Please use a PC Browser to access Register-Tadawul

Benign Growth For Similarweb Ltd. (NYSE:SMWB) Underpins Stock's 48% Plummet

Similarweb Ltd. SMWB | 7.48 | -2.73% |

Similarweb Ltd. (NYSE:SMWB) shareholders won't be pleased to see that the share price has had a very rough month, dropping 48% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 2.0% over that longer period.

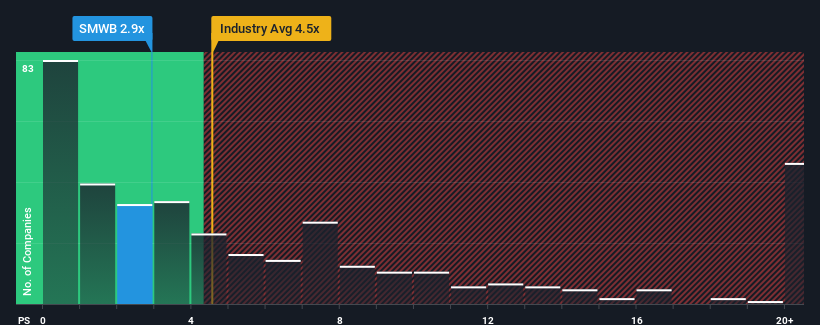

Since its price has dipped substantially, Similarweb may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.9x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.5x and even P/S higher than 10x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Similarweb's Recent Performance Look Like?

There hasn't been much to differentiate Similarweb's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Similarweb will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Similarweb will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Similarweb?

In order to justify its P/S ratio, Similarweb would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. This was backed up an excellent period prior to see revenue up by 82% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 21% each year growth forecast for the broader industry.

In light of this, it's understandable that Similarweb's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Similarweb's P/S?

The southerly movements of Similarweb's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Similarweb's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

If you're unsure about the strength of Similarweb's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.