Please use a PC Browser to access Register-Tadawul

AudioCodes (NASDAQ:AUDC) Is Increasing Its Dividend To $0.20

AudioCodes Ltd. AUDC | 9.08 | -0.87% |

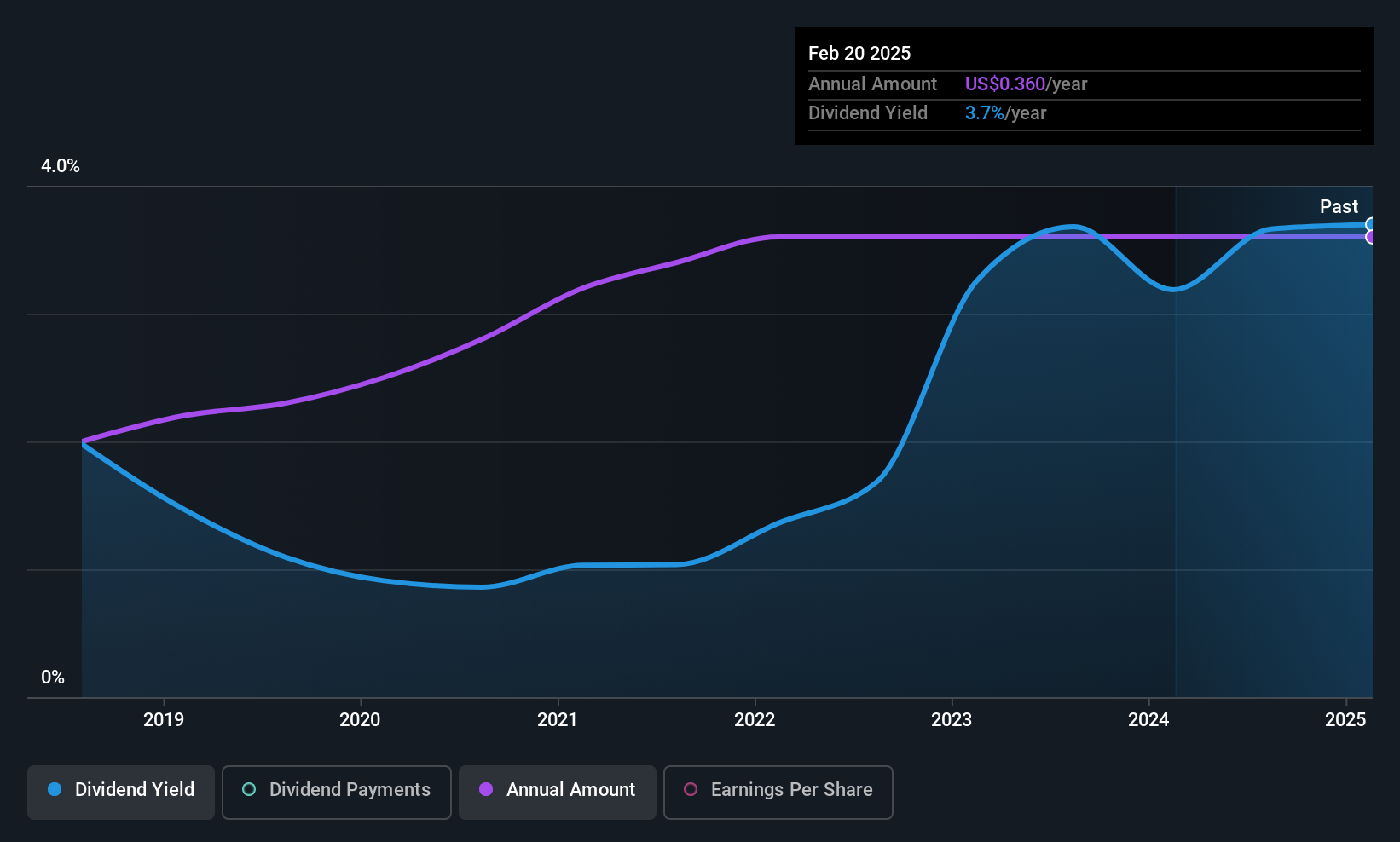

The board of AudioCodes Ltd. (NASDAQ:AUDC) has announced that it will be paying its dividend of $0.20 on the 28th of August, an increased payment from last year's comparable dividend. This will take the dividend yield to an attractive 4.1%, providing a nice boost to shareholder returns.

AudioCodes' Future Dividends May Potentially Be At Risk

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. The last payment made up 82% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Over the next year, EPS is forecast to fall by 87.9%. If the dividend continues along the path it has been on recently, the company could be paying out more than double what it is earning, which is definitely a bit high to be sustainable going forward.

AudioCodes Doesn't Have A Long Payment History

It is great to see that AudioCodes has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2018, the dividend has gone from $0.20 total annually to $0.40. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

AudioCodes Might Find It Hard To Grow Its Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that AudioCodes has grown earnings per share at 12% per year over the past five years. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

In Summary

Overall, we always like to see the dividend being raised, but we don't think AudioCodes will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.