Please use a PC Browser to access Register-Tadawul

AZZ Inc.'s (NYSE:AZZ) Shares Climb 25% But Its Business Is Yet to Catch Up

AZZ Inc. AZZ | 108.86 | +0.62% |

AZZ Inc. (NYSE:AZZ) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

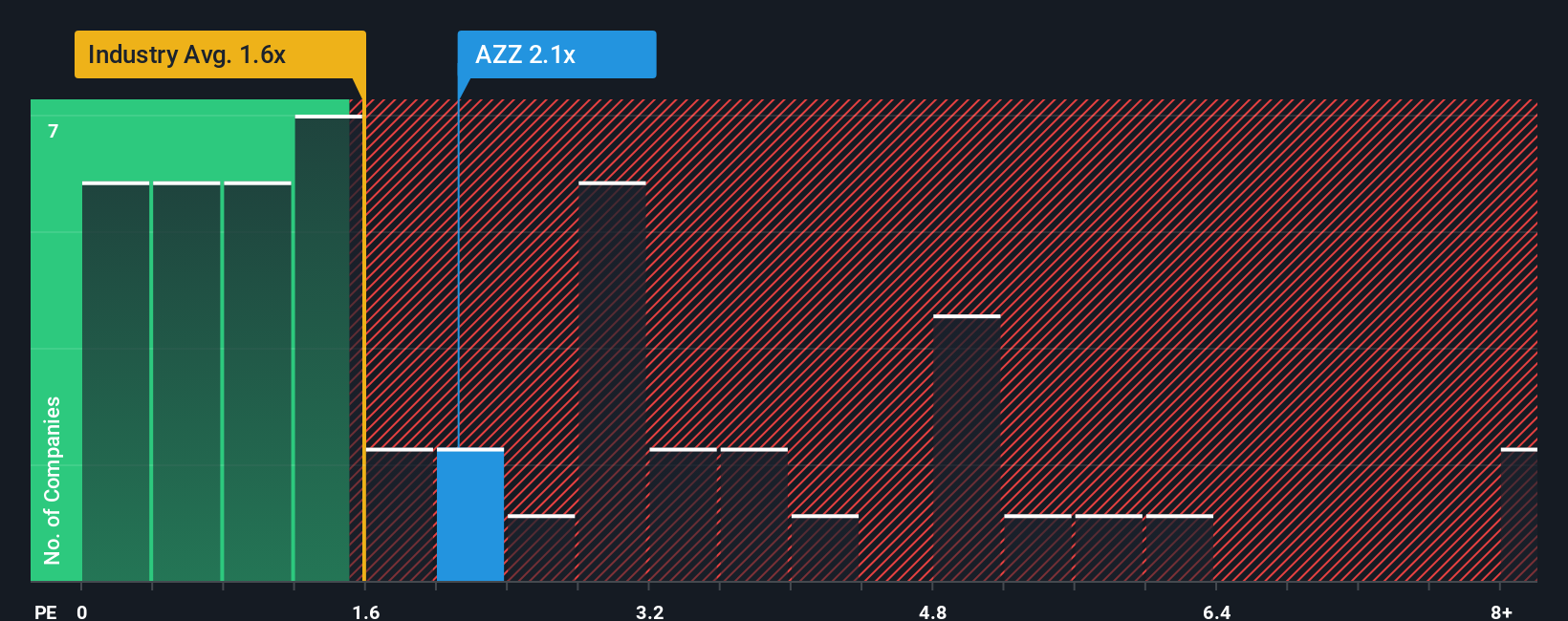

After such a large jump in price, when almost half of the companies in the United States' Building industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider AZZ as a stock probably not worth researching with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How AZZ Has Been Performing

Recent times haven't been great for AZZ as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on AZZ will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For AZZ?

AZZ's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 163% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 5.6% per year as estimated by the ten analysts watching the company. With the industry predicted to deliver 5.5% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that AZZ's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From AZZ's P/S?

The large bounce in AZZ's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting AZZ's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.