Please use a PC Browser to access Register-Tadawul

Assessing Rhythm Pharmaceuticals (RYTM) Valuation After Strong IMCIVREE Revenue Guidance For 2025

Rhythm Pharmaceuticals, Inc. RYTM | 99.78 | -3.28% |

Guidance highlights for IMCIVREE driven revenue

Rhythm Pharmaceuticals (RYTM) recently issued preliminary 2025 guidance that puts IMCIVREE at the center of the story, with management flagging sharp year over year gains in both quarterly and full year net product revenue.

The company expects IMCIVREE net product revenue of about US$57 million for the fourth quarter of 2025, based on unaudited figures, which it says is an 11% sequential increase versus the third quarter.

For the full year 2025, Rhythm is guiding to approximately US$194 million in IMCIVREE net product revenue, compared with US$130 million in 2024. Management describes this as roughly 50% growth over the prior year.

Management also highlighted the importance of the U.S. market, with U.S. IMCIVREE sales contributing around 68% of fourth quarter preliminary revenue and about 69% of the full year 2025 preliminary net product revenue base.

Rhythm’s latest IMCIVREE guidance lands after a softer trading patch, with a 1 day share price return of 4.18% decline and a 30 day share price return of 9.37% decline. However, the 1 year total shareholder return of 86.34% and 3 year total shareholder return of about 2.4x still point to strong longer term momentum.

If this kind of rare disease story has your attention, it could be a good moment to widen your watchlist and check out healthcare stocks as potential next ideas.

With IMCIVREE revenue guidance pointing higher and Rhythm shares trading at US$101.63 versus an average analyst target of about US$140, is the market offering a rare disease discount, or is it already baking in future growth?

Most Popular Narrative: 26.9% Undervalued

Rhythm Pharmaceuticals last closed at US$101.63, while the most popular narrative pegs fair value closer to US$139, framing a sizeable valuation gap for IMCIVREE and the wider pipeline story.

Upcoming potential regulatory approvals and launches for setmelanotide (IMCIVREE) in new indications like acquired hypothalamic obesity and Prader Willi syndrome, alongside expansion into younger age groups, are set to materially grow Rhythm's commercial opportunity and topline over the next several years.

Curious what kind of revenue ramp, margin shift and future earnings multiple sit behind that gap to fair value, and how far those projections really stretch? The full narrative lays out a detailed roadmap of growth assumptions and profitability targets that extend beyond IMCIVREE's current label.

Result: Fair Value of $139 (UNDERVALUED)

However, you also have to weigh the heavy ongoing losses and Rhythm’s reliance on setmelanotide, as setbacks here could quickly challenge the view that the stock is 26.9% undervalued.

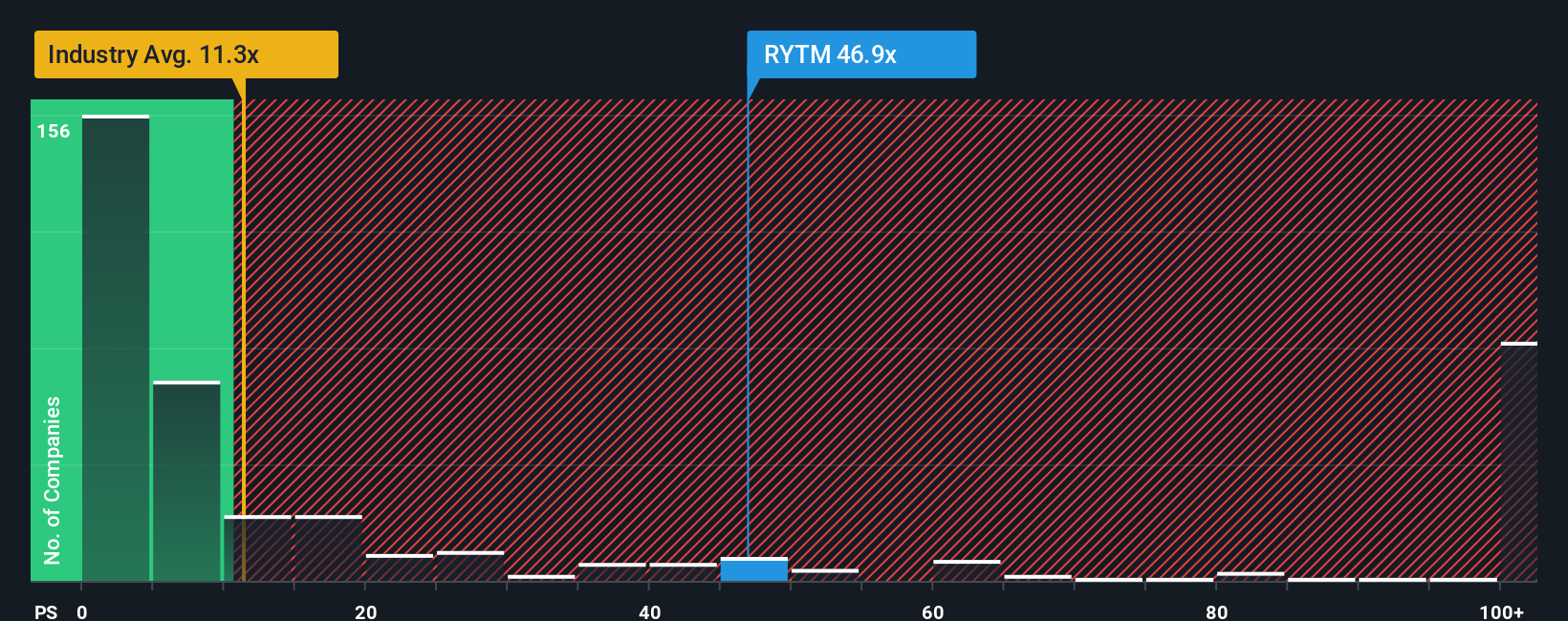

Another View: Multiples Paint A Very Different Picture

While the narrative and fair value estimate of US$139 suggest upside, the current P/S ratio of 38.9x tells a tougher story. That compares with a fair ratio of 23.8x, the US Biotechs industry at 12.1x and peers at 21.6x, which points to meaningful valuation risk if sentiment cools.

Build Your Own Rhythm Pharmaceuticals Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a fresh Rhythm Pharmaceuticals story yourself in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

Looking for more investment ideas?

If Rhythm is on your radar, do not stop there. The screener can surface other opportunities you might regret skipping once the data starts to move.

- Spot potential mispricings by scanning these 876 undervalued stocks based on cash flows that appear cheap relative to their cash flows and might deserve a closer look.

- Ride the wave of new technology by checking out these 24 AI penny stocks that are tied to artificial intelligence themes.

- Target higher income potential with these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.