Please use a PC Browser to access Register-Tadawul

BlackLine (BL) Margin Compression To 3.5% Tests Bullish Earnings Growth Narratives

BlackLine, Inc. BL | 36.15 | -2.32% |

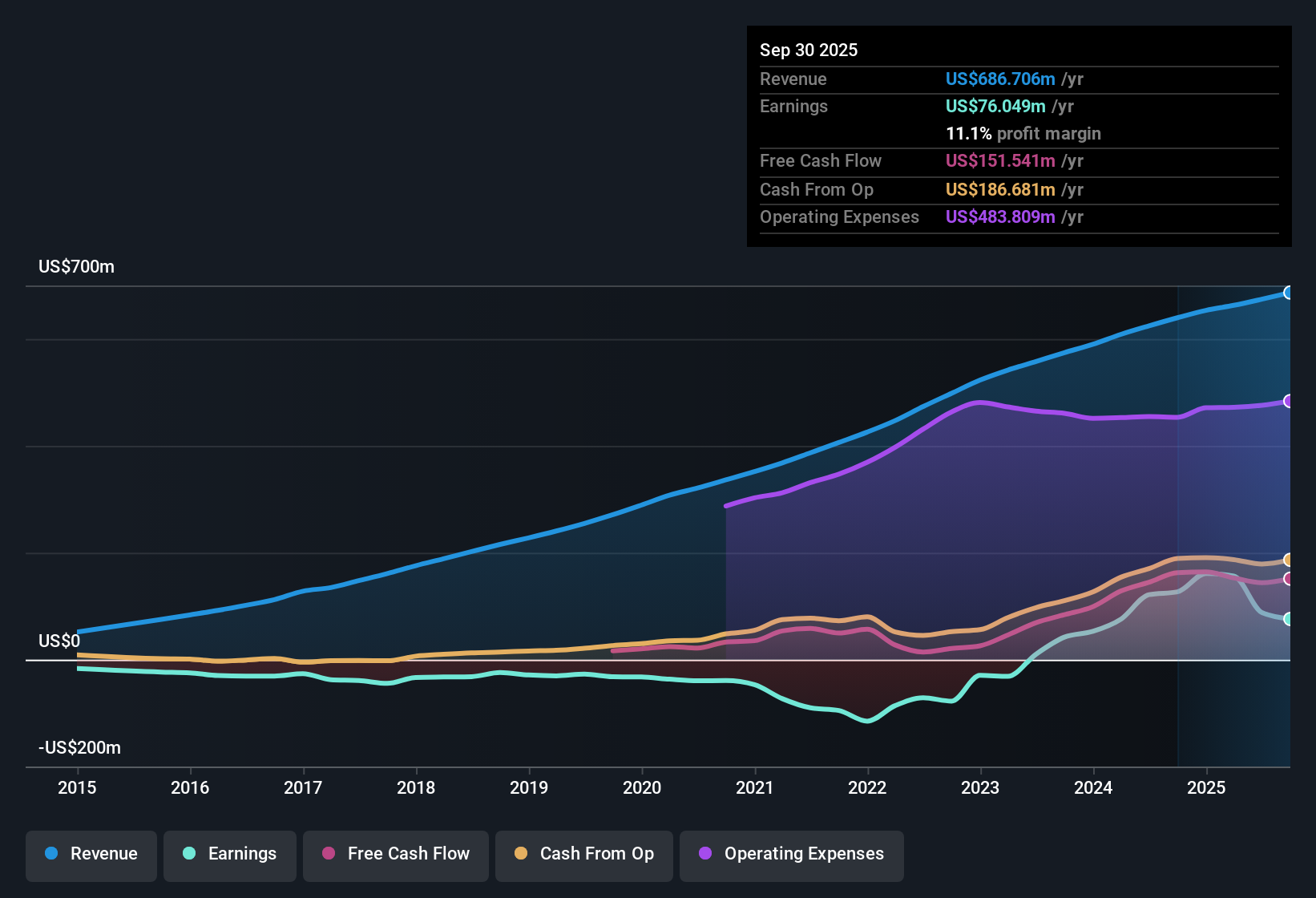

BlackLine (BL) has wrapped up FY 2025 with fourth quarter revenue of US$183.2 million and basic EPS of US$0.08, alongside net income of US$4.9 million. Over recent quarters the company has seen revenue move from US$169.5 million in Q4 2024 to US$183.2 million in Q4 2025, while quarterly basic EPS shifted from US$0.90 to US$0.08. This sets the backdrop for a year where margins are front and center for investors.

