Please use a PC Browser to access Register-Tadawul

Assessing U.S. Physical Therapy’s Valuation After Recent Share Price Momentum

U.S. Physical Therapy, Inc. USPH | 85.09 | -1.57% |

Why U.S. Physical Therapy Is Drawing Fresh Attention

U.S. Physical Therapy (USPH) is back on investor radars after a recent share price move, with the stock up around 3% over the past month and roughly 14% in the past 3 months.

That recent 3 month share price return of 13.81% sits against a one year total shareholder return decline of 1.89% and a 5 year total shareholder return decline of 33.30%, which suggests near term momentum has picked up even as longer term investors have faced weaker outcomes.

If U.S. Physical Therapy has you looking more closely at the sector, this could be a useful moment to scan other healthcare stocks that might fit your watchlist.

With U.S. Physical Therapy trading at US$84.07, sitting at a reported 47.31% intrinsic discount and about 25.29% below analyst targets, you have to ask: is this a genuine entry point, or is the market already baking in future growth?

Most Popular Narrative: 21.3% Undervalued

Against the last close of $84.07, the most followed narrative points to a higher fair value, built on a detailed view of U.S. Physical Therapy's growth drivers and earnings power.

Strategic cost efficiency initiatives, such as AI-driven clinical documentation, semi-virtualized front desk operations, and recruitment/retention technology, are beginning to materially lower operating and labor costs per visit, directly improving net margins and earnings potential.

Curious what has to happen for that margin story to hold up? The narrative leans on rising clinic volumes, expanding employer services, and a richer profit profile than today.

According to this narrative, fair value for U.S. Physical Therapy sits at $106.83, using a 6.78% discount rate and a view that earnings, margins and revenue all trend higher over time than they are today. That framework also assumes the P/E multiple remains elevated compared to the wider U.S. Healthcare industry, and that share count edges up gradually rather than sharply diluting existing holders.

Ultimately, you are weighing two price tags: the current market price around $84 and a narrative driven fair value a little above $106, each built on different expectations for how clinic volumes, employer contracts, reimbursement and margins play out over the next few years.

Result: Fair Value of $106.83 (UNDERVALUED)

However, you still need to keep an eye on reimbursement pressure and tight clinician supply, as either could quickly cap margins and weaken the bullish earnings story.

Another Take: Multiples Paint a Tougher Picture

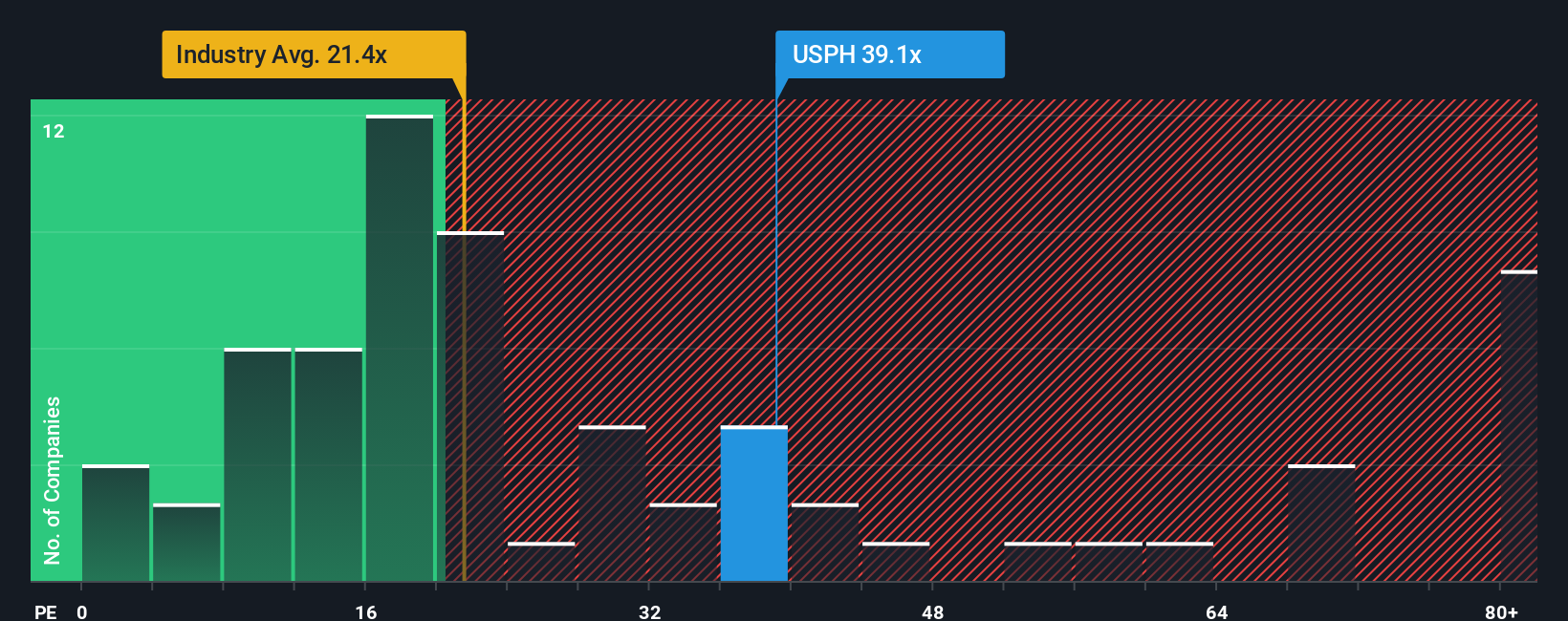

While the narrative and intrinsic value work suggest U.S. Physical Therapy looks underpriced, the current P/E of 34.9x tells a different story. This is especially true when you compare it with the US Healthcare industry at 22.5x, peers at 15.2x, and a fair ratio of 18.9x.

That gap implies you are paying a premium today that the market could eventually pull closer to the fair ratio. This would mean less room for error if growth or margins fall short. So is this a value opportunity, or just an expensive way to back the same growth story?

Build Your Own U.S. Physical Therapy Narrative

If the assumptions here do not sit right with you, or you prefer to lean on your own work, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If U.S. Physical Therapy has sparked your interest, do not stop here. Use the Simply Wall St Screener to compare fresh ideas side by side before the crowd catches on.

- Scan for potential bargains by reviewing these 861 undervalued stocks based on cash flows that may offer attractive cash flow profiles relative to their current market prices.

- Ride major technology shifts by checking out these 30 AI penny stocks that are tied to artificial intelligence themes across different industries.

- Target income focused opportunities by filtering for these 11 dividend stocks with yields > 3% that might suit a portfolio built around regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.