Please use a PC Browser to access Register-Tadawul

Assessing Willdan Group’s Valuation After Contract Win And Compass Municipal Advisors Acquisition

Willdan Group, Inc. WLDN | 119.00 | +0.74% |

Why Willdan Group (WLDN) Is Back on Investors’ Radar

Willdan Group (WLDN) has been in focus after completing its acquisition of Compass Municipal Advisors and winning a US$97 million energy savings performance contract with Alameda County, California, covering upgrades across 24 county sites.

Investors appear to be reacting to this mix of new contracts and an expanded municipal finance platform, with a 29.12% 1 month share price return and a very large 3 year total shareholder return that together point to strong recent momentum.

If news like Willdan’s contract wins has you looking wider, this could be a useful moment to scan fast growing stocks with high insider ownership as another source of potential ideas.

With Willdan shares up 29.12% over the past month and trading at US$133.99 versus a US$145 analyst target and a modelled 29.91% intrinsic discount, the key question is whether this surge leaves more upside or if the market is already pricing in future growth.

Most Popular Narrative: 1% Overvalued

Compared with Willdan Group’s last close at US$133.99, the most followed narrative sees fair value at US$132.50, putting the shares roughly in line with that view.

Rapidly expanding demand for electrification and AI-driven data centers, combined with resilient infrastructure investment, is described as driving multi-year growth in Willdan's core addressable markets. This is presented as supporting organic revenue growth and large new contract wins that could substantially increase top-line results. Willdan's ongoing rollout of proprietary software and analytics platforms, paired with its established consulting services, is described as creating cross-selling opportunities and enabling technology-driven solutions for clients.

Curious what earnings path, margin lift, and future profit multiple are baked into that fair value? The narrative leans on ambitious but tightly argued forecasts.

Result: Fair Value of $132.5 (ABOUT RIGHT)

However, policy shifts affecting utility and government funded energy work, or higher costs from acquisitions and wage inflation, could quickly challenge that fair value story.

Another View: Cash Flows Tell a Different Story

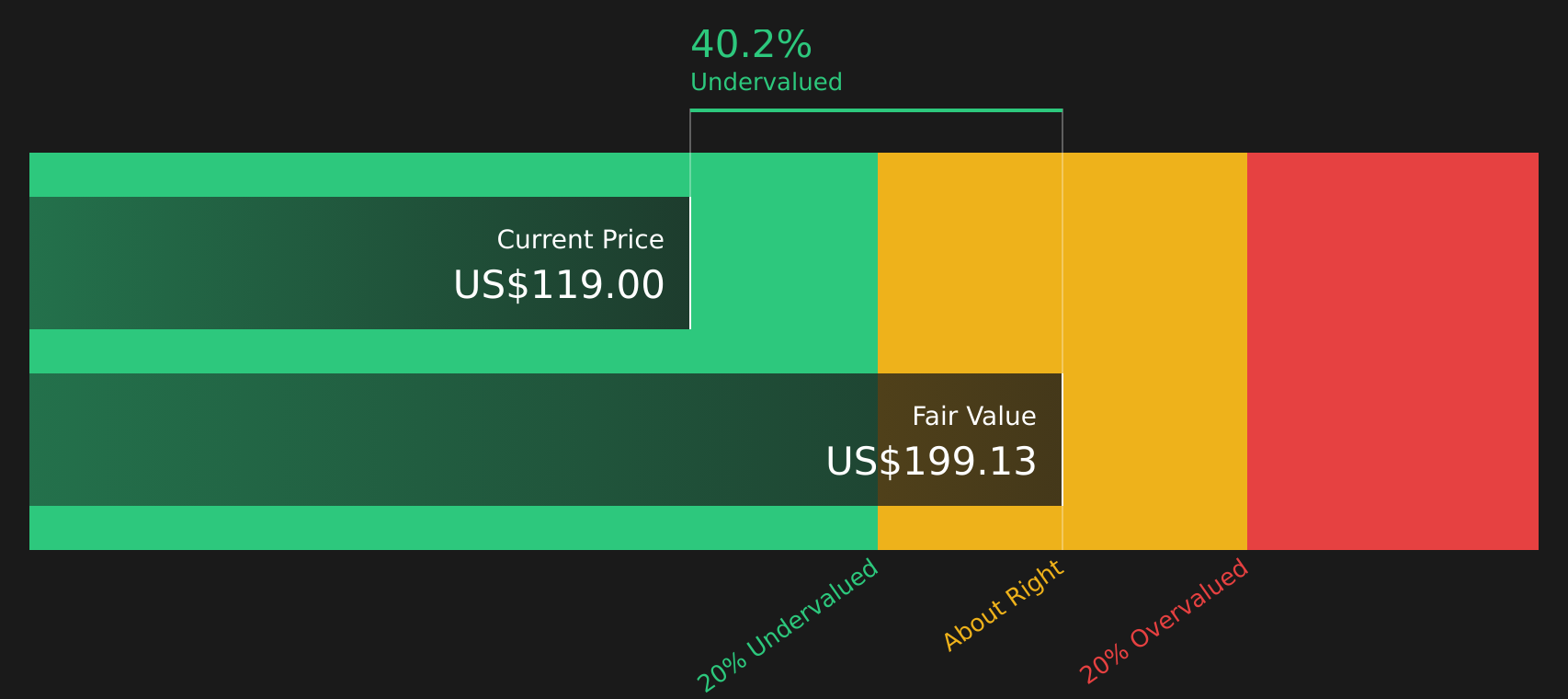

While the consensus narrative sees Willdan as roughly fairly priced, our DCF model points to a different conclusion. On that measure, WLDN at US$133.99 screens as around 30% below an estimated fair value of US$191.18, which frames the recent rally as less stretched than it might look at first glance.

That gap between price and DCF output raises a straightforward question for you: which set of assumptions do you think is closer to how Willdan’s contracts, margins, and tax changes will actually play out over time?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Willdan Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Willdan Group Narrative

If you look at the numbers and reach a different conclusion, or simply prefer your own work, you can build a custom view in minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Willdan Group.

Ready to Find Your Next Idea?

If Willdan has caught your attention, do not stop here. Use the Simply Wall Street Screener to quickly surface other stocks that fit the kind of opportunities you care about.

- Scan for potential value by hunting through these 863 undervalued stocks based on cash flows where the market price and underlying cash flows may be out of sync.

- Tap into long term themes by checking out these 24 AI penny stocks that sit at the intersection of computing power and real world applications.

- Balance growth with income by reviewing these 12 dividend stocks with yields > 3% that couple established businesses with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.