Please use a PC Browser to access Register-Tadawul

Benign Growth For SoundThinking, Inc. (NASDAQ:SSTI) Underpins Stock's 26% Plummet

SoundThinking, Inc. SSTI | 7.61 | +2.42% |

SoundThinking, Inc. (NASDAQ:SSTI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

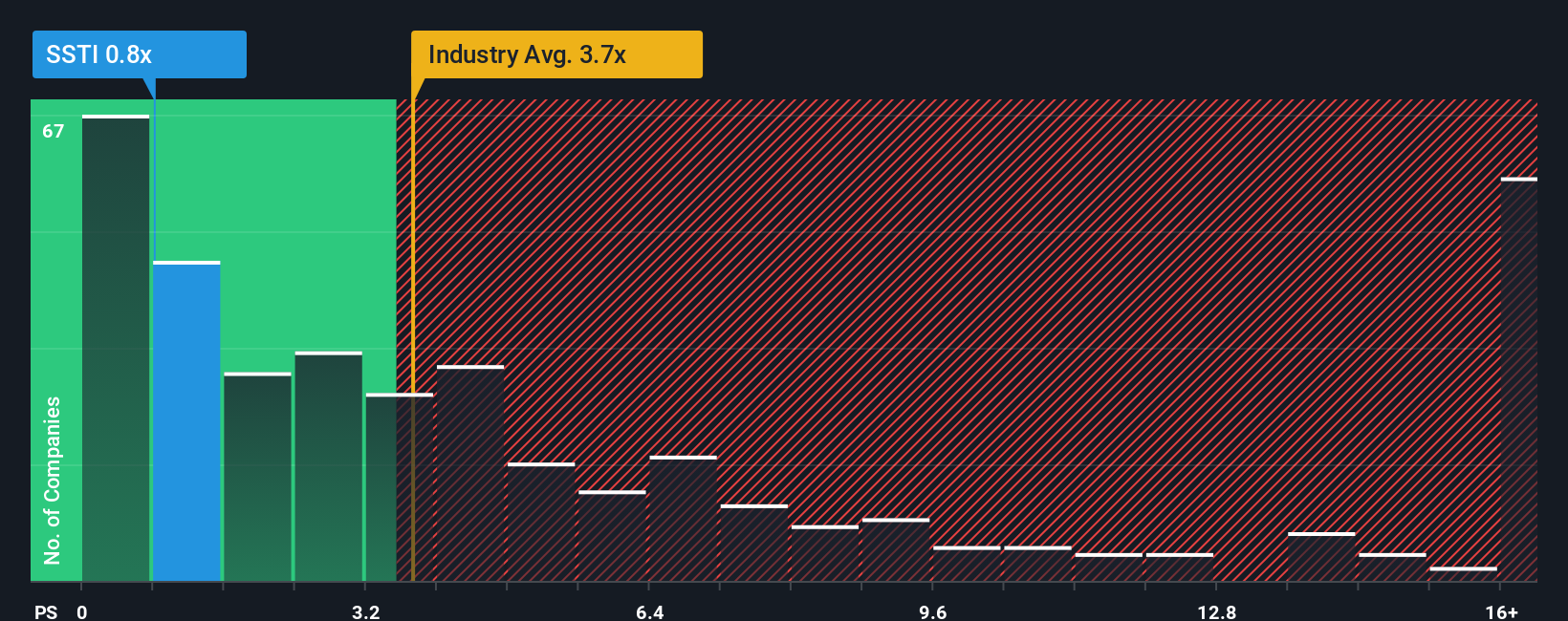

After such a large drop in price, SoundThinking may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Has SoundThinking Performed Recently?

SoundThinking could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SoundThinking.Is There Any Revenue Growth Forecasted For SoundThinking?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like SoundThinking's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.8%. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 8.7% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 32%, which is noticeably more attractive.

In light of this, it's understandable that SoundThinking's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in SoundThinking have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that SoundThinking maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware SoundThinking is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on SoundThinking, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.