Please use a PC Browser to access Register-Tadawul

Assessing Wave Life Sciences (WVE) Valuation After Regaining Global Rights To WVE-006 From GSK

Wave Life Sciences Ltd. WVE | 13.49 | +2.51% |

Wave Life Sciences (WVE) is back in full control of its RNA editing candidate WVE-006 for alpha-1 antitrypsin deficiency after GSK returned global rights, and the company now plans to pursue an FDA accelerated approval path.

The latest WVE-006 update comes after a sharp 69.16% 90 day share price return and a 1 year total shareholder return of 8.91%. Longer term holders have seen a 3 year total shareholder return of 181.22%, suggesting momentum has been building despite recent pullbacks.

If WVE-006 has caught your attention, it could be a useful moment to see what else is happening across RNA, gene editing, and rare disease names via healthcare stocks.

With Wave now fully in charge of WVE-006, revenue at $109.23m, a net loss of $121.946m, and the share price at $13.33 versus an average analyst target of $32.73, investors may wish to consider whether there is still a buying opportunity here or whether the market is already pricing in future growth.

Most Popular Narrative: 58.3% Undervalued

With Wave Life Sciences closing at $13.33 versus a narrative fair value of $31.93, the current share price sits well below that estimate.

The expansion and clinical validation of Wave's proprietary RNA editing and siRNA platforms, including the emergence of new wholly-owned pipeline candidates for both rare and prevalent diseases, position the company to benefit from growing market adoption of RNA-based and precision therapies, underpinning longer-term top-line growth and partnership revenue potential.

Curious what kind of revenue ramp, margin shift, and future earnings multiple need to line up to support that fair value number? The narrative lays out a detailed path, backed by assumed growth rates, profit margins, and a rich earnings multiple that is more often associated with mature category leaders, not loss making biotechs.

Result: Fair Value of $31.93 (UNDERVALUED)

However, these upbeat assumptions can unravel quickly if key trials for WVE-006 or WVE-007 disappoint, or if partnership revenue and funding fall short of expectations.

Another Take On Valuation

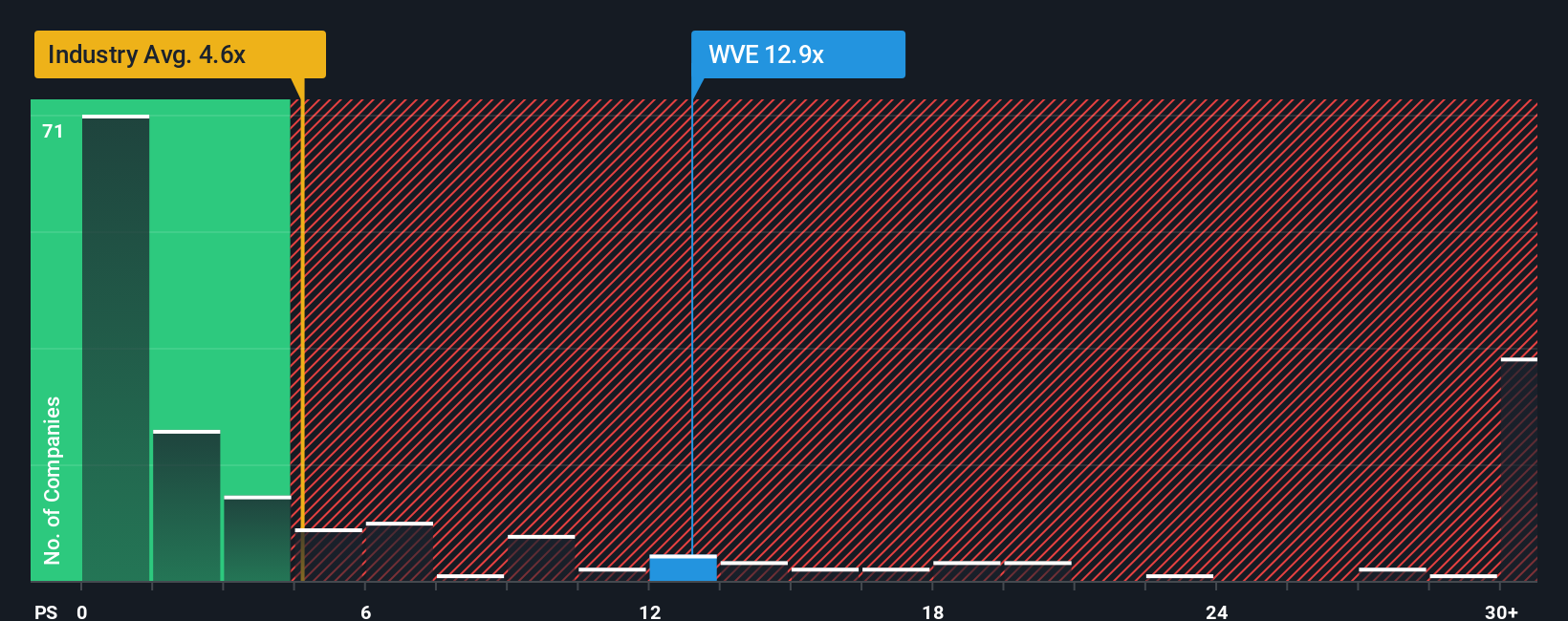

The fair value narrative points to WVE at $31.93, yet the current P/S of 22.3x looks heavy next to the US Pharmaceuticals industry at 4.5x, peers at 16.9x, and a fair ratio of 3.2x. That gap leans more toward valuation risk than clear upside. Which signal do you trust more?

Build Your Own Wave Life Sciences Narrative

If you see the numbers differently or want to test your own assumptions, you can build a complete Wave Life Sciences story in just a few minutes, starting with Do it your way.

A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research at one stock. Broaden your watchlist with focused idea lists that can quickly surface opportunities you might otherwise miss.

- Target potential mispricings by scanning these 868 undervalued stocks based on cash flows that match your preferred mix of quality, price, and future prospects.

- Ride major technology shifts early by checking out these 27 AI penny stocks shaping how artificial intelligence reaches real world applications.

- Boost your income focus by reviewing these 11 dividend stocks with yields > 3% that combine yield with underlying business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.