Please use a PC Browser to access Register-Tadawul

Assessing Toast’s Value After New Partnership Expansion and a 3% Drop in Share Price

Toast, Inc. Class A TOST | 27.73 | +2.51% |

- Wondering if Toast stock could be a bargain right now? Let’s take a closer look at the numbers and recent trends to get a clearer picture of its value.

- The share price has pulled back a bit lately, dropping 3.0% in the last week and down 3.5% over the month. However, the three-year performance is still an impressive 97.3% higher.

- Investors have responded to news that Toast is expanding partnerships across new merchant categories and piloting innovative features at several large restaurant groups. This wave of activity has stirred optimism around long-term growth, even as short-term volatility increases.

- On our value checks, Toast scores a 1 out of 6 on our valuation scale, suggesting there is more work to do before calling it a screaming buy. There are several ways to value Toast, and later I’ll show you an approach the pros use that makes it even clearer when a stock offers real value.

Toast scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Toast Excess Returns Analysis

The Excess Returns model focuses on how effectively Toast converts its invested equity into profits above the required cost of equity. In simple terms, it gauges how much value the company creates for shareholders beyond what they could expect from simply investing in similar-risk assets elsewhere.

For Toast, the model uses a Book Value of $3.43 per share and a Stable EPS of $1.25 per share, drawn from weighted future Return on Equity estimates from nine analysts. The company’s average Return on Equity is a strong 22.42%, with a Cost of Equity at $0.41 per share. This results in an Excess Return of $0.84 per share. Looking ahead, analysts forecast Toast’s Stable Book Value rising to $5.56 per share based on projections from five analysts.

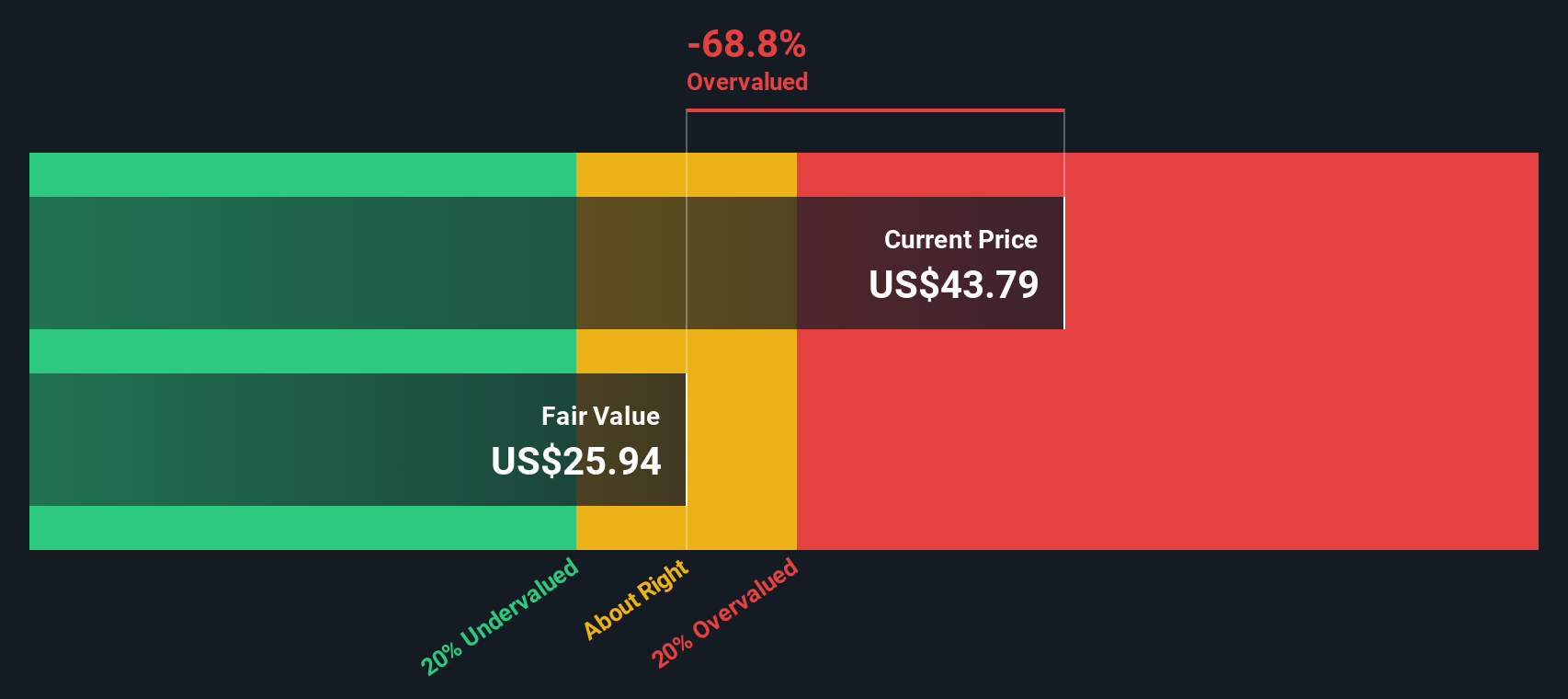

Taking all these factors into account, the model estimates Toast’s intrinsic value at $26.28 per share. However, compared to its current share price, the stock appears about 36.6% overvalued according to this approach.