See our full analysis for BlackLine.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the widely followed stories about BlackLine, and where those narratives might need a rethink.

Margins Look Thin At 3.5%

- On a trailing 12 month basis, BlackLine earned US$24.5 million of net income on US$700.4 million of revenue, which works out to a 3.5% net margin compared with 24.7% in the prior year and includes a one off loss of US$14.6 million.

- What stands out for the bullish view is that this slimmer 3.5% margin is paired with a five year earnings growth rate of 62.3% per year and forecasts that earnings could grow about 48.8% per year, which supports the idea that the business model can still convert revenue into profit over time even if the latest year looks pressured.

- Bulls point to execution on platform integration and AI as reasons margins could improve, and the current net income of US$24.5 million on US$700.4 million of revenue gives them a base from which any efficiency gains would show up quite clearly.

- At the same time, the 3.5% margin and the one off US$14.6 million loss keep the bullish story honest, because they highlight that recent profitability is far from the 24.7% margin seen in the previous year that those long term earnings growth numbers are built on.

Bulls argue these compressed margins could be a temporary pause before the model scales again, while skeptics see them as a warning sign, so if you want to see how the optimistic case is built around these figures, 🐂 BlackLine Bull Case

High P/E Versus DCF Fair Value

- The shares trade on a P/E of about 101.7x, compared with 28.7x for the US Software industry and 97.6x for peers, while a DCF fair value in the data is US$102.68 per share against a current price of US$41.90.

- Critics highlight that a P/E above both the industry and peer averages fits a bearish narrative that the market is paying a lot for only 3.5% trailing margins, even though the same dataset shows the stock price sitting roughly 59.2% below the DCF fair value, which pushes back on the idea that it is automatically expensive relative to estimated cash flows.

- Bears focus on the 101.7x P/E and the weaker trailing profitability when they argue that rising costs and competition could make it hard to justify a higher multiple over time, especially if margins stayed closer to 3.5% than the prior 24.7% level.

- What complicates the bearish case is that the DCF fair value of US$102.68 is more than double the current US$41.90 share price, so anyone leaning on the cautious view has to reconcile those compression worries with a model that points to a large gap between price and estimated value.

If you are weighing those margin pressures against the rich P/E and wide DCF gap and want to see how the cautious camp frames the risks, 🐻 BlackLine Bear Case

Revenue Growing, Profit More Volatile

- Quarterly revenue moved from US$165.9 million in Q3 2024 to US$169.5 million in Q4 2024 and then to US$166.9 million, US$172.0 million, US$178.3 million, and US$183.2 million through FY 2025, while basic EPS over those same six quarters went from US$0.28 to US$0.90, then US$0.10, US$0.13, US$0.09 and US$0.08 on a trailing 12 month EPS of US$0.40.

- Consensus narrative notes that this mix of steady revenue progress and lumpier EPS is consistent with their view that BlackLine is pushing into larger enterprise deals and new regions, which can support revenue growth but may come with periods of margin pressure and slower profit growth compared with the 62.3% per year headline rate seen over five years.

- The trailing 12 month revenue of US$700.4 million is higher than the US$639.6 million and US$653.3 million levels in the earlier LTM snapshots, aligning with the idea that the top line is trending upward Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BlackLine on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data points you in another direction, shape your own view in a few minutes and Do it your way

A great starting point for your BlackLine research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

BlackLine pairs a 3.5% net margin and volatile EPS with a P/E of 101.7x, which leaves little room for comfort if profitability stays pressured.

If those thin margins and the rich multiple make you uneasy, shift some of your research time toward our 84 resilient stocks with low risk scores that prioritizes steadier earnings and lower risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- The trailing 12 month revenue of US$700.4 million is higher than the US$639.6 million and US$653.3 million levels in the earlier LTM snapshots, aligning with the idea that the top line is trending upward Next Steps