Please use a PC Browser to access Register-Tadawul

Assessing Targa Resources (TRGP) Valuation After Record EBITDA, Raised Outlook And Expansion Plans

Targa Resources Corp. TRGP | 231.35 | +3.21% |

Targa Resources (TRGP) is back in focus after reporting record adjusted EBITDA of US$1.27b in Q3 2025, issuing a higher full-year outlook, advancing major Permian growth projects, and outlining plans for a higher dividend.

The recent Q3 earnings beat, higher outlook and new Permian projects have coincided with a 20.8% 1 month share price return and a 32.0% 3 month share price return. The 3 year total shareholder return of more than 3x suggests momentum has been strong over a longer stretch.

If this kind of move in midstream energy has your attention, it could be a good moment to see what else is setting up in the sector, including 25 power grid technology and infrastructure stocks as potential ideas beyond Targa.

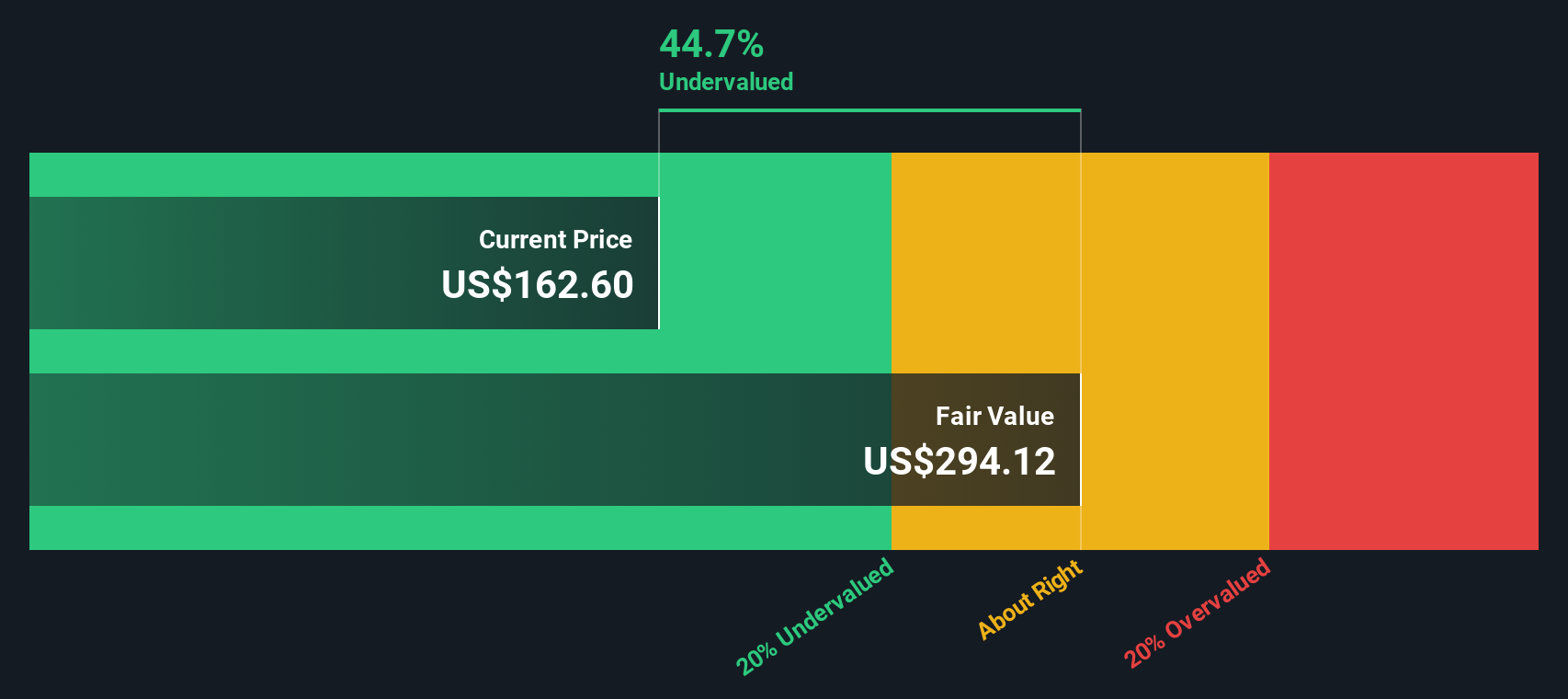

With the shares up more than 30% in three months and trading above the average analyst price target, yet still screening at roughly a 20% intrinsic discount, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 5% Overvalued

At a last close of $223.89 versus a most followed fair value estimate of about $212.40, Targa Resources is framed as slightly ahead of that narrative, with the debate centering on how far current volumes and future growth can carry cash flows.

Targa's strategic focus on long-term, fee-based contracts with blue-chip producers and end-users has driven resilience in cash flows, even amid commodity price volatility, and sets the stage for more predictable, higher free cash flow available for shareholder returns and potential deleveraging.

• The company's ongoing share repurchase program and growing dividend, backed by a strong balance sheet and flexible capital allocation, signal confidence in intrinsic value and suggest an undervaluation if fundamentals remain robust, directly benefiting per-share earnings and supporting total shareholder return.

Curious how this cash flow story gets translated into that fair value number? The narrative leans heavily on volume growth, rising margins and a richer earnings multiple. The exact mix of those ingredients might surprise you.

Result: Fair Value of $212.40 (OVERVALUED)

However, you also need to weigh risks such as potential midstream overbuild and tighter fee structures, or higher project costs that could pressure future cash generation.

Another Way To Look At Value

The narrative crowd sees Targa Resources as about 5% overvalued at a fair value of $212.40, but our DCF model says something different. On that scorecard, the shares trade around a 20% discount to an estimated future cash flow value of $280.80. So which story do you trust more: the cash flows or the crowd?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Targa Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 54 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Targa Resources Narrative

If you see the numbers differently or simply prefer to test your own view, you can build a data driven Targa story in just a few minutes, starting with Do it your way.

A great starting point for your Targa Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Targa has sharpened your interest, do not stop here. The screener can quickly surface other opportunities you would not want to miss.

- Zero in on value driven opportunities by checking companies our screener flags as screener containing 24 high quality undiscovered gems before they hit everyone’s radar.

- Protect your downside by scanning for 83 resilient stocks with low risk scores that pair measured risk profiles with solid fundamentals.

- Target quality at a reasonable price by reviewing 54 high quality undervalued stocks that combine fundamentals with what our models see as attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.