Please use a PC Browser to access Register-Tadawul

Axogen, Inc.'s (NASDAQ:AXGN) Shares Leap 29% Yet They're Still Not Telling The Full Story

AxoGen, Inc. AXGN | 29.35 29.35 | -1.44% 0.00% Pre |

Those holding Axogen, Inc. (NASDAQ:AXGN) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 33%.

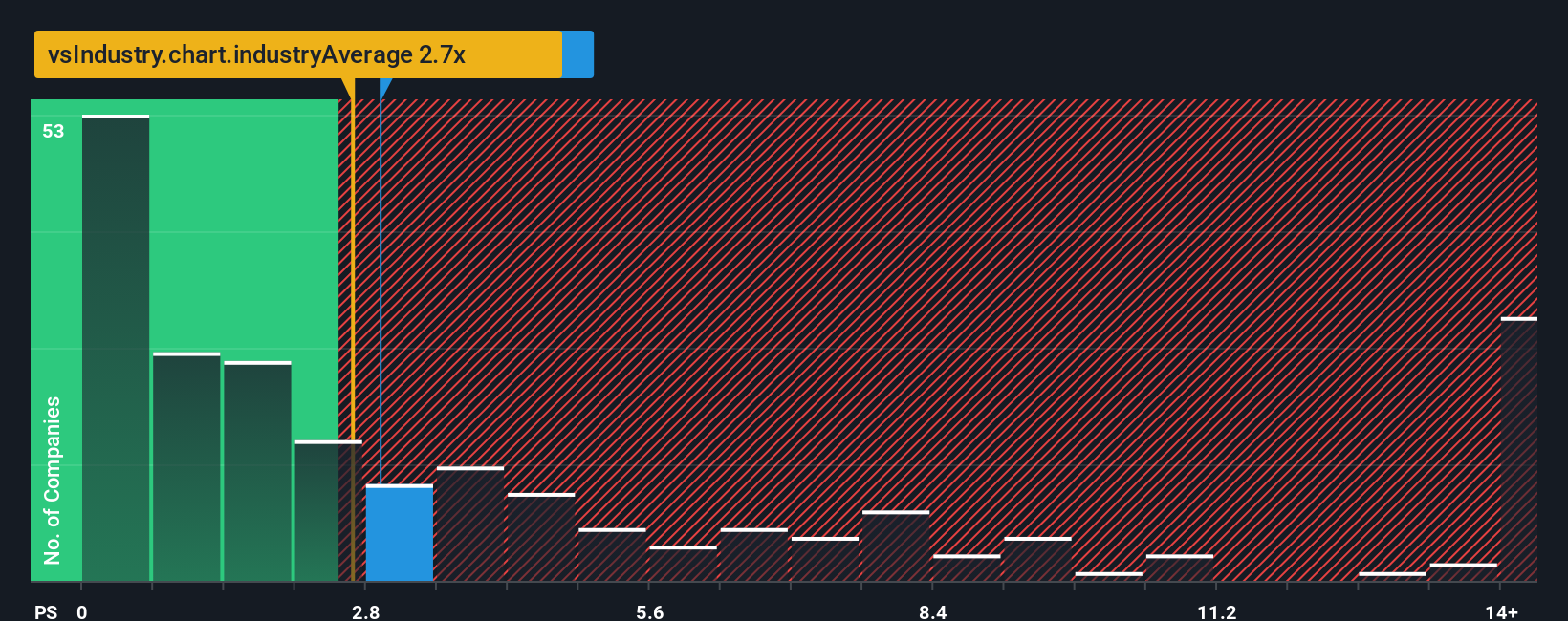

Even after such a large jump in price, it's still not a stretch to say that Axogen's price-to-sales (or "P/S") ratio of 2.9x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in the United States, where the median P/S ratio is around 2.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Axogen's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Axogen has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Axogen.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Axogen's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 10% per year growth forecast for the broader industry.

In light of this, it's curious that Axogen's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Axogen's P/S?

Axogen appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Axogen currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If you're unsure about the strength of Axogen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.