Please use a PC Browser to access Register-Tadawul

Assessing Workiva (WK) Valuation After Board Refresh And New Lead Independent Director

Workiva Inc. Class A WK | 61.43 | +3.66% |

Board changes put governance in focus at Workiva

Workiva (WK) has refreshed its board, adding two independent directors, former finance chiefs Scott Herren and Mark Peek. Long-serving director David Mulcahy resigned, and Suku Radia became Lead Independent Director.

Workiva’s 1 day share price return of 1.77% comes after a tougher stretch, with a 30 day share price return of 21.84% and a 1 year total shareholder return of 25.85%. This suggests momentum has been fading even as governance changes draw fresh attention.

If this governance shake up has you thinking about what else is out there in software and automation, it could be a good moment to scan 30 robotics and automation stocks as a fresh set of ideas.

With the shares down over the past year and trading at what looks like roughly a 41% discount to one intrinsic value estimate and a 52% discount to analyst targets, you have to ask: is this a reset, or is the market already pricing in future growth?

Most Popular Narrative: 35.5% Undervalued

With Workiva shares at $69.96 and the most followed narrative pointing to fair value around $108.45, the gap between market price and that framework is clear.

The analysts have a consensus price target of $94.1 for Workiva based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $85.0.

Want to see what kind of revenue climb, margin shift and future earnings multiple have been woven together here? The narrative leans on bold growth and profitability assumptions that differ from today’s income statement. Curious how those moving parts stack up to reach that higher fair value band?

Result: Fair Value of $108.45 (UNDERVALUED)

However, that upside story can wobble if European rules like CSRD shift, or if weaker customer budgets slow the take up of Workiva’s reporting platform.

Another Angle on Workiva’s Value

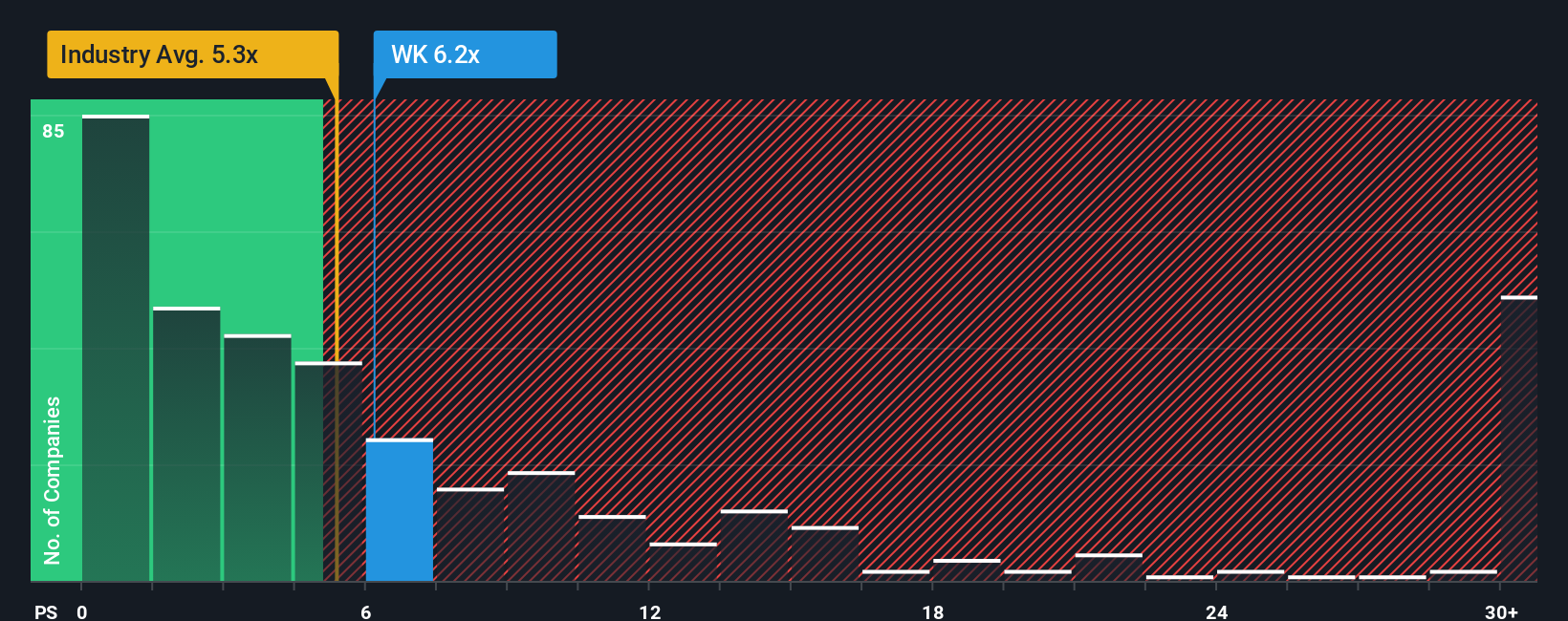

Those cash flow and fair value estimates tell one story, but the simple sales ratio tells another. Workiva trades on a P/S of 4.6x, compared with 3.7x for the US Software industry and 4.8x for peers, while our fair ratio sits higher at 5.2x. That mix points to both a valuation cushion and clear risk if sentiment turns. Which signal feels more convincing to you?

Build Your Own Workiva Narrative

If this view of Workiva does not align with your perspective on the business, you can examine the numbers yourself and Do it your way in under 3 minutes.

A great starting point for your Workiva research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one company, you miss the chance to compare different strengths, risks and income profiles that could suit your own goals better.

- Target potential upside by checking out 51 high quality undervalued stocks that combine quality fundamentals with prices that sit below one view of fair value.

- Strengthen your core holdings by reviewing solid balance sheet and fundamentals stocks screener (45 results) that prioritize financial resilience and cleaner balance sheets.

- Put your cash to work with income ideas by scanning 14 dividend fortresses offering higher yields that some investors use for regular portfolio payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.