Result: OVERVALUED

Our Excess Returns analysis suggests Toast may be overvalued by 36.6%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Toast Price vs Earnings

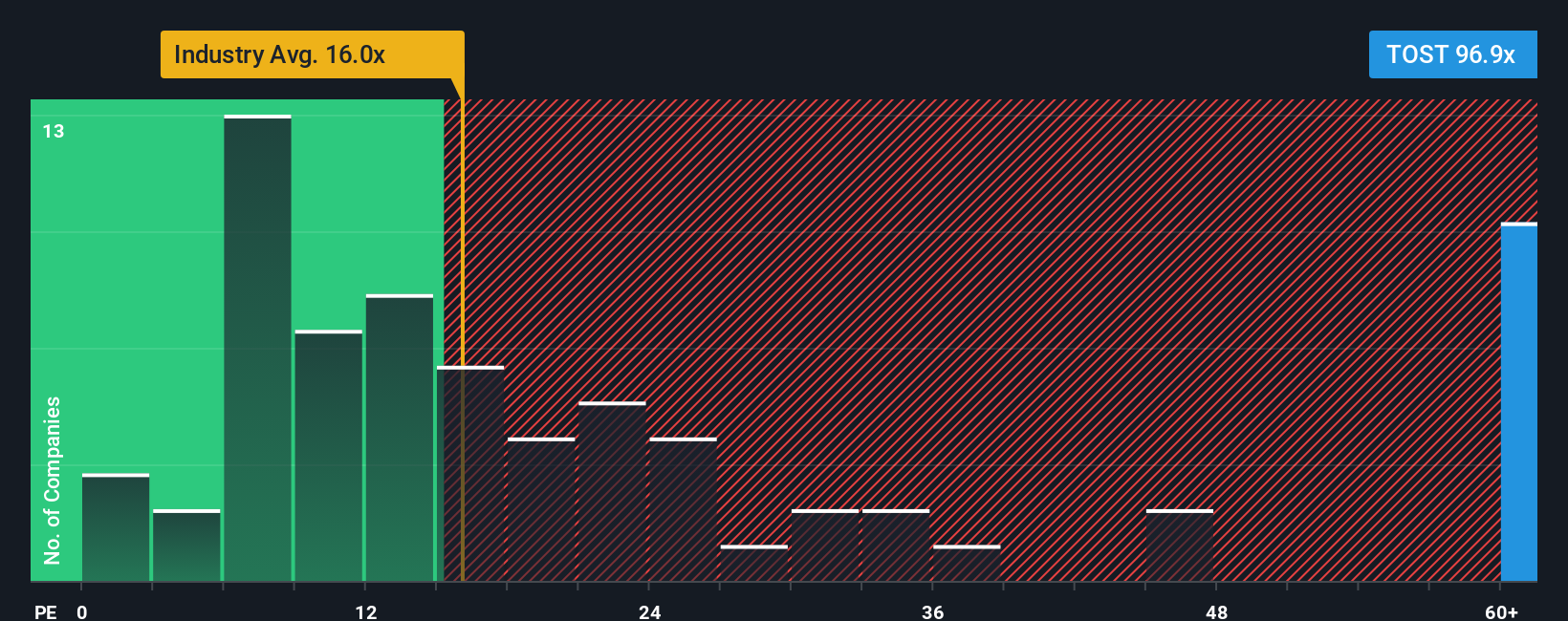

The Price-to-Earnings (PE) ratio is generally seen as the go-to valuation method for profitable companies like Toast because it relates a company's share price directly to its earnings. This makes it a simple way to gauge whether a stock is reasonably valued. The "right" PE ratio for a business depends on a blend of factors, including how fast a company is expected to grow and how much risk investors are taking on. Higher growth often justifies a higher PE, while higher risk typically pushes the ratio down.

Toast currently trades at a PE ratio of 77.3x, which is more than double the Diversified Financial industry average PE of 13.2x, and well above the peer average of 34.6x. On the surface, this makes Toast look very expensive compared to its immediate competitors and the broader sector.

However, Simply Wall St also calculates a proprietary Fair Ratio, which is a PE multiple that considers Toast’s specific fundamentals, including its expected earnings growth, industry position, profit margins, market cap, and risk factors. This approach goes beyond simple peer comparisons and factors in many more variables to give a tailored benchmark for value. Toast’s Fair Ratio is estimated at 23.0x, which is far lower than its current market multiple.

Given the current PE of 77.3x is well above the Fair Ratio of 23.0x, Toast appears overvalued using this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toast Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple but powerful tool that lets investors tie their own story about a company directly to the numbers, so you can connect your unique view of Toast’s future with a financial forecast and fair value.

Instead of relying just on ratios or blanket analyst targets, Narratives let you input your expectations, such as how much Toast’s revenue might grow, where margins could land, or what level of risk you see, and immediately generate your own Fair Value estimate. Because Narratives connect a company’s evolving story (from product launches to industry challenges) to the financial numbers, you can more confidently judge when it makes sense to buy or sell; if your Fair Value is above today’s price, that’s a buy signal, and vice versa.

Even better, Narratives on Simply Wall St’s Community page (used by millions of investors) update dynamically whenever important news or results are announced, so your estimates stay in sync with what matters most. For Toast, that could mean one investor sets a higher Fair Value by believing in the company’s fast international expansion, while another chooses a lower value amid concerns about margin pressures and hardware challenges. Both are valid perspectives, but Narratives make it easy to see the numbers behind each point of view in real time.

Do you think there's more to the story for Toast? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.