Please use a PC Browser to access Register-Tadawul

Best Buy (BBY) Valuation After Earnings Beat, Guidance Hike and Renewed Investor Confidence

Best Buy Co.,Inc. BBY | 72.62 | +0.95% |

Best Buy (BBY) just reminded investors it is more than a cyclical gadget shop, with Q3 results that topped forecasts and a guidance raise that helped spark a sharp move higher in the stock.

The positive reaction to Q3 comes after a tougher year, with the share price at $73.46 and a year to date share price return of negative 14.75 percent. The one year total shareholder return of negative 11.85 percent shows sentiment has been cautious even as recent results hint that momentum could be turning.

If Best Buy’s latest quarter has you rethinking retail tech, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover other compelling growth stories with skin in the game.

With earnings surprising to the upside and the stock still trading at a discount to analyst and intrinsic value estimates, the big question now is whether Best Buy is a genuine bargain or if markets are already pricing in a full recovery.

Most Popular Narrative Narrative: 12.4% Undervalued

With Best Buy closing at $73.46 against a narrative fair value near $83.90, the current setup frames a meaningful upside gap for patient investors.

Launch and scaling of Best Buy's online marketplace add significant product assortment (6x prior levels), improve customer digital experience, and broaden participation in profitable retail media (ad) revenue streams, driving top-line growth and contributing to improved operating margin over time even with initial investment costs.

Curious how moderate growth assumptions can still back a richer valuation? The narrative leans heavily on margin mix, new profit engines, and a surprisingly disciplined earnings trajectory. Want to see which numbers really move the model?

Result: Fair Value of $83.90 (UNDERVALUED)

However, sustained online competition and a sales mix skewed to lower margin categories could pressure profitability and blunt the impact of newer profit streams.

Another Angle on Valuation

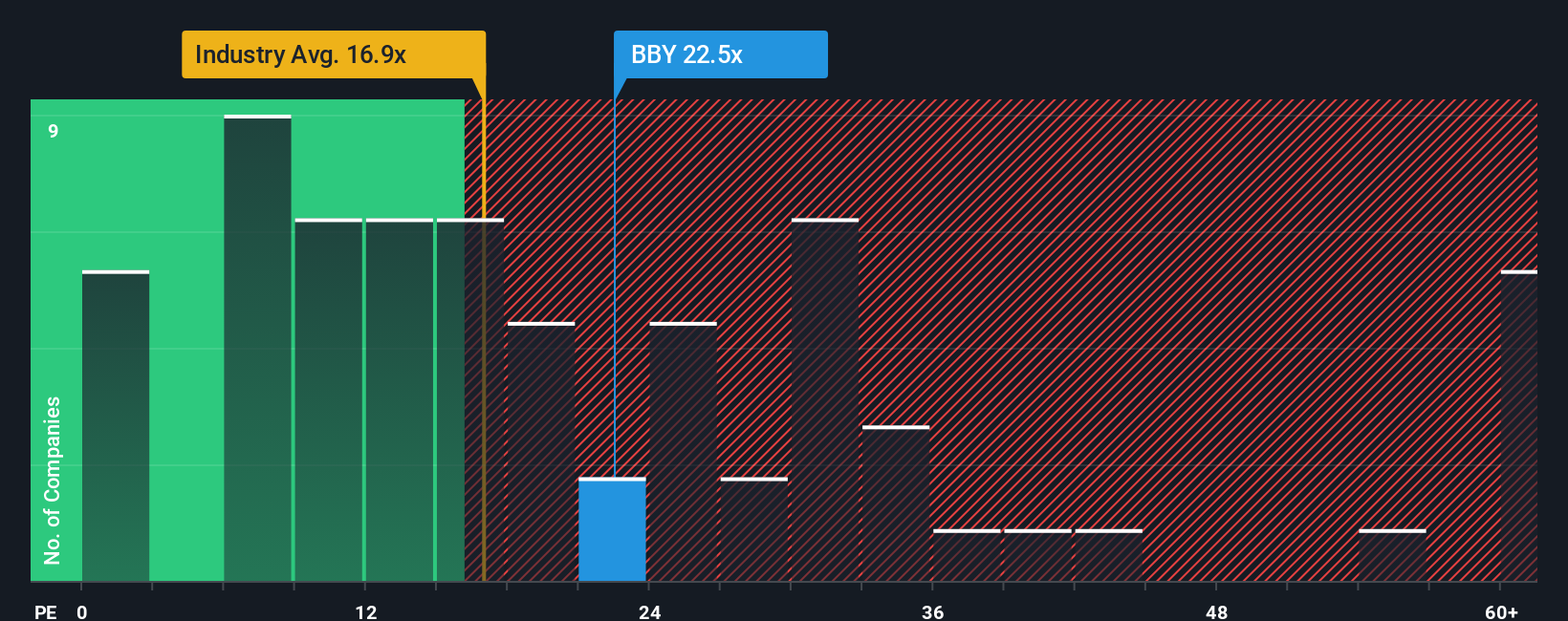

On earnings multiples, the picture is less generous. Best Buy trades on a price to earnings ratio of 23.9 times versus a fair ratio of 23.2 times and an industry average of 20.2 times, suggesting limited margin for error if growth underwhelms.

Build Your Own Best Buy Narrative

If you see the numbers differently, or would rather test your own assumptions, you can craft a personalized story in just minutes using Do it your way.

A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single stock when the Simply Wall Street Screener can help you pinpoint stronger opportunities, refine your strategy, and stay ahead of other investors.

- Capture momentum early by focusing on these 26 AI penny stocks that are shaping the next wave of intelligent technology and automation.

- Strengthen long term returns with these 13 dividend stocks with yields > 3% that offer attractive income while still keeping an eye on quality fundamentals.

- Position yourself for asymmetric upside through these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.