Please use a PC Browser to access Register-Tadawul

Assessing Toast (TOST) Valuation After Q3 ARR Reaches US$2.02b

Toast, Inc. Class A TOST | 27.07 | -2.06% |

Q3 ARR milestone puts Toast (TOST) under the spotlight

Toast (TOST) is back on investors’ radar after reporting annual recurring revenue of US$2.02b in Q3, alongside year-on-year ARR growth averaging 31.3% and a negative customer acquisition cost payback period.

The strong Q3 ARR update has come against a weaker share price backdrop, with Toast’s 1-day, 7-day and 30-day share price returns of 10.37%, 13.02% and 16.96% declines respectively, and a 1-year total shareholder return decline of 28.01% but a positive 3-year total shareholder return of 18.15%. This suggests shorter term momentum is fading while longer term holders have still seen gains.

If Toast’s recent swings have you rethinking your watchlist, it could be a good moment to look at other high growth tech and AI names through high growth tech and AI stocks.

With Toast now reporting US$2.02b in ARR, a value score of 1 and a last close of US$28.25 against a US$46.38 analyst target, you have to ask: is there a mispriced opportunity here, or is future growth already reflected in the price?

Most Popular Narrative: 39.4% Undervalued

Toast’s most followed narrative pegs fair value at $46.63, well above the last close at $28.25, which frames a sizeable valuation gap for investors to weigh.

The analysts have a consensus price target of $50.542 for Toast based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $36.0.

Want to see what kind of revenue ramp, margin lift and future earnings multiple are being baked into that fair value gap? The forecast path and the assumed profitability step up are doing most of the heavy lifting here, alongside a relatively low discount rate and a rich earnings multiple that still sits well above the broader industry.

Result: Fair Value of $46.63 (UNDERVALUED)

However, the story can break if higher sales and marketing spend or tougher competition force Toast to accept lower margins or slower international traction than analysts expect.

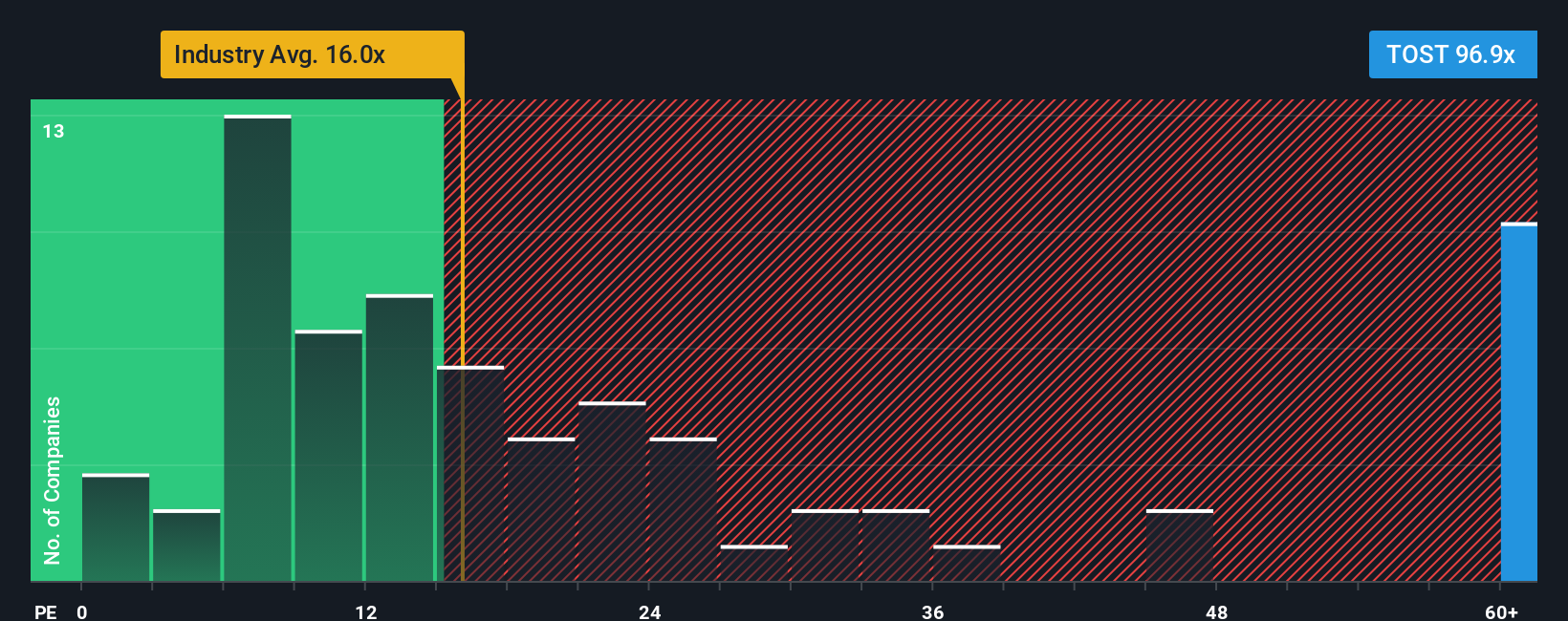

Another View: Rich P/E Ratio Keeps Toast in the Hot Seat

That fair value of $46.63 paints Toast as undervalued, but its P/E of 60.8x tells a different story. The peer average sits at 35.8x, the wider US Diversified Financial industry at 15.5x, and the fair ratio at 22.6x. This combination signals potential valuation risk if sentiment cools. Which signal do you trust more, the cash flow story or the multiples check?

Build Your Own Toast Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a personalised view in just a few minutes with Do it your way.

A great starting point for your Toast research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for your next idea?

If Toast has your attention, do not stop there. Use the screener to quickly surface fresh ideas that match your style before other investors focus on them.

- Spot potential turnaround candidates by scanning these 871 undervalued stocks based on cash flows that currently trade at prices that may not fully reflect their underlying fundamentals.

- Explore trends in digital assets through these 19 cryptocurrency and blockchain stocks that provide stock market exposure to cryptocurrency and blockchain themes.

- Build your income watchlist with these 13 dividend stocks with yields > 3% that currently offer yields above 3% and may suit a cash flow focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.