Please use a PC Browser to access Register-Tadawul

Assessing TSMC (NYSE:TSM) Valuation: Is the Semiconductor Giant’s Growth Potential Fully Priced In?

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 292.03 | 0.00% |

Taiwan Semiconductor Manufacturing (NYSE:TSM) may be catching your eye this week, especially if you are weighing up your next move. While there is no headline-grabbing news event sparking waves across the market, the recent drift in its share price is enough to have investors pausing to reconsider what might be around the corner for this semiconductor giant. Sometimes it is these seemingly quiet stretches that open up new questions about a company’s real value and risk profile, so let’s dig in.

Zooming out, TSM has enjoyed a resurgence this year. The stock is up 53% in the past 12 months, building on its impressive three-year run and topping even that with over 20% growth over the past three months. While there have been no market-rattling developments recently, momentum appears very much on its side, bolstered by steady revenue and net income growth over the past year.

After this sustained push, the big question is whether TSM is trading at a bargain relative to its long-term potential, or if the market has already priced in everything investors need to know.

Most Popular Narrative: 123.7% Overvalued

According to the most widely followed narrative, the current market price for TSM appears to run far ahead of fair value based on key long-term assumptions. The narrative paints a picture of robust business momentum but questions how much future upside is already baked in.

"At 10% revenue growth over the next 5 years, I expect $115.3b in revenues by 2028 (based on the latest Y/Y revenue of $71.6b). At 40% net margin (average of the last 3 years), the net income is approx $46.2b. With 5.186b shares outstanding, this results in an EPS of $8.89. For a future multiple, I’ll use the long-term P/E which has averaged 20. This gives me a terminal stock price of $178 (20 x $8.89). By discounting this terminal stock price to present value at a rate of 8.5%, I arrive at a present value of approximately $118.4, which is 32% above the current value of $89 per share."

Want to know what powers such a dramatic difference between fair value and market price? The narrative’s projections are built on bold profit margins and optimistic revenue momentum, all while keeping a sharp eye on future multiples. Which number makes this thesis so daring? Click in to see the assumptions that drive this perspective.

Result: Fair Value of $118.4 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical uncertainty or unexpected disruptions in chip manufacturing could quickly challenge even the most stable and reliable outlook for TSM.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.Another View: Peers and Industry Paint a Different Picture

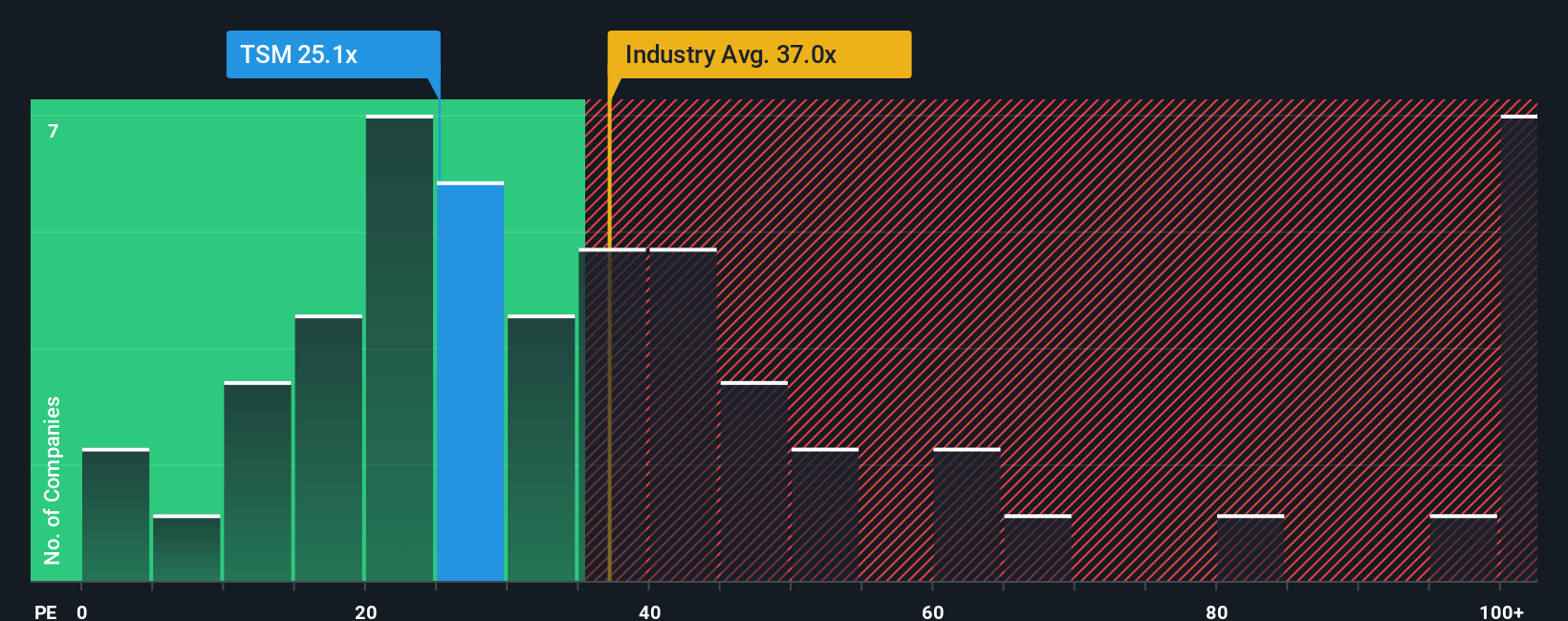

Looking past detailed fair value calculations, some investors prefer to judge TSM's pricing by lining up its current share price against similar businesses. On this measure, shares actually appear reasonably valued compared to the broader industry, and even look affordable against sector averages. If market trends hold, could this simpler perspective be missing hidden risks or future surprises?

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you have a different perspective or want to test your own expectations, building your personal valuation for TSM is fast and straightforward. The process takes just a few minutes. Do it your way

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your investing journey end here. Broaden your horizons and zero in on opportunities tailored to your financial goals with the Simply Wall Street Screener.

- Uncover opportunities in the AI revolution by tracking the next wave of innovation and market leaders using the AI penny stocks.

- Accelerate your search for undervalued gems with strong fundamentals by leveraging our powerful tool for undervalued stocks based on cash flows.

- Seek out market-beating income and long-term stability with stocks known for their robust payouts. Check out the latest dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.