Please use a PC Browser to access Register-Tadawul

Assessing Samsara (IOT) Valuation After Fresh Analyst Optimism On Growth And Physical Operations Platform

Samsara, Inc. Class A IOT | 26.79 | -0.04% |

Recent analyst coverage has put Samsara (IOT) back in focus, with BTIG, KeyBanc, and TD Cowen all underscoring its role in connecting physical operations, as well as highlighting its growth profile and improving efficiency.

Despite the fresh analyst attention and executive 10b5 1 trading plans, Samsara’s recent share price return has softened, with a 30 day share price return of 22.81% and a 1 year total shareholder return of 23.49% contrasting with a very large 3 year total shareholder return of about 3x. This suggests longer term momentum has been strong even as shorter term sentiment has cooled.

If Samsara’s recent moves have caught your eye, it could be a good moment to see what else is happening across high growth tech and AI names via high growth tech and AI stocks.

With the shares down over the past year despite analyst optimism and a price target well above the last close, the key question is whether Samsara is now trading at a discount or if the market is already pricing in future growth.

Most Popular Narrative: 32.9% Undervalued

On the most followed narrative, Samsara’s fair value sits at about US$50.36 per share versus the last close of US$33.80, setting up a valuation gap built on ambitious growth and margin assumptions.

Samsara is in the early stages of addressing a massive market opportunity as the majority of North American commercial vehicles still lack telematics and safety products. This under-penetrated market provides substantial room for growth, potentially leading to significant revenue increases. Impact: Revenue.

Curious what kind of revenue ramp, margin lift, and future earnings multiple are baked into that fair value? The narrative leans on rapid recurring revenue expansion, a shift from losses to healthy profitability, and a premium earnings multiple rarely seen outside fast growing software names. Want to see exactly how those ingredients combine into a US$50 plus figure per share?

Result: Fair Value of $50.36 (UNDERVALUED)

However, longer sales cycles with large customers and uncertainty around monetizing early stage AI products could challenge the growth assumptions that support this case of 32.9% undervaluation.

Another Way To Look At Value

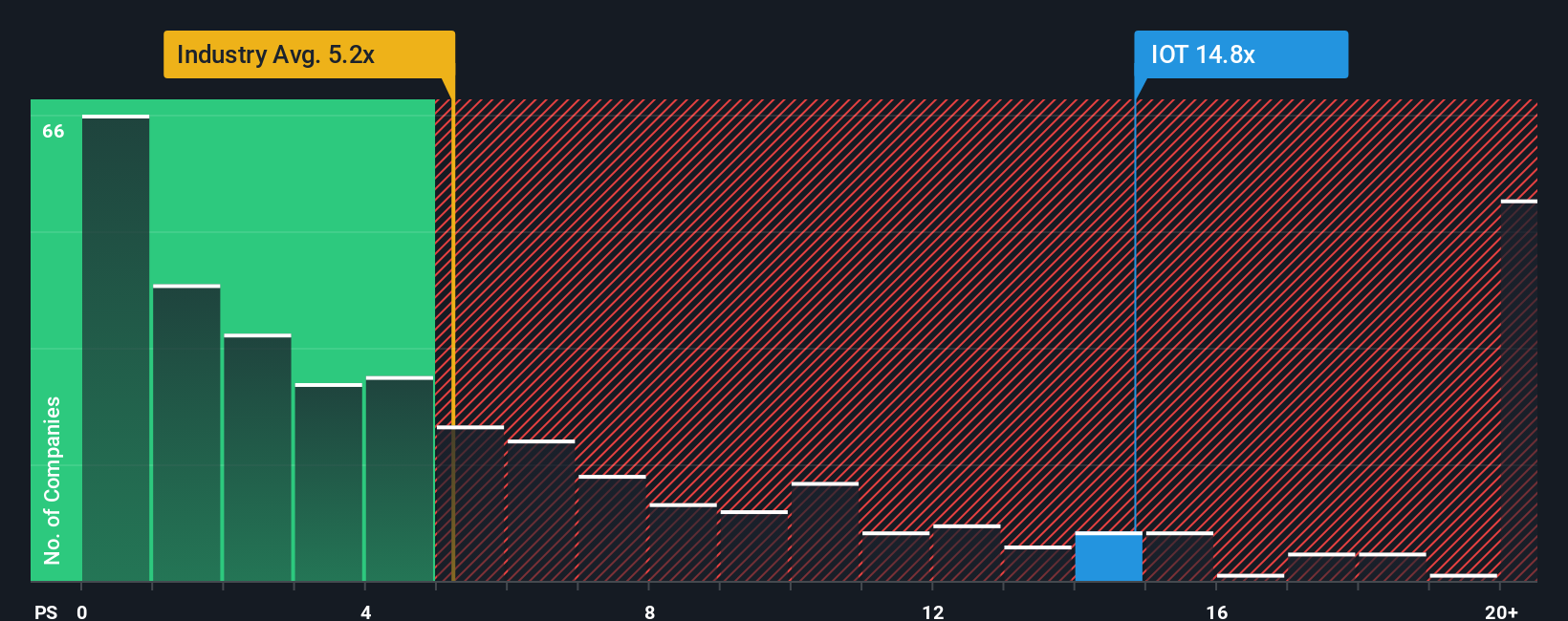

That 32.9% undervalued narrative leans on long term growth and margin expansion, but the simple P/S check tells a very different story. Samsara trades around 12.8x sales compared with 4.9x for the US software sector and 8.5x for peers, while our fair ratio sits closer to 10.1x.

In plain terms, the market is already attaching a premium to Samsara versus both the sector and similar companies, and even the fair ratio suggests less headroom than the narrative implies. The question for you is whether that premium feels earned or a stretch given the risks.

Build Your Own Samsara Narrative

If you see the data differently or prefer to stress test your own assumptions, you can create a personalized Samsara view in a few minutes, Do it your way.

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Samsara has raised fresh questions for you, do not stop there. Widen your search and let data driven ideas surface stocks you might otherwise miss.

- Spot potential high risk, high reward names early by scanning these 3545 penny stocks with strong financials that pair low prices with stronger financial footing than many peers.

- Zero in on the AI theme by reviewing these 28 AI penny stocks that connect artificial intelligence exposure with the penny stock segment.

- Target value orientated opportunities by checking these 877 undervalued stocks based on cash flows that look cheap based on cash flows, before the crowd pays closer attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.