Please use a PC Browser to access Register-Tadawul

Benign Growth For Build-A-Bear Workshop, Inc. (NYSE:BBW) Underpins Stock's 27% Plummet

Build-A-Bear Workshop, Inc. BBW | 52.53 | -0.94% |

Build-A-Bear Workshop, Inc. (NYSE:BBW) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 34%, which is great even in a bull market.

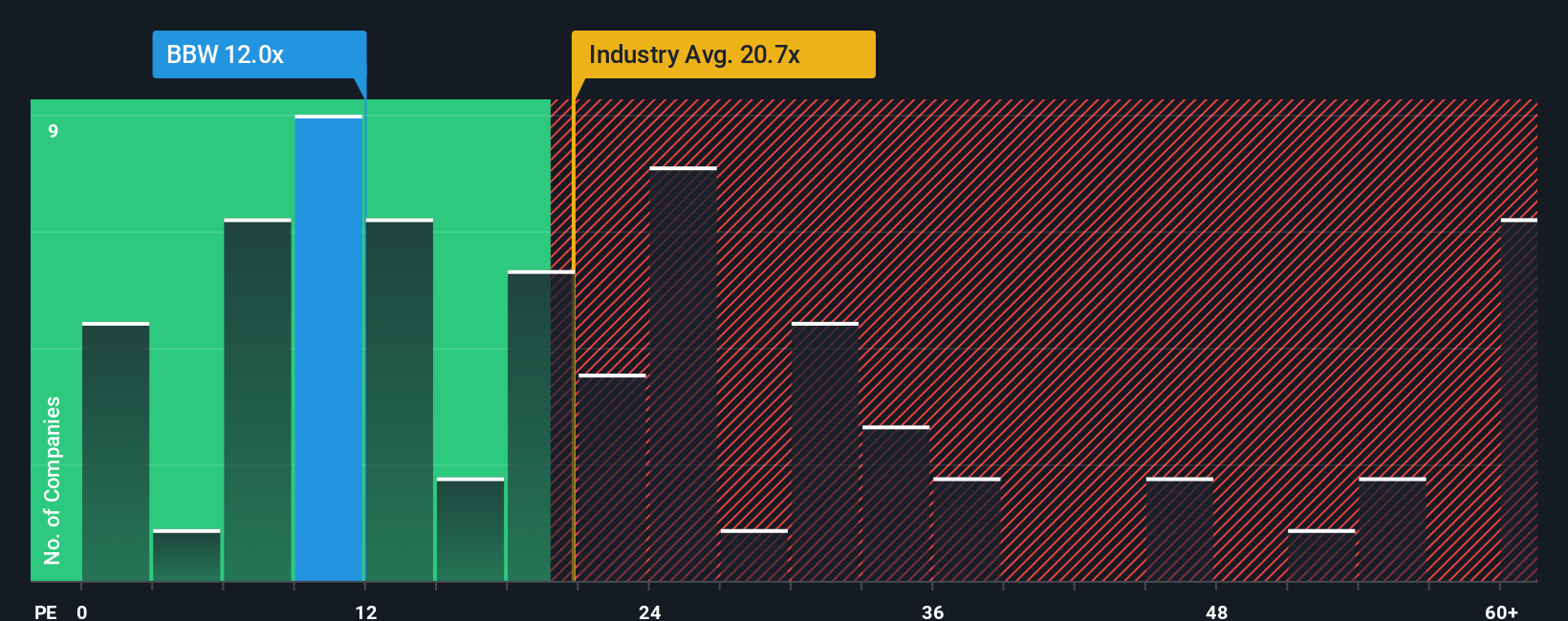

In spite of the heavy fall in price, Build-A-Bear Workshop may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.1x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 35x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Build-A-Bear Workshop has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Build-A-Bear Workshop's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. The latest three year period has also seen an excellent 34% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 2.6% per year during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 12% per annum growth forecast for the broader market.

In light of this, it's understandable that Build-A-Bear Workshop's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The softening of Build-A-Bear Workshop's shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Build-A-Bear Workshop maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Build-A-Bear Workshop with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.