Please use a PC Browser to access Register-Tadawul

Assessing Virtus Investment Partners (VRTS) Valuation After A Year Of Weaker Shareholder Returns

Virtus Investment Partners, Inc. VRTS | 146.91 | +0.29% |

Why Virtus Investment Partners Is On Investors’ Radar Today

Virtus Investment Partners (VRTS) has recently drawn attention after a period of mixed share performance, with a small gain over the past month alongside weaker moves over the past 3 months and year.

At a last close of $170.27, the US based asset manager sits against a backdrop of measured value indicators, including a value score of 3 and an intrinsic discount figure provided by some models of 19.24%.

The recent 2.21% 1 month share price return contrasts with a 7.41% 3 month share price decline and a 15.03% 1 year total shareholder return decline. This suggests momentum has cooled even as some investors focus on the current valuation signals.

If you are comparing Virtus with other financial names, it can also be useful to broaden your research to fast growing stocks with high insider ownership for more ideas that might fit your style.

With shares down over the past year but some models pointing to a 19.24% intrinsic discount and only a modest gap to the price target, you have to ask: is this a genuine value opportunity, or is the market already pricing in future growth?

Price-to-Earnings of 8.4x: Is it justified?

At a P/E of 8.4x and a last close of $170.27, Virtus Investment Partners screens as cheaper than many peers that sit on much higher earnings multiples.

The P/E ratio compares the current share price to earnings per share. For an asset manager like Virtus it gives a quick read on how the market is valuing its profit stream.

Here, the company is trading at 8.4x earnings, while both the US Capital Markets industry average and a peer group average are much higher, at 25.6x and 24.6x respectively. That is a wide gap and suggests the market is assigning a lower earnings multiple to Virtus than it does to comparable names.

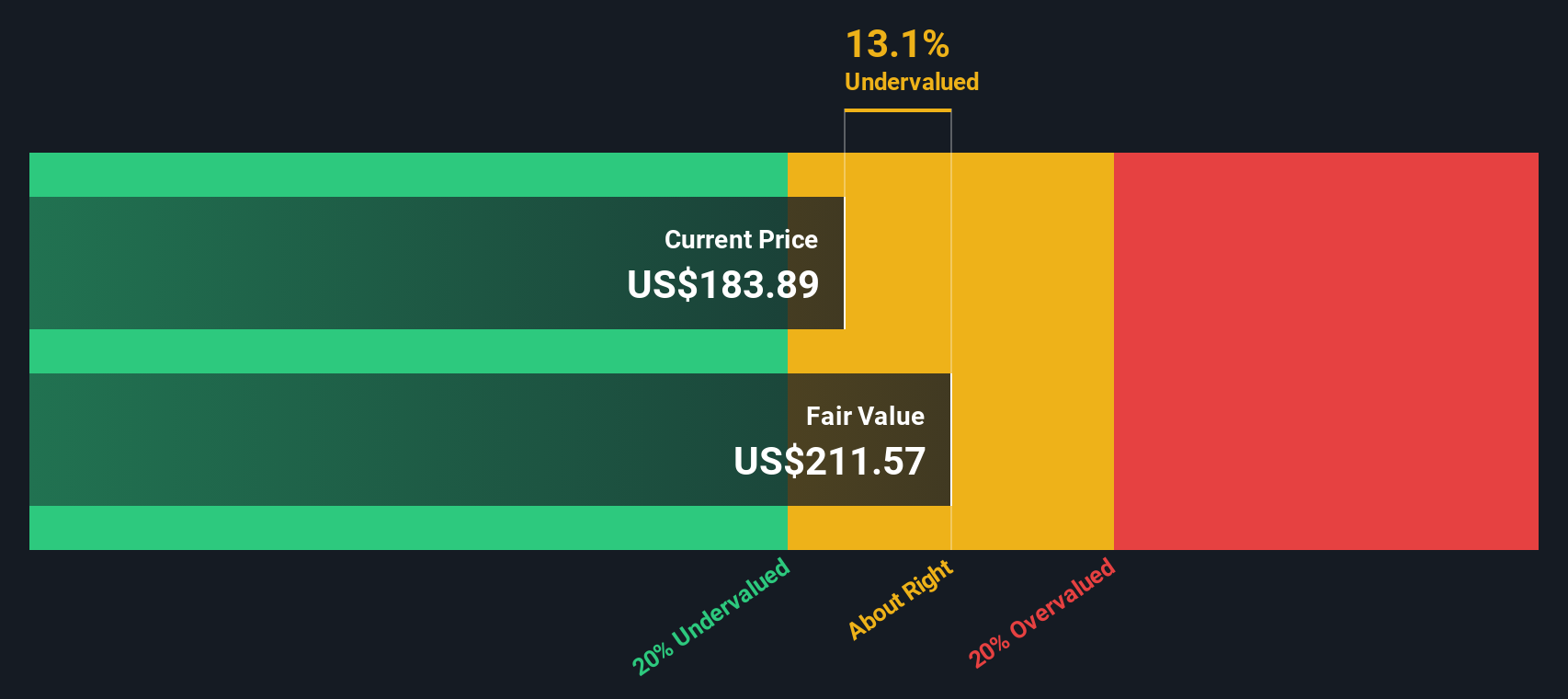

Against that backdrop, Simply Wall St’s DCF model currently suggests Virtus is trading at a 19.2% discount to an estimated fair value of $210.83. This provides another angle on the low P/E story.

Result: Price-to-Earnings of 8.4x (UNDERVALUED)

However, you also have to weigh the 3.6% annual revenue decline and the weaker 1 year and 3 year total returns as potential signals of pressure on the story.

Another Angle on Virtus’ Value

While the 8.4x P/E suggests Virtus Investment Partners looks cheap compared to an industry on 25.6x and peers on 24.6x, our DCF model is even more direct, pointing to a 19.2% discount to an estimated fair value of US$210.83. So is this a margin of safety or a value trap in disguise?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Virtus Investment Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Virtus Investment Partners Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test the data yourself, you can build a complete view in just a few minutes with Do it your way.

A great starting point for your Virtus Investment Partners research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other opportunities that better fit your goals, so keep widening your net with focused stock screens.

- Spot potential value by scanning these 868 undervalued stocks based on cash flows that currently trade at prices some models view as below their estimated cash flow worth.

- Ride powerful tech themes by zeroing in on these 24 AI penny stocks that are closely tied to artificial intelligence trends.

- Strengthen your income focus by filtering for these 12 dividend stocks with yields > 3% that may help you build a more consistent cash return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.