Please use a PC Browser to access Register-Tadawul

ATA Creativity Global (NASDAQ:AACG) Stock's 32% Dive Might Signal An Opportunity But It Requires Some Scrutiny

ATA CREATIVITY GLOBAL SPON ADS EACH REP 2 ORD SHS AACG | 0.90 | -12.62% |

Unfortunately for some shareholders, the ATA Creativity Global (NASDAQ:AACG) share price has dived 32% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

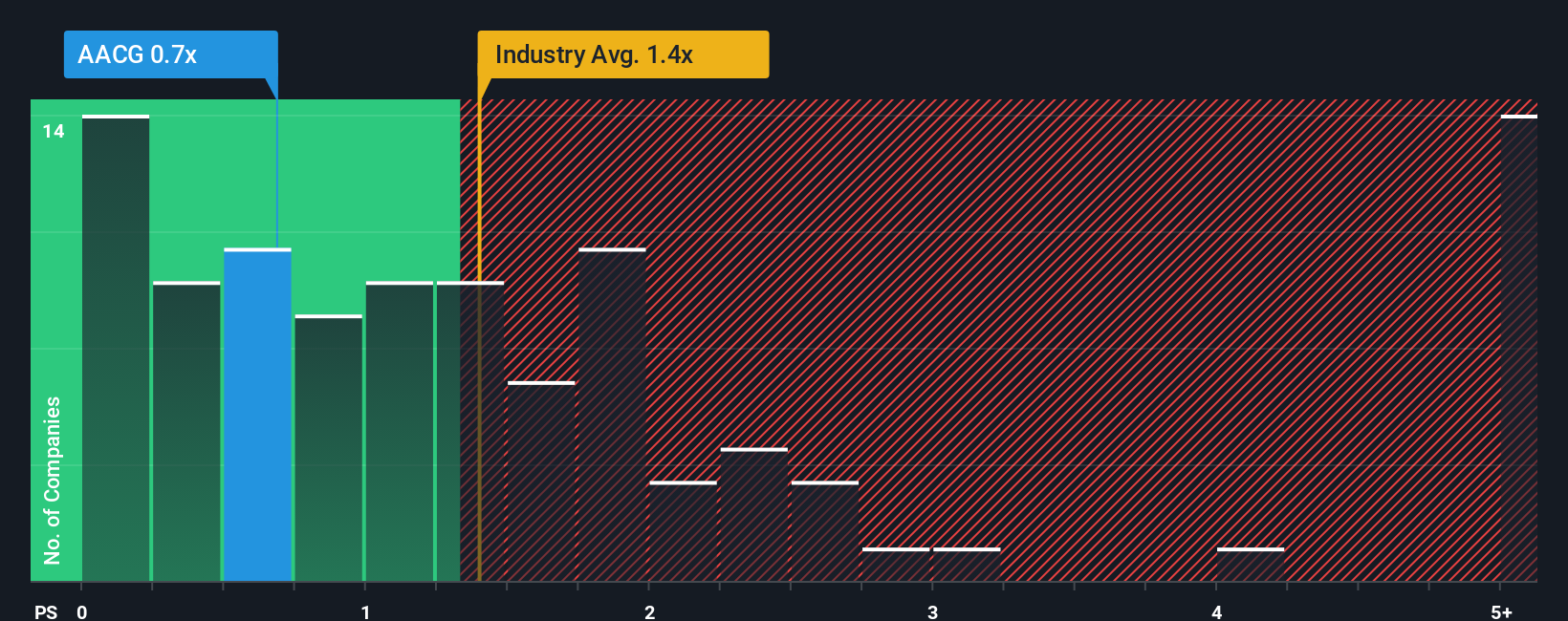

Following the heavy fall in price, given about half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider ATA Creativity Global as an attractive investment with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How ATA Creativity Global Has Been Performing

The revenue growth achieved at ATA Creativity Global over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ATA Creativity Global's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

ATA Creativity Global's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The latest three year period has also seen an excellent 39% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.8% shows it's noticeably more attractive.

In light of this, it's peculiar that ATA Creativity Global's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

The southerly movements of ATA Creativity Global's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of ATA Creativity Global revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.