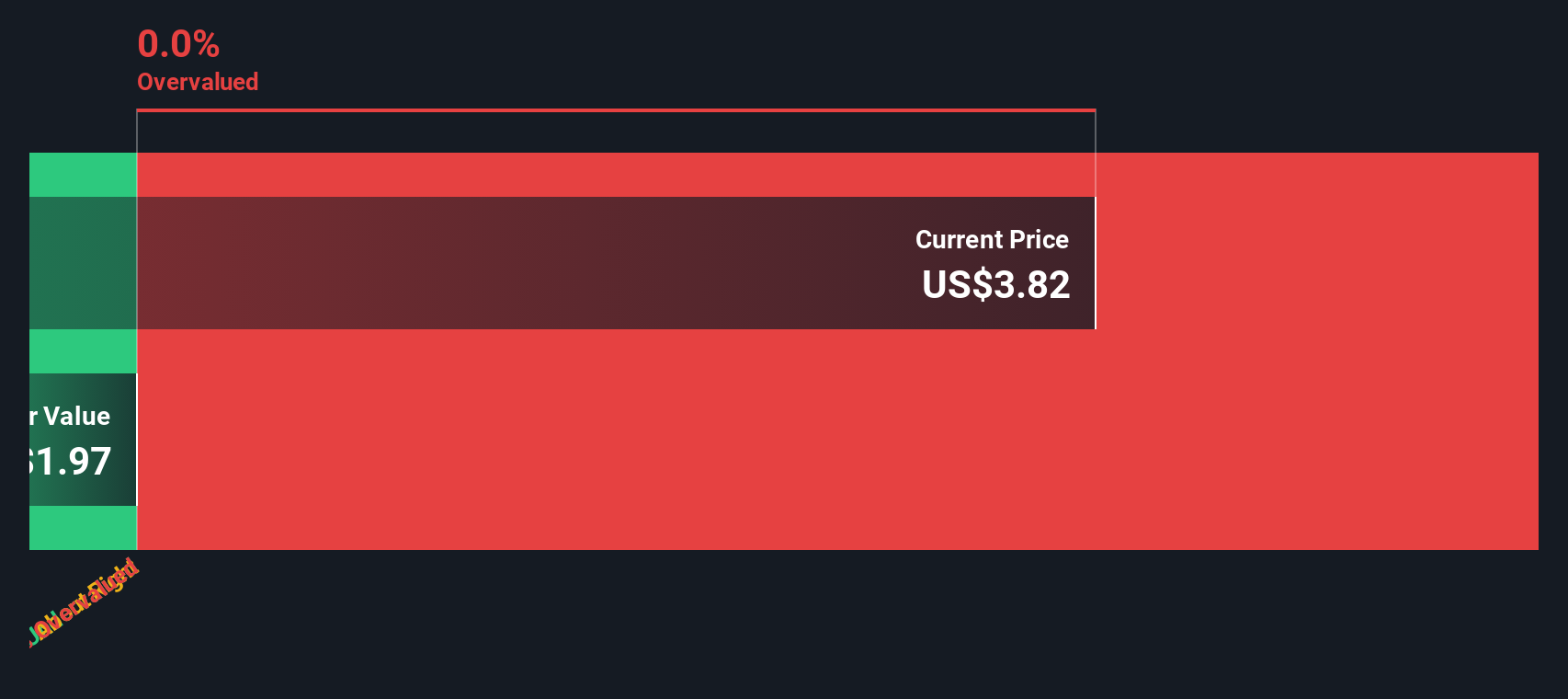

Another View: Our DCF Model Sees Less Upside

While the 37.3x P/B suggests a very rich price versus book value, our DCF model points in the same direction. At US$4.41, Precigen trades above our fair value estimate of US$0.80. This limits room for error if expectations on PAPZIMEOS or the broader pipeline change.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Precigen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Precigen Narrative

If you see the numbers differently or prefer to piece together your own view, you can build a custom Precigen thesis in just a few minutes: Do it your way

A great starting point for your Precigen research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss other opportunities that better fit your goals. Consider widening your lens and pressure testing your thesis across the market.

- Scan for potential value opportunities by checking out these 884 undervalued stocks based on cash flows that trade below what their cash flows might suggest.

- Tap into the AI trend by reviewing these 25 AI penny stocks that are building tools, platforms and services around artificial intelligence.

- Strengthen your income watchlist by focusing on these 12 dividend stocks with yields > 3% that could help support a more reliable return stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.