Please use a PC Browser to access Register-Tadawul

Assessing Workday (WDAY) Valuation After Launch Of Military Skills Mapper For Veteran Hiring

Workday, Inc. Class A WDAY | 137.81 | -1.58% |

Workday (WDAY) is back in focus after launching Military Skills Mapper in Workday Recruiting, a new capability that translates veterans' military experience into civilian skills and draws fresh attention to its broader cloud HR and finance platform.

Despite the Military Skills Mapper launch and a stream of new partner integrations, Workday’s share price has faced selling pressure, with a 30 day share price return of -24.51% and a 1 year total shareholder return of -42.86%, signalling fading momentum after earlier optimism.

If this veteran hiring push has you thinking more broadly about where AI is reshaping HR and productivity, it could be worth scanning our screener of 56 profitable AI stocks that aren't just burning cash as a starting list of ideas.

With Workday now trading around US$158.76 after a 1 year total return decline of 42.86%, and screens flagging an intrinsic discount close to 51%, investors may need to consider whether this represents a reset that creates opportunity or whether the market is already correctly pricing its future growth.

Most Popular Narrative: 37.3% Undervalued

At a last close of $158.76 versus a narrative fair value of $253.14, the gap in expectations on Workday is already pretty clear according to Chester.

This narrative is brief and simply stands on the shoulders of the recent aggregate analysts review (Dec 2024). Put simply, if revenue grows at <15% pa and margins fall to <20% average over the next 3 years, that implies a pretty consistent growth rate that contradicts the high PE ratio for this stock. A reasonable investor is not going to pay 50+ PE (for 2% returns on current price) for a company with proven growth <15%. Further, with the risk factors in play especially AI, the discount rate used by any investor should be higher to justify the returns. Thus, even allowing for revenue growth at 15% and margins at 20%, with the discount rate holding at 7.08%, if PE acceptance falls to 30x then indicated fair value is $253.14. That still implies higher future growth than would have been demonstrated for 5-7 years up that point.

Curious how a higher discount rate, moderate top line growth and firmer margins can still land on a premium earnings multiple? The tension between assumed profitability, future P/E and today’s price sits at the heart of this narrative. If you want to see exactly how those moving parts stack up, the full story lays out each step in the fair value build.

Result: Fair Value of $253.14 (UNDERVALUED)

However, there are still clear risks here, including slower than modelled revenue growth or lower market willingness to support a 30x future P/E.

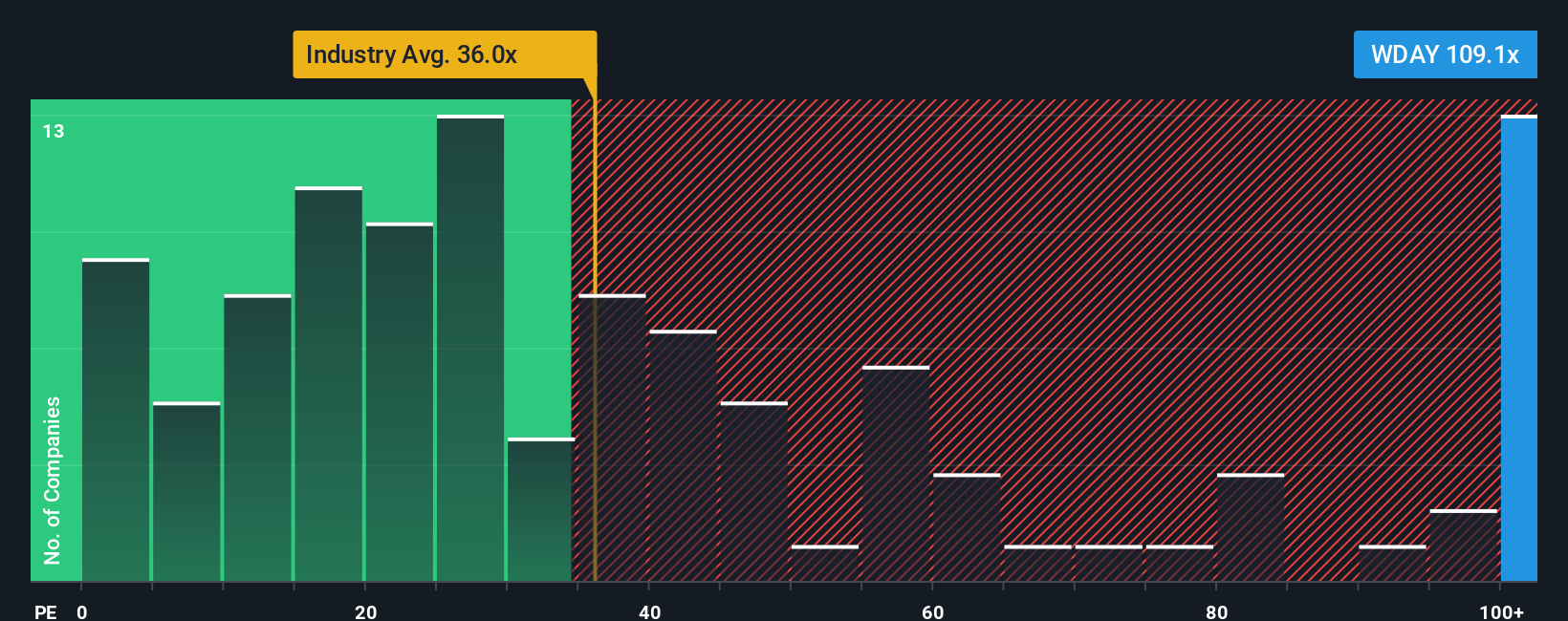

Another View: Valuation Through The P/E Lens

Chester’s fair value of $253.14 paints Workday as undervalued, but current market ratios tell a different story. At a 65x P/E, Workday trades well above the US Software industry average of 25.7x, the peer average of 30.8x and even above its own fair ratio of 41.1x. This points to richer expectations baked into today’s price. With that kind of premium, is the real risk missing upside or overpaying for growth that may already be factored in?

Build Your Own Workday Narrative

If you are not convinced by these takes or prefer to stress test the assumptions yourself, you can build a personalised Workday thesis in minutes using Do it your way.

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Workday has sharpened your thinking, do not stop here. Broaden your watchlist with other ideas that fit different goals and risk levels.

- Target long term compounding potential by reviewing our list of 55 high quality undervalued stocks that combine strong fundamentals with prices that screens flag as below their assessed worth.

- Strengthen your income stream by checking out 15 dividend fortresses, a focused set of companies offering 5%+ yields with an emphasis on resilience.

- Dial down portfolio risk by scanning 81 resilient stocks with low risk scores, highlighting companies our models flag with more resilient profiles and lower overall risk scores.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.