Please use a PC Browser to access Register-Tadawul

Assessing Tri Pointe Homes (TPH) Valuation After Strong Recent Share Price Momentum

Tri Pointe Homes, Inc. TPH | 46.31 | 0.00% |

Recent performance and business snapshot

Tri Pointe Homes (TPH) has drawn investor attention after a series of strong recent returns, including around 27% over the past day, 31% over the past week, and just over 50% in the past 3 months.

The homebuilder, headquartered in Incline Village, Nevada, designs, constructs, and sells single family attached and detached homes across the United States. It also offers mortgage financing, title and escrow, and property and casualty insurance agency services through its financial services segment.

At a share price of $46.37, Tri Pointe Homes has seen strong recent momentum, with the 90 day share price return of 51.14% sitting alongside a 5 year total shareholder return of 145.60%.

The recent jump in the share price suggests investors are reassessing the company’s prospects and risk profile. However, the 1 year total shareholder return of 28.02% indicates that the story has been building over a longer period rather than being driven only by short term moves.

If this kind of move in a homebuilder has caught your eye, it could be a good moment to broaden your search and check out 23 top founder-led companies as potential next ideas.

So with Tri Pointe Homes now at $46.37 and recent returns far outpacing its 1 year total shareholder return of 28.02%, is there still value on the table here or is the market already pricing in future growth?

Most Popular Narrative: 21% Overvalued

Tri Pointe Homes last closed at $46.37, while the most followed narrative pegs fair value closer to $38.20, using a 9.57% discount rate.

Tri Pointe is positioned to benefit from the sustained U.S. housing supply-demand imbalance and favorable demographic trends, which are expected to provide a long runway for revenue growth as household formation continues to outpace new home supply. Ongoing expansion into high-growth Sun Belt and Southeastern markets (Florida, Coastal Carolinas, Utah) broadens Tri Pointe's geographic footprint and capitalizes on migration patterns and hybrid/remote work trends, which should support higher sales volumes and revenue visibility.

Curious how a shrinking top line, thinner margins, and a higher future earnings multiple can still support that fair value math. The full narrative lays out the revenue path, margin reset, and valuation multiple needed to bridge the gap between $38.20 and today’s price.

Result: Fair Value of $38.20 (OVERVALUED)

However, there are still pressure points, including a 25% drop in home orders versus peers and concentrated exposure to softer Western markets that could challenge this thesis.

Another view on valuation

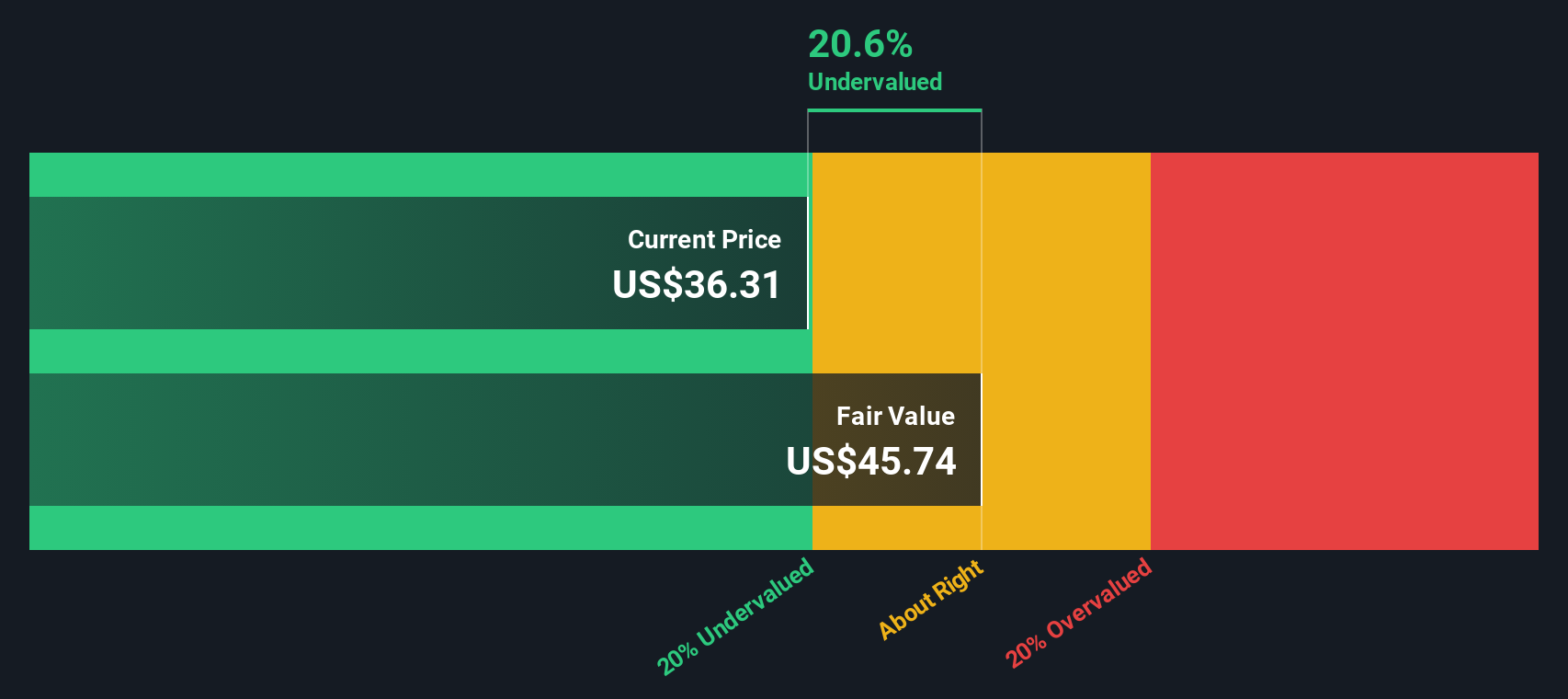

That $38.20 fair value comes from a forward earnings and multiple based narrative, but a different lens tells a slightly different story. Our DCF model points to a value of $45.09 per share, which puts today’s $46.37 price only modestly above that mark. So how much weight do you give to cash flows versus earnings multiples?

Build Your Own Tri Pointe Homes Narrative

If you are not fully on board with this narrative, or you would rather rely on your own analysis, you can quickly build a custom view instead: Do it your way.

A great starting point for your Tri Pointe Homes research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Tri Pointe Homes has you thinking harder about where you put your capital next, do not stop here. Broaden your watchlist with a few focused ideas.

- Target potential mispricing by checking out 53 high quality undervalued stocks that may combine solid fundamentals with more attractive entry points.

- Prioritize resilience and sleep better at night by scanning 84 resilient stocks with low risk scores that score well on stability and risk controls.

- Hunt for quality beyond the obvious names with our screener containing 23 high quality undiscovered gems that many investors might be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.