Please use a PC Browser to access Register-Tadawul

Assessing Toast (NYSE:TOST) Valuation As AI Retail Tools And Profitable Growth Gain Attention

Toast, Inc. Class A TOST | 27.07 | -2.06% |

Why Toast’s latest news matters for investors

Toast (TOST) is back in focus after rolling out new AI powered tools for retailers and appointing Mastercard veteran Rossana Niola as Chief Accounting Officer, a combination that touches both product direction and financial oversight.

For investors, this pairing of product updates and leadership change offers a fresh chance to look at how Toast’s retail ambitions sit alongside its core restaurant platform and recent profitability, as well as what that might mean for the stock’s risk and reward profile.

Despite Toast’s product launches and leadership changes, the stock’s recent tone has been softer. The 7 day share price return is 5.47% and the 90 day share price return is 10.61%, while the 1 year total shareholder return of 11.51% contrasts with a three year total shareholder return of 61.39%. This suggests that earlier strong compounding has cooled more recently.

If you are interested in how AI is reshaping business models beyond Toast, it could be a good moment to look at other high growth tech and AI stocks that are riding similar themes.

Toast now trades around $33.52, with a recent 1-year total shareholder return of 11.51% and a three-year return of 61.39%. The key question for investors is whether this represents a reset that leaves upside on the table, or whether future growth is already fully reflected in the price.

Most Popular Narrative: 29.8% Undervalued

At a last close of US$33.52 versus a narrative fair value of about US$47.75, the current price sits well below what this widely followed view suggests.

The analysts are assuming Toast's revenue will grow by 17.3% annually over the next 3 years.

Curious what kind of earnings power and profit margins have to sit behind that revenue path, and which future P/E multiple keeps the story intact? The full narrative lays out a detailed set of growth, profitability and valuation assumptions that tie this fair value back to Toast's current business mix and fintech model.

Result: Fair Value of $47.75 (UNDERVALUED)

However, there are still clear pressure points, including intense competition from other payment platforms and the risk that rising sales and marketing spend will limit future margin expansion.

Another way to look at Toast’s valuation

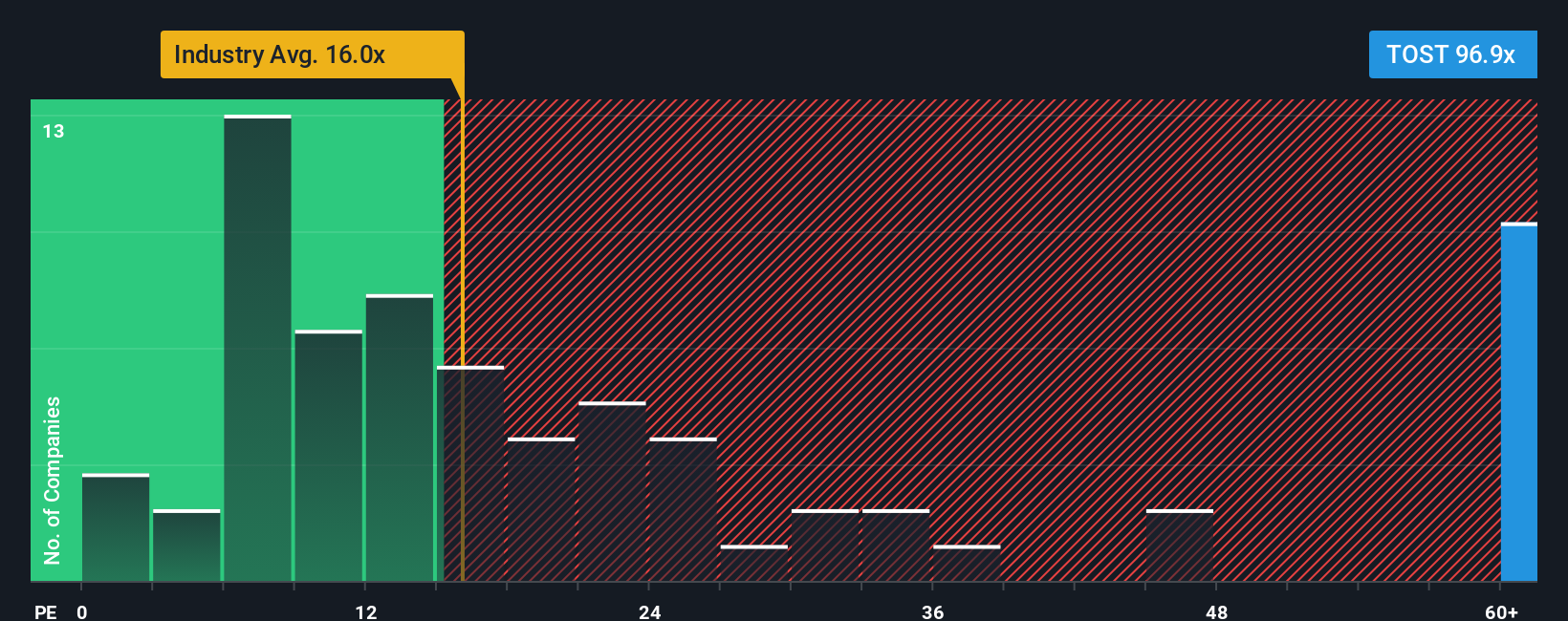

Analyst narratives point to Toast being about 29.8% undervalued, yet the current P/E of 72.2x tells a different story. It sits well above the US Diversified Financial industry average of 14.5x, the peer average of 42.1x, and the SWS fair ratio estimate of 22x, which hints at meaningful valuation risk if sentiment cools.

Build Your Own Toast Narrative

If you see the numbers differently or prefer to lean on your own work, you can build a custom view in just a few minutes using Do it your way.

A great starting point for your Toast research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss opportunities that fit your goals even better, so widen your search before you commit fresh capital.

- Tap into potential value by checking out these 863 undervalued stocks based on cash flows that currently trade below what their cash flows might justify.

- Explore technology themes by scanning these 24 AI penny stocks tied to real AI use cases rather than hype.

- Target income-focused opportunities through these 12 dividend stocks with yields > 3% that may suit a yield oriented portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.