Please use a PC Browser to access Register-Tadawul

Assessing PROCEPT BioRobotics (PRCT) Valuation As Fresh Analyst Downgrade Meets Confident Long-Term Growth Views

PROCEPT BioRobotics Corp. PRCT | 27.27 | +1.91% |

PROCEPT BioRobotics (PRCT) is back in focus after a flurry of analyst updates, including a downgrade from Bank of America that sits alongside more optimistic views on future utilization and long-term market potential.

The recent analyst flurry comes after a choppy stretch for PROCEPT BioRobotics, with a 7 day share price return of 6.73% following a 1 day decline of 4.79% and a 1 year total shareholder return of 62.20% in the red. This suggests near term momentum is rebuilding while longer term holders remain deeply underwater.

If you are looking beyond a single MedTech name, this could be a useful moment to scan other healthcare opportunities using our screener for healthcare stocks.

So with PROCEPT BioRobotics still loss making, trading at US$32.83 and sitting at more than a 50% discount to the average analyst target of US$50.73, is this a mispriced growth story, or is the market already discounting those expectations?

Most Popular Narrative: 35.3% Undervalued

Compared with the last close of US$32.83, the most followed narrative anchors PROCEPT BioRobotics at a fair value of about US$50.73, framing a sizable gap that rests on ambitious growth and margin assumptions.

Ongoing positive clinical trial progress (including WATER IV for prostate cancer) and anticipated future approvals for new indications will expand the total addressable market, which in turn may support higher system placements, greater procedure volumes, and improved long-run profitability as new patient populations are reached.

Curious what kind of revenue runway and margin shift would need to line up to support that valuation gap? The narrative focuses on rapid top line expansion, a meaningful swing in profitability, and a premium future earnings multiple that is positioned above the broader medical equipment group. Want to see how those moving parts are modeled together to reach that fair value?

Result: Fair Value of $50.73 (UNDERVALUED)

However, the whole setup still hinges on Aquablation keeping its edge, while ongoing operating losses and potential regulatory or reimbursement shifts could quickly flip sentiment on those growth assumptions.

Another Angle on Value

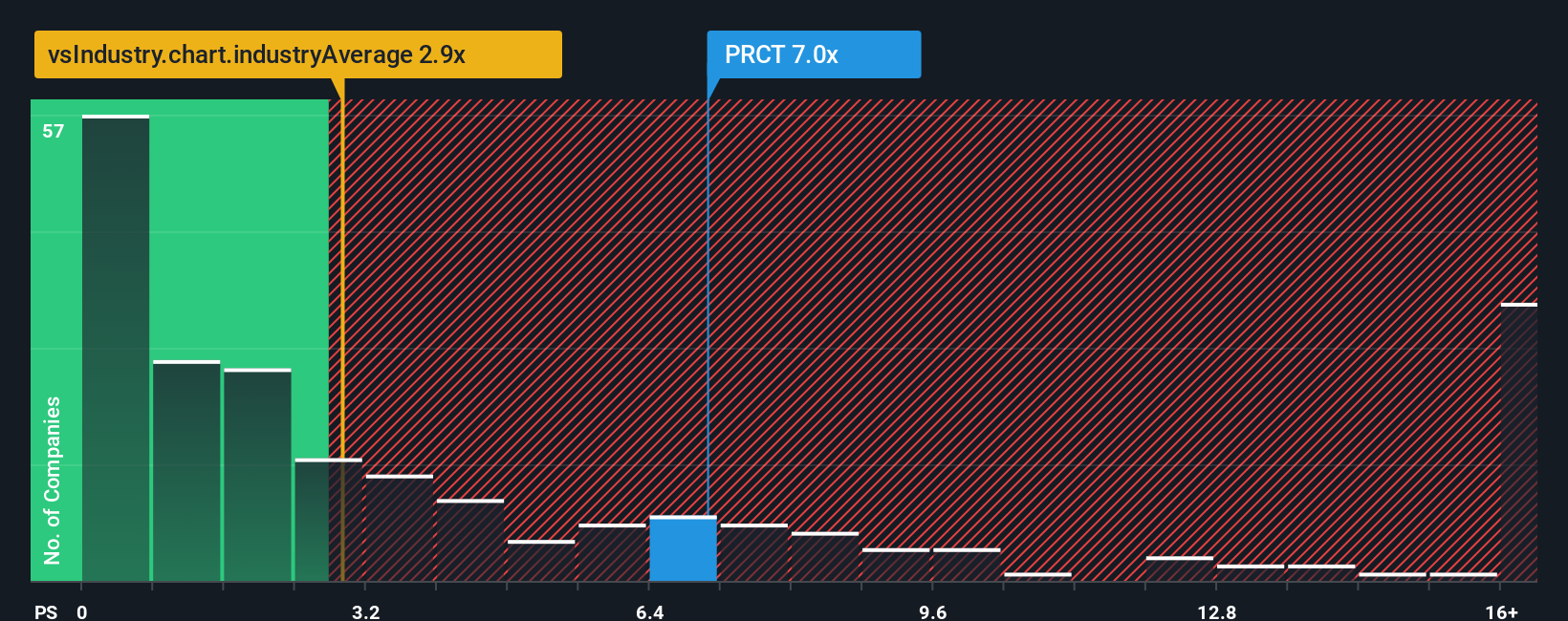

Analysts see PROCEPT BioRobotics trading below their targets, but the P/S ratio tells a more cautious story. At 6.1x sales, compared with a fair ratio of 3.6x and an industry average of 3.3x, the stock screens as expensive. Is the market already pricing in a lot of that growth narrative?

Build Your Own PROCEPT BioRobotics Narrative

If this view does not quite fit your own, or you would rather test the numbers firsthand, you can build a custom story in minutes with Do it your way.

A great starting point for your PROCEPT BioRobotics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about tightening up your process, consider scanning whole groups of ideas built around clear fundamentals rather than stopping at a single stock.

- Target potential mispricings by reviewing these 877 undervalued stocks based on cash flows that line up strong cash flow profiles with prices that may not fully reflect them.

- Spot emerging themes in machine learning and automation by tracking these 28 AI penny stocks that sit at the center of real-world adoption.

- Build your income watchlist faster by focusing on these 12 dividend stocks with yields > 3% that offer yields above 3% and may warrant further research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.