Please use a PC Browser to access Register-Tadawul

Assessing Robinhood Markets (HOOD) Valuation As Profitability And User Growth Reshape Expectations

Robinhood Markets, Inc. Class A HOOD | 76.11 | +0.61% |

Recent performance snapshot

Robinhood Markets (HOOD) has been volatile for investors, with the stock showing a 0.69% move over the past day, a small decline over the past week, and deeper pullbacks over the month and past 3 months.

Those short term swings sit alongside a 1 year total return above 100% and a very large 3 year total return. This makes it a name where timing, risk tolerance, and expectations around future execution can matter a lot for your portfolio.

Recent pullbacks, including the 30 day share price return of 11.17% and 90 day share price return of 23.47%, sit against a 1 year total shareholder return of 109.28% and a very large 3 year total shareholder return. This suggests earlier enthusiasm has cooled recently even though long term holders have still seen strong gains.

If Robinhood’s swings have you thinking about where else growth and risk are being repriced, this is a useful moment to broaden your search with fast growing stocks with high insider ownership.

With Robinhood posting US$4,204.0m in revenue, US$2,194.0m in net income, and trading about 40% below the average analyst target, investors may now be asking whether this represents a genuine opportunity or whether the market is already incorporating expectations of future growth.

Most Popular Narrative: 45% Undervalued

Compared with Robinhood Markets’ last close at $106.99, the most followed narrative points to a fair value of $194.61, a large gap that frames the rest of the story for this stock.

Robinhood (NASDAQ: HOOD) just delivered one of its strongest quarters to date, not just in growth, but in profitability and user monetization. For Q2 2025, total net revenues jumped 45% year-over-year to $989 million, while net income surged 105% to $386 million. Diluted EPS doubled to $0.42, marking Robinhood’s most profitable quarter ever. Platform engagement continues to strengthen. Net Deposits were $13.8 billion, and over the last twelve months, deposits reached $57.9 billion, equivalent to 41% of asset growth. Platform assets nearly doubled year-over-year to $279 billion, helped by crypto recovery, equities appreciation, and the recent Bitstamp acquisition.

Want to see what sits behind that gap between price and fair value? The narrative leans heavily on earnings power, monetization per user, and richer profit margins. Curious how those moving parts feed into the final number and what they assume about the next few years? That detail only shows up when you read it in full.

Result: Fair Value of $194.61 (UNDERVALUED)

However, the story could shift quickly if trading activity slows or regulators take a tougher stance on crypto and tokenization, which could affect both revenue mix and sentiment.

Another View on Valuation

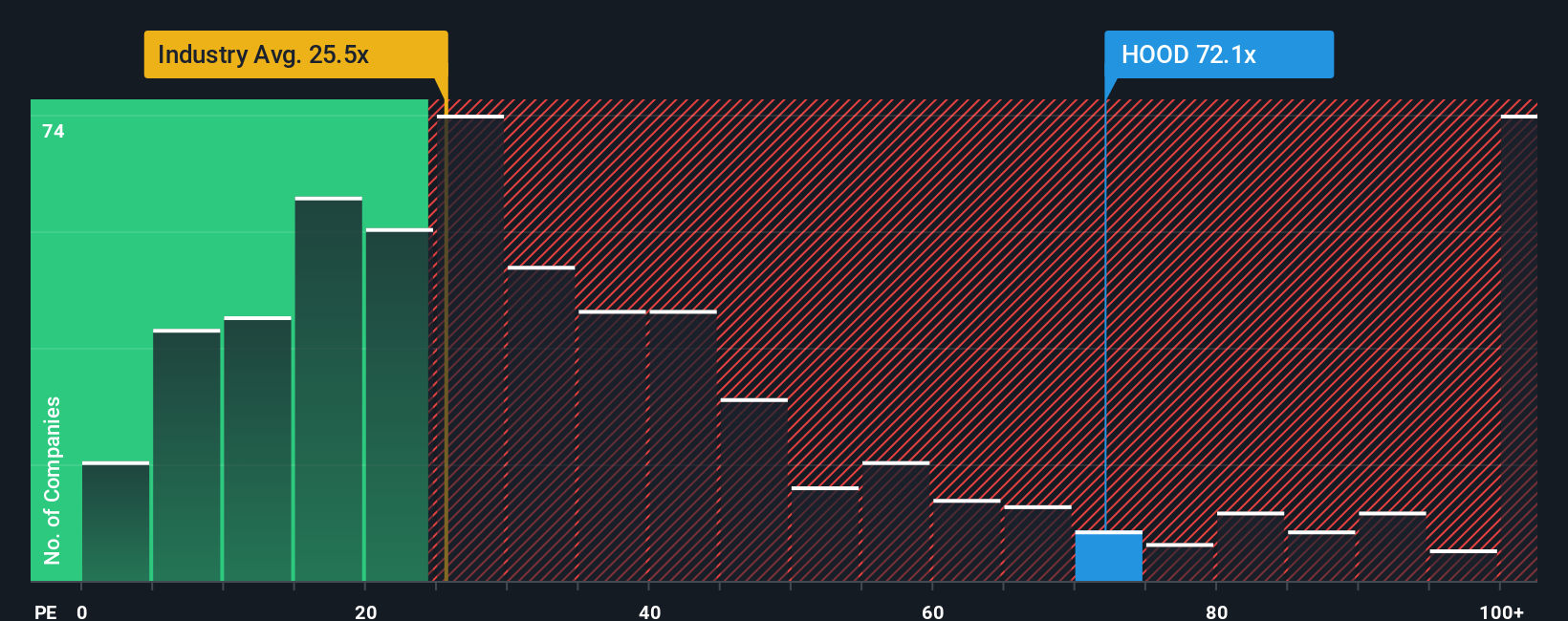

That 45% undervalued narrative sits uncomfortably next to how the market is pricing Robinhood today. The shares trade on a P/E of 43.8x, compared with 27.8x for peers, 25.9x for the US Capital Markets industry, and a fair ratio of 26.7x. That premium raises a simple question: how much optimism are you really paying for?

Build Your Own Robinhood Markets Narrative

If you are not fully on board with this view or prefer to rely on your own work, you can test the numbers yourself in just a few minutes with Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Robinhood sits in your “maybe” pile, do not stop there. This is your chance to widen the net and pressure test your next moves.

- Target potential value gaps by checking out these 866 undervalued stocks based on cash flows that currently screen well on cash flow based pricing.

- Tap into powerful long term themes by scanning these 24 AI penny stocks that could benefit as artificial intelligence adoption spreads across sectors.

- Strengthen your income side by reviewing these 13 dividend stocks with yields > 3% that might help you balance growth ideas with regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.