Please use a PC Browser to access Register-Tadawul

Assessing Robinhood Markets (HOOD) Valuation After Recent Volatility And Strong Profitability Context

Robinhood Markets, Inc. Class A HOOD | 76.11 | +0.61% |

Recent share performance and business snapshot

Robinhood Markets (HOOD) has seen its share price move in different directions over recent periods, with a 14% gain in the past day, offset by declines of 17% over the week and around 28% over the month.

Over the past 3 months, the stock has recorded a return of about a 39% decline, while year to date it is down roughly 28%. Looking further back, the reported 1-year total return is about 48%, and the 3-year total return is a very large 7x figure.

The company reports revenue of about US$4.2b and net income of roughly US$2.2b, alongside annual revenue growth of 16% and net income growth of 12%. These figures provide a starting point if you are assessing how the current share price lines up with the underlying business performance.

Robinhood’s share price has been under pressure in recent months despite a very large 3 year total shareholder return. The recent 1 day share price gain of 13.95% to US$82.82 came after a 30 day share price decline of 28.15%, which hints that sentiment has cooled and short term risk perceptions have shifted even as longer term holders have seen substantial gains.

If this kind of volatility has your attention, it could be a good moment to scan beyond a single name and check out 18 cryptocurrency and blockchain stocks for other listed ways to gain exposure to the broader crypto theme.

With the share price well below some analyst targets and the business reporting US$4.2b in revenue and US$2.2b in net income, you have to ask: is this a genuine opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 57.4% Undervalued

At a last close of $82.82 versus a narrative fair value of $194.61, Robinhood Markets is framed as materially undervalued in the most followed story on the stock.

Robinhood (NASDAQ: HOOD) just delivered one of its strongest quarters to date, not just in growth, but in profitability and user monetization. For Q2 2025, total net revenues jumped 45% year-over-year to $989 million, while net income surged 105% to $386 million. Diluted EPS doubled to $0.42, marking Robinhood’s most profitable quarter ever. Platform engagement continues to strengthen. Net Deposits were $13.8 billion, and over the last twelve months, deposits reached $57.9 billion, equivalent to 41% of asset growth. Platform assets nearly doubled year-over-year to $279 billion, helped by crypto recovery, equities appreciation, and the recent Bitstamp acquisition.

According to yiannisz, this valuation leans heavily on strong profitability, rising monetization per user, and a rich profit margin held against a premium future earnings multiple. Want to see how those ingredients are combined to reach that $194.61 figure and what kind of growth runway sits behind it?

Result: Fair Value of $194.61 (UNDERVALUED)

However, this story can change quickly if trading activity cools or regulators take a tougher stance on crypto, tokenization, or higher risk retail products.

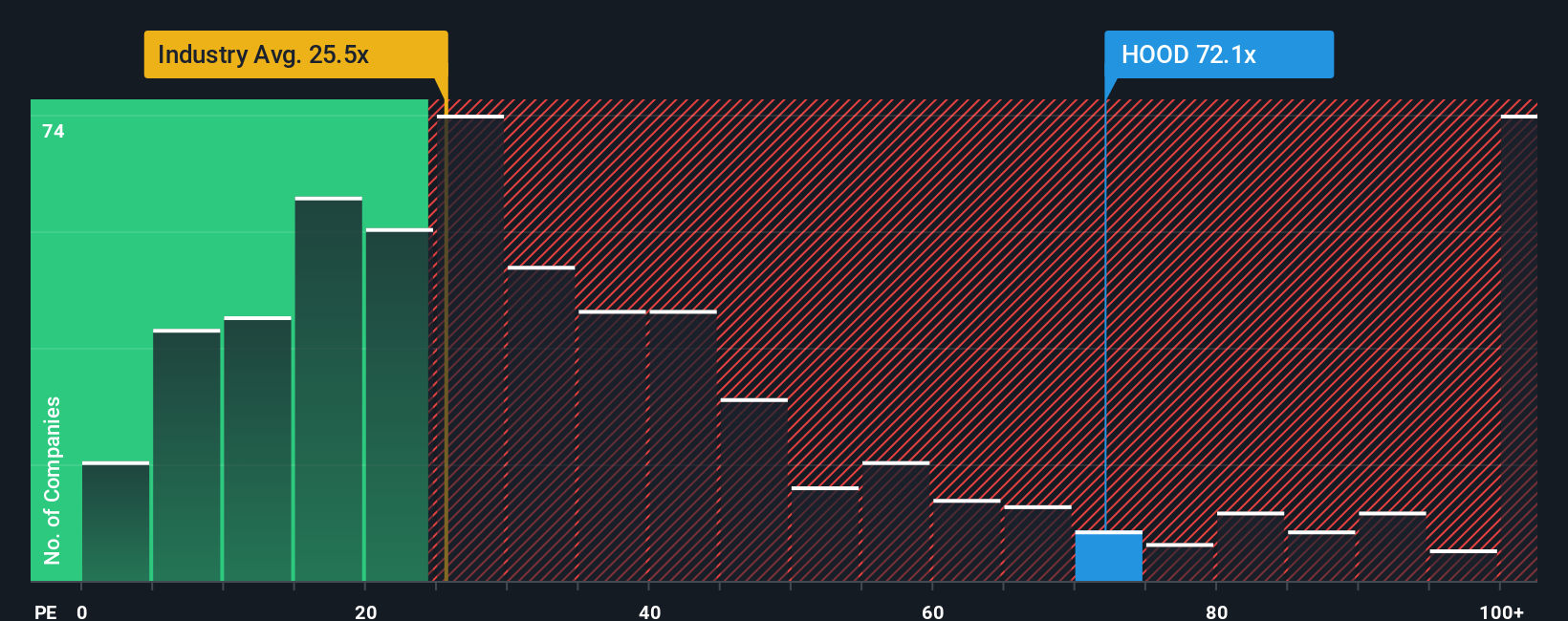

Another view on valuation: earnings multiples paint a tougher picture

That user narrative leans on a $194.61 fair value, but the current P/E of 33.9x tells a different story. It sits above the estimated fair ratio of 27.5x, the US Capital Markets industry at 23.3x, and peers at 27.1x. This points to richer pricing and less room for error if sentiment turns.

Build Your Own Robinhood Markets Narrative

If you look at the numbers and reach a different conclusion, or just prefer to trust your own work, you can pull the data together and build a full story yourself in just a few minutes, then Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Robinhood has sparked your interest, do not stop here. The market is full of other opportunities, and a focused stock list can help you spot them faster.

- Target value by checking companies our screener flags as potential opportunities in 52 high quality undervalued stocks and see which names stand out to you.

- Prioritise resilience with stocks highlighted in 84 resilient stocks with low risk scores, designed for investors who want potential upside without taking on the highest risk profiles.

- Hunt for lesser known opportunities through our screener containing 24 high quality undiscovered gems, so you are not only looking where everyone else already is.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.