Please use a PC Browser to access Register-Tadawul

Assessing Toast’s Valuation After New AI Retail Features And Product Expansion Push

Toast, Inc. Class A TOST | 27.07 | -2.06% |

Toast’s AI retail push and what it might mean for the stock

Toast (TOST) has rolled out new AI driven tools for retailers, including Toast IQ updates, AI invoice scanning, and connected scales, timed around the 2026 National Retail Federation Show in New York.

Toast’s AI retail push comes after a period where short term share price momentum has been positive, with a 30 day share price return of 5.90% and year to date gain of 7.64%, while the 1 year total shareholder return is slightly negative and the 3 year total shareholder return of 87.31% points to a strong earlier run.

If you are watching how AI driven tools are changing the sector, this could be a useful moment to scan high growth tech and AI stocks for other potential ideas in the space.

With Toast trading at US$36.62, carrying a low value score of 1 and sitting at a 30% discount to average analyst targets, you have to ask: is there real upside here or is future growth already priced in?

Most Popular Narrative: 22.8% Undervalued

Compared with Toast’s last close at US$36.62, the most followed narrative pegs fair value closer to the high US$40s, framing the stock as materially discounted.

The analysts have a consensus price target of $50.542 for Toast based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $36.0.

Curious what earnings profile could justify paying a premium multiple on future profits, even as discount rates stay above 7%? The narrative leans heavily on compounded revenue expansion, improving margins and a rich earnings multiple years from now. If you want to see how those ingredients fit together, the full narrative sets out the complete playbook behind that valuation gap.

Result: Fair Value of $47.42 (UNDERVALUED)

However, that upside case can unravel quickly if restaurant spending weakens, which would pressure transaction volumes, or if competitive responses force Toast to pull back on pricing.

Another View: Rich Multiple, Different Message

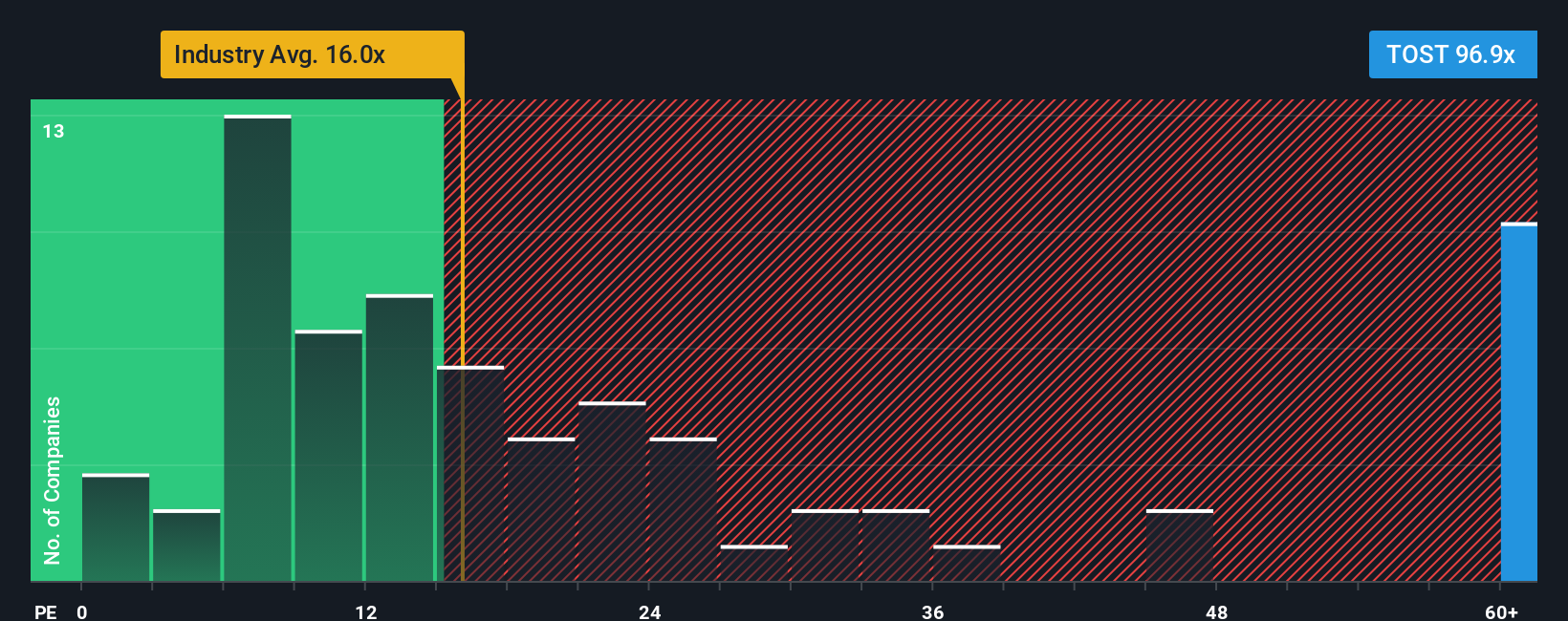

If you switch from the narrative fair value to a simple earnings multiple, the picture is very different. Toast trades on a P/E of 78.9x, compared with 14.3x for the US Diversified Financial industry, 44.3x for peers, and a fair ratio of 22x. That gap suggests a lot already priced in and raises the question of how much execution the market is assuming from here.

Build Your Own Toast Narrative

If the story so far does not quite fit how you see Toast, you can stress test the numbers yourself and shape a custom narrative in minutes, then Do it your way.

A great starting point for your Toast research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond Toast?

If Toast has sharpened your interest, do not stop here. Broaden your watchlist with a few focused idea lists built around clear themes and fundamentals.

- Target income first and foremost by scanning these 11 dividend stocks with yields > 3% that might help you build a portfolio with more consistent cash payouts.

- Spot potential mispricings early by reviewing these 876 undervalued stocks based on cash flows that currently trade below estimates based on their cash flows.

- Lean into transformational tech by checking out these 29 quantum computing stocks that are working on next generation compute breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.