Please use a PC Browser to access Register-Tadawul

Assessing Quaker Chemical (KWR) Valuation After Earnings Beat And Stronger High Value Formulation Demand

Quaker Houghton KWR | 174.44 | +0.28% |

Quaker Chemical (KWR) drew fresh attention after its recent earnings modestly topped expectations, with management pointing to strong customer demand, realized synergies, and greater use of higher-value formulations as key drivers.

The recent earnings beat has been followed by strong momentum in the share price, with a 1-month share price return of 20.28% and a 90-day share price return of 29.22%. The 1-year total shareholder return of 26.60% contrasts with negative total shareholder returns over three and five years, which hints that sentiment has improved more recently than over the longer term.

If Quaker Chemical's move has caught your eye, it could be a good moment to see what else is setting up in the sector through aerospace and defense stocks.

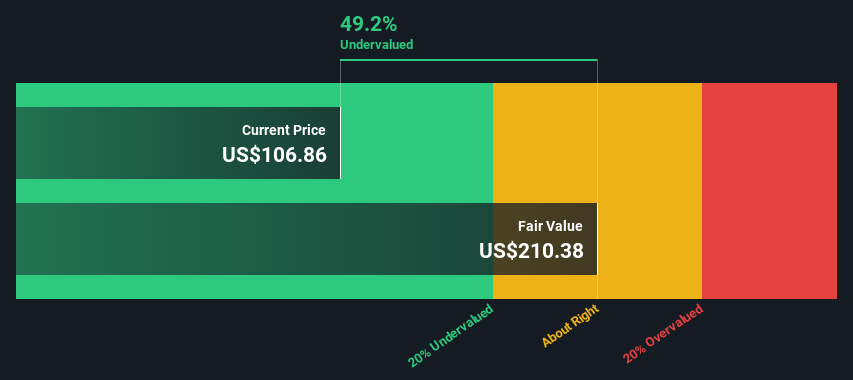

With Quaker Chemical up strongly over the last quarter and trading close to the average analyst price target, the key question now is whether its higher-value positioning still leaves mispricing on the table, or if the market already reflects future growth.

Most Popular Narrative: 2.7% Overvalued

Quaker Chemical last closed at $170.50, slightly above the most followed fair value estimate of $166.00, which is built around detailed earnings and margin assumptions.

The ongoing roll-out of FLUID INTELLIGENCE (breakthrough sensor technology, digitalization, and automation of services) creates stickier customer relationships and recurring revenue streams, while also differentiating Quaker in an environment increasingly focused on sustainability and efficiency, supporting more predictable cash flows and potentially higher net margins.

Want to see what kind of revenue profile and margin lift that recurring model is built on, and how much profit power the narrative is baking in? The projections behind that $166 fair value are more aggressive than the headline growth rate suggests and assume a very different earnings mix to today.

Result: Fair Value of $166 (OVERVALUED)

However, you still need to weigh softer margins in some regions and higher leverage, as both could pressure cash flow and challenge that higher margin narrative.

Another View: Cash Flows Tell a Different Story

While the most followed fair value points to Quaker Chemical being 2.7% overvalued at $166 versus the $170.50 share price, the SWS DCF model paints a very different picture, suggesting the stock is trading about 44.1% below an estimated future cash flow value of $304.84.

Those are very different messages, one anchored in earnings and margins and the other in long term cash flows. Which set of assumptions do you find more convincing for a business that is currently unprofitable but expected to turn the corner?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Quaker Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Quaker Chemical Narrative

If this storyline does not fit how you see Quaker Chemical, you can review the numbers yourself and form your own view in just a few minutes, then Do it your way.

A great starting point for your Quaker Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Quaker Chemical has you thinking differently about your portfolio, this is a smart moment to widen the net and see what else fits your style.

- Spot potential value plays early by checking out these 862 undervalued stocks based on cash flows that may offer more attractive prices relative to their cash flows.

- Tap into the growth story around artificial intelligence with these 30 AI penny stocks that are directly tied to this fast-moving theme.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that can add yield alongside potential capital returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.