Please use a PC Browser to access Register-Tadawul

Beta Bionics, Inc.'s (NASDAQ:BBNX) Popularity With Investors Under Threat As Stock Sinks 58%

Beta Bionics, Inc. BBNX | 13.70 | +1.78% |

The Beta Bionics, Inc. (NASDAQ:BBNX) share price has fared very poorly over the last month, falling by a substantial 58%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

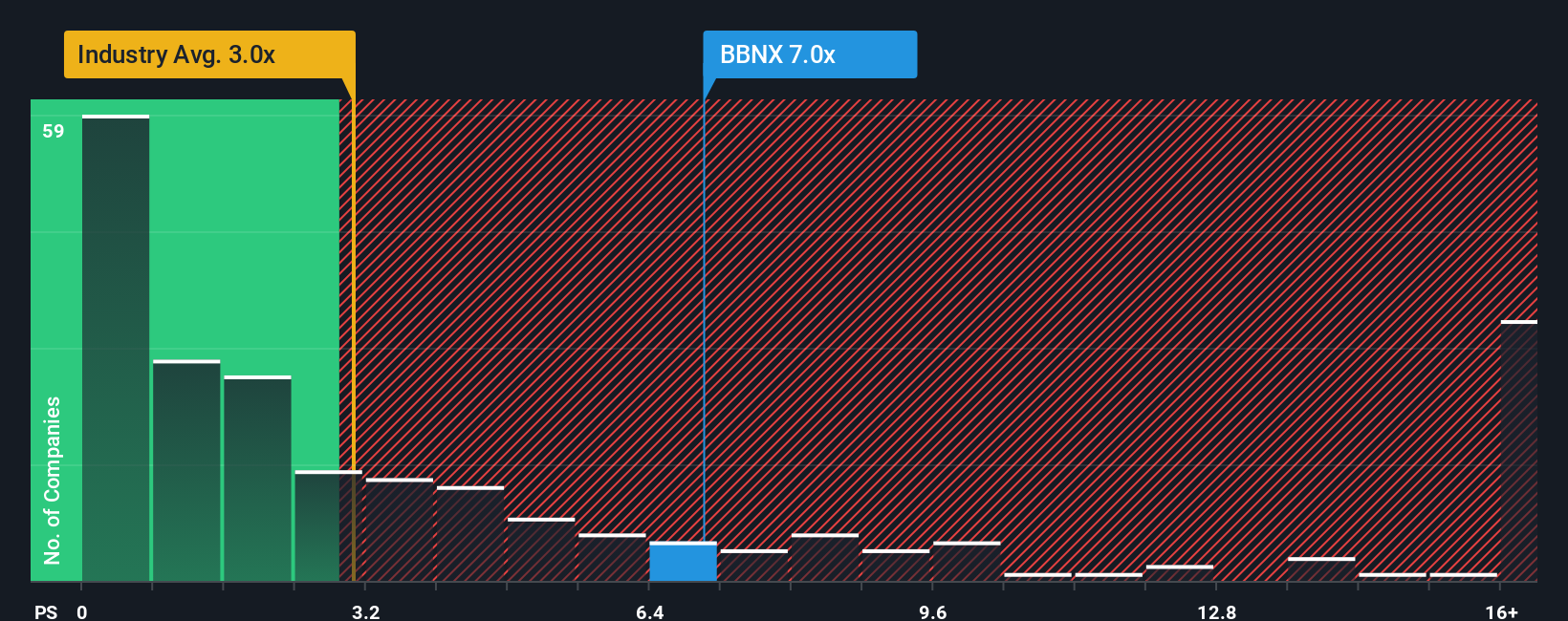

Although its price has dipped substantially, when almost half of the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3x, you may still consider Beta Bionics as a stock not worth researching with its 6.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Beta Bionics' Recent Performance Look Like?

Recent times have been advantageous for Beta Bionics as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Beta Bionics' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Beta Bionics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 67%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 38% per annum over the next three years. That's shaping up to be materially lower than the 126% per annum growth forecast for the broader industry.

In light of this, it's alarming that Beta Bionics' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, Beta Bionics' P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Beta Bionics, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Beta Bionics has 3 warning signs we think you should be aware of.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.