Please use a PC Browser to access Register-Tadawul

Assessing SentinelOne (S) Valuation As New AI Data Security Tools Gain Traction

SentinelOne, Inc. Class A S | 13.83 | +1.99% |

Why SentinelOne’s new AI security tools matter for shareholders

SentinelOne (S) has rolled out new Data Security Posture Management tools for its AI Security Platform, aiming to control data risks across AI pipelines as enterprises move deeper into production use.

For you as an investor, the key point is that these DSPM capabilities are designed to keep sensitive or high risk data from entering AI models in the first place, addressing issues like data memorization and pipeline poisoning before training even starts.

Despite the recent product launch and upcoming earnings call, the share price return over the past 90 days is a 17.39% decline, contributing to a 44.07% drop in the 1 year total shareholder return. This suggests momentum has been fading even as new AI security capabilities are added.

If SentinelOne’s AI push has caught your attention, it could be a good moment to see what else is happening in this space with our screen of 57 profitable AI stocks that aren't just burning cash.

So with the shares down sharply over the past year, yet trading around a 43% intrinsic discount and roughly 50% below the average analyst target, is SentinelOne a mispriced AI security play or is the market already discounting future growth?

Most Popular Narrative: 34.4% Undervalued

Against the last close of $13.87, the most followed narrative puts SentinelOne’s fair value closer to $21.15, using an 8.44% discount rate and detailed long term assumptions.

Expansion beyond endpoint security into high demand adjacent markets such as cloud security, identity, and data protection, including the Prompt Security acquisition for GenAI risk, unlocks significant cross sell opportunities and is expected to elevate average contract value and diversify revenue streams, laying the groundwork for outsized multi year revenue growth.

Curious what kind of revenue trajectory and margin lift need to line up for that fair value to hold up? The narrative leans on compound growth, rising profitability, and a richer product mix. The details behind those assumptions are where the story really gets interesting.

Based on this narrative, SentinelOne is seen as trading at a steep discount to an estimated fair value of $21.15, with that gap grounded in specific views on future revenue growth, margin improvement and a higher earnings multiple over time.

Result: Fair Value of $21.15 (UNDERVALUED)

However, this hinges on execution, as greater reliance on partners and added costs from acquisitions like Prompt Security could squeeze margins and unsettle the growth story.

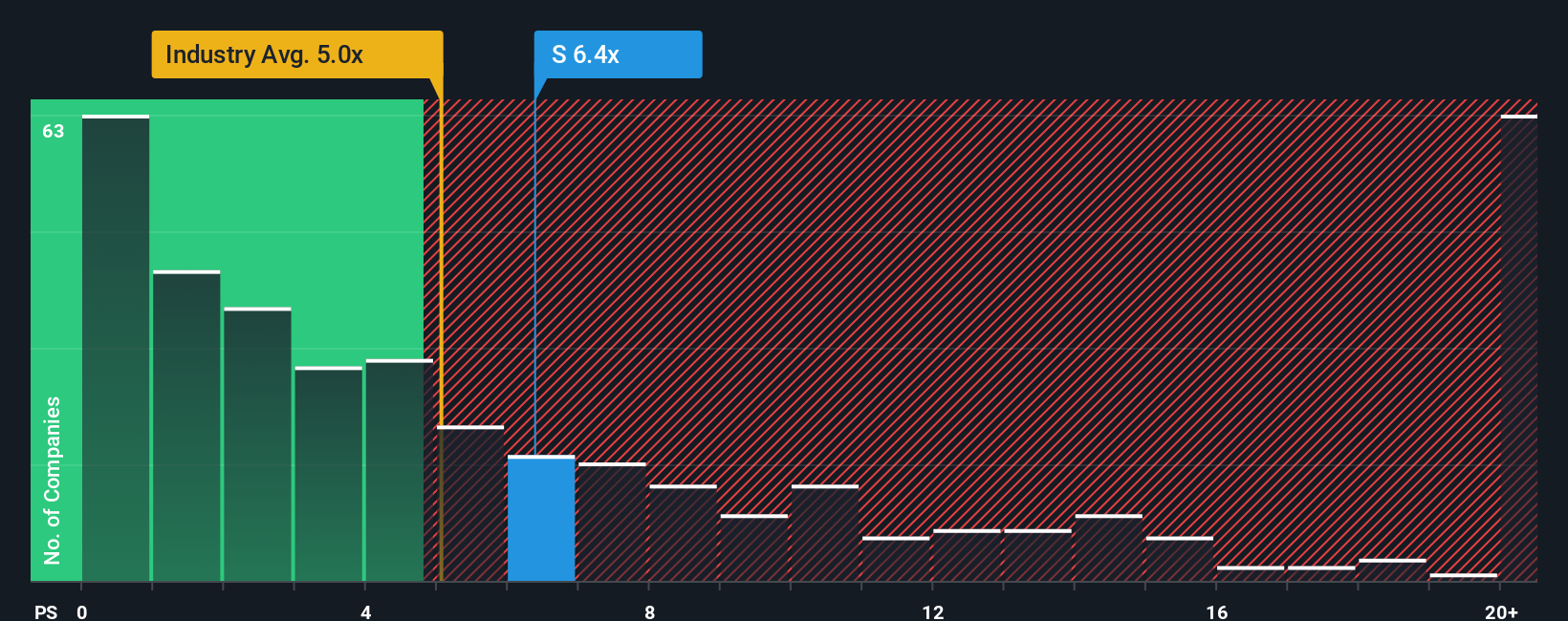

Another View: What the P/S ratio is telling you

The narrative and DCF style fair value put SentinelOne at a sharp discount, yet the current P/S of 4.9x is richer than the US Software industry at 3.6x, even though it sits below peer average at 7.1x and close to a 5.2x fair ratio. That mix of signals points to both upside potential and valuation risk, so which side of the trade do you think the market will focus on next?

Build Your Own SentinelOne Narrative

If you see the data pointing in a different direction, or simply want to stress test your own view, you can build a fresh narrative in minutes starting with Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SentinelOne has sharpened your thinking, do not stop here. Widening your watchlist now could be the edge that others only realize later.

- Target potential value opportunities early by checking out our list of 53 high quality undervalued stocks that stand out on price and fundamentals.

- Strengthen the defensive side of your portfolio by scanning the solid balance sheet and fundamentals stocks screener (44 results) that pair financial resilience with quality metrics.

- Spot future leaders before they hit the spotlight by reviewing the screener containing 23 high quality undiscovered gems hiding strong fundamentals in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.