Please use a PC Browser to access Register-Tadawul

Assessing UPS (UPS) Valuation After Earnings Beat And Reaffirmed 2026 Outlook

United Parcel Service, Inc. Class B UPS | 116.73 | +1.03% |

United Parcel Service (UPS) is back in focus after reporting fourth quarter and full year 2025 results that exceeded expectations, reaffirming 2026 revenue guidance and keeping its dividend unchanged despite ongoing cost pressures.

The latest quarterly beat and reaffirmed 2026 guidance have coincided with a clear shift in sentiment, with a 90 day share price return of 26.09% and 1 year total shareholder return of 10.87% suggesting momentum has recently picked up after weaker multi year outcomes.

If UPS's turnaround has caught your attention, this could be a good moment to broaden your watchlist. You may wish to consider 22 top founder-led companies as potential long term compounders beyond the transport sector.

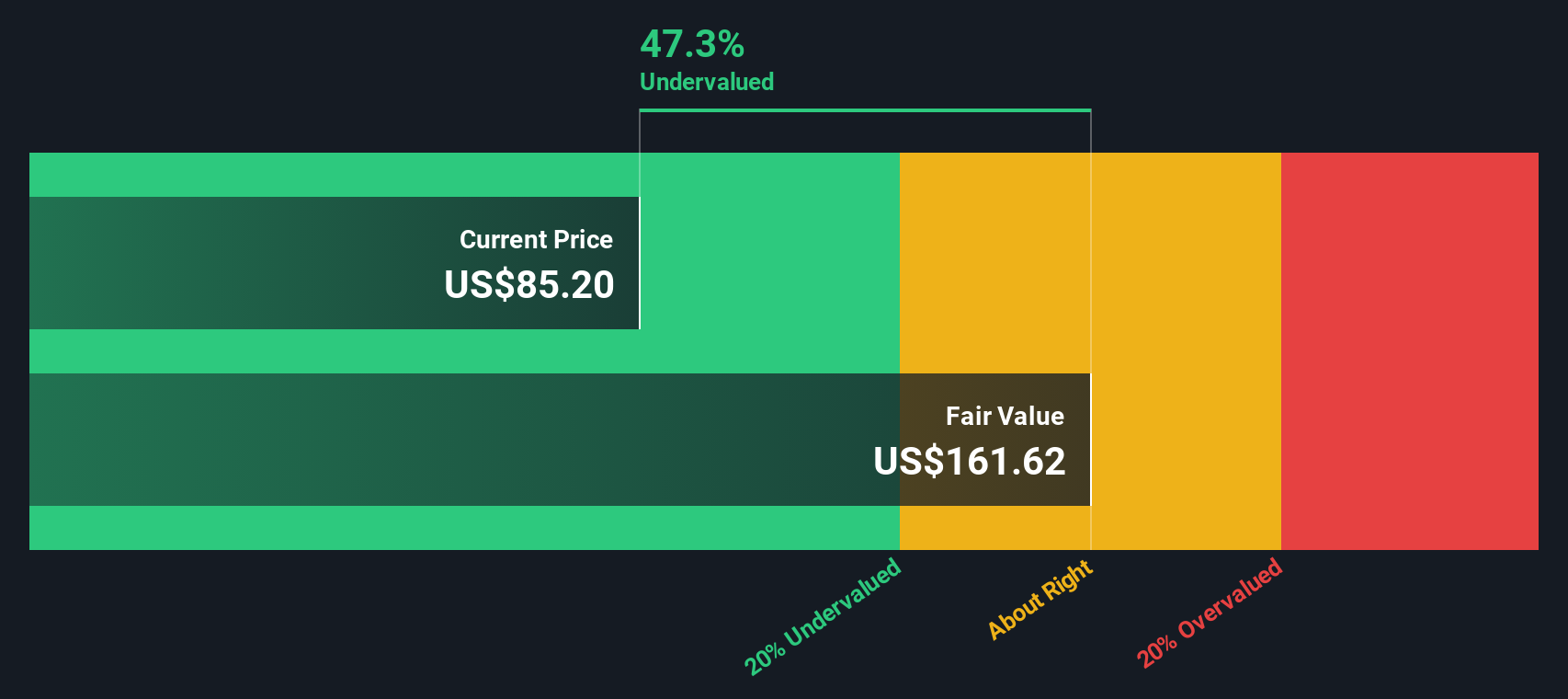

UPS now trades around $117 with an estimated 28% intrinsic discount, yet it sits slightly above the average analyst target. Is the recent rally still leaving room for mispricing, or is the market already baking in the turnaround?

Most Popular Narrative: 23.2% Overvalued

UPS closed at $117.34, while the most followed narrative on the stock anchors fair value at $95.21, framing the recent share price strength in a more cautious light.

We believe in a cautious approach in our analysis as UPS has been clouded with sustainability issues, higher costs, and internal headwinds. Can UPS navigate financial and operational pressures with resilience? Launched in early 2025, UPS's "Efficiency Reimagined" outlined the company’s largest network overhaul in company history, and this multi-year initiative sets out management's goals to streamline domestic operations.

If you want to understand why this narrative still lands well below today’s price, the key is in its measured revenue lift, modest margin rebuild, and a future earnings multiple that stays deliberately shy of sector leaders. Curious which specific assumptions pull fair value down toward $95.21 instead of closer to $117.34? The full narrative lays out the numbers and the reasoning in detail, according to NVF.

Result: Fair Value of $95.21 (OVERVALUED)

However, unresolved union tensions and higher interest costs on new long term debt could still pressure earnings enough to challenge this more cautious fair value story.

Another View: Cash Flows Point the Other Way

While the most followed narrative pegs UPS at $95.21 and calls the shares overvalued, our DCF model lands in a very different place. On that framework, UPS at $117.34 is trading about 28% below an estimated fair value of $162.37, which frames today’s price as a potential discount rather than excess. When one method flags downside and another flags upside, which set of assumptions do you find more convincing?

Build Your Own United Parcel Service Narrative

If you are not convinced by any single fair value view or prefer to work from the raw numbers yourself, you can build a personalised UPS thesis in just a few minutes. To begin, start with Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If UPS is already on your radar, do not stop there. The real edge often comes from lining up a few high quality alternatives alongside your main idea.

- Target potential value opportunities first by scanning companies that look mispriced using our 52 high quality undervalued stocks, built from hard numbers rather than headlines.

- Prioritise resilience by checking out 82 resilient stocks with low risk scores. This is a focused set of businesses with lower risk scores that can help steady the bumpier parts of your portfolio.

- Spot under followed potential before everyone else by reviewing our screener containing 24 high quality undiscovered gems, where solid fundamentals meet limited market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.