Please use a PC Browser to access Register-Tadawul

Box (BOX): Evaluating Valuation After Major AI-Powered Product Launches in Secure Content and Workflow Automation

Box, Inc. Class A BOX | 22.87 | +0.66% |

If you have been tracking Box (NYSE:BOX), you probably noticed the flurry of activity around its latest product launches. This week, the company rolled out Box Shield Pro and Box Automate, both powered by advanced AI capabilities that promise a new era of content protection and workflow automation. These announcements caught the market’s eye for good reason, as they signal more than just incremental updates. They reveal a company putting AI and automation at the center of its future growth strategy.

Looking at the bigger picture, Box has had its ups and downs throughout the year. Despite some volatility, the stock is up 3.6% year-to-date but down 2.5% over the past year, reflecting a cooling period after years of steady gains. With new AI investments, a quarterly revenue growth just above 9%, and a recent dip in net income, investors appear to be recalibrating expectations as the company transitions into higher-value enterprise offerings.

After this year’s sideways movement, the question remains: are Box’s new products setting it up for a breakout, or has the market already accounted for this next phase of growth in the share price?

Most Popular Narrative: 13.4% Undervalued

The most widely followed narrative views Box as notably undervalued, with analysts suggesting the company’s shares trade well below what its future growth prospects and risk profile imply.

Ongoing investments in AI-powered metadata extraction, no-code workflow automation, and integration with leading AI model providers (OpenAI, Anthropic, xAI) and enterprise software ecosystems (Microsoft, Google, Salesforce) are deepening Box's value proposition. These developments support premium pricing, reduce churn, and contribute to margin expansion over time.

Curious how analysts reach such a bullish conclusion? The real excitement hides in ambitious growth assumptions and a dramatic shift in Box’s projected earnings profile. What financial upgrade triggers this undervalued call, and what margin vision sets the bar above industry norms? The full narrative reveals the game-changing thesis fueling this price target.

Result: Fair Value of $37.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from hyperscalers and tightening data privacy regulations could limit Box’s growth trajectory and put pressure on future margins.

Find out about the key risks to this Box narrative.Another View: What Does the DCF Model Say?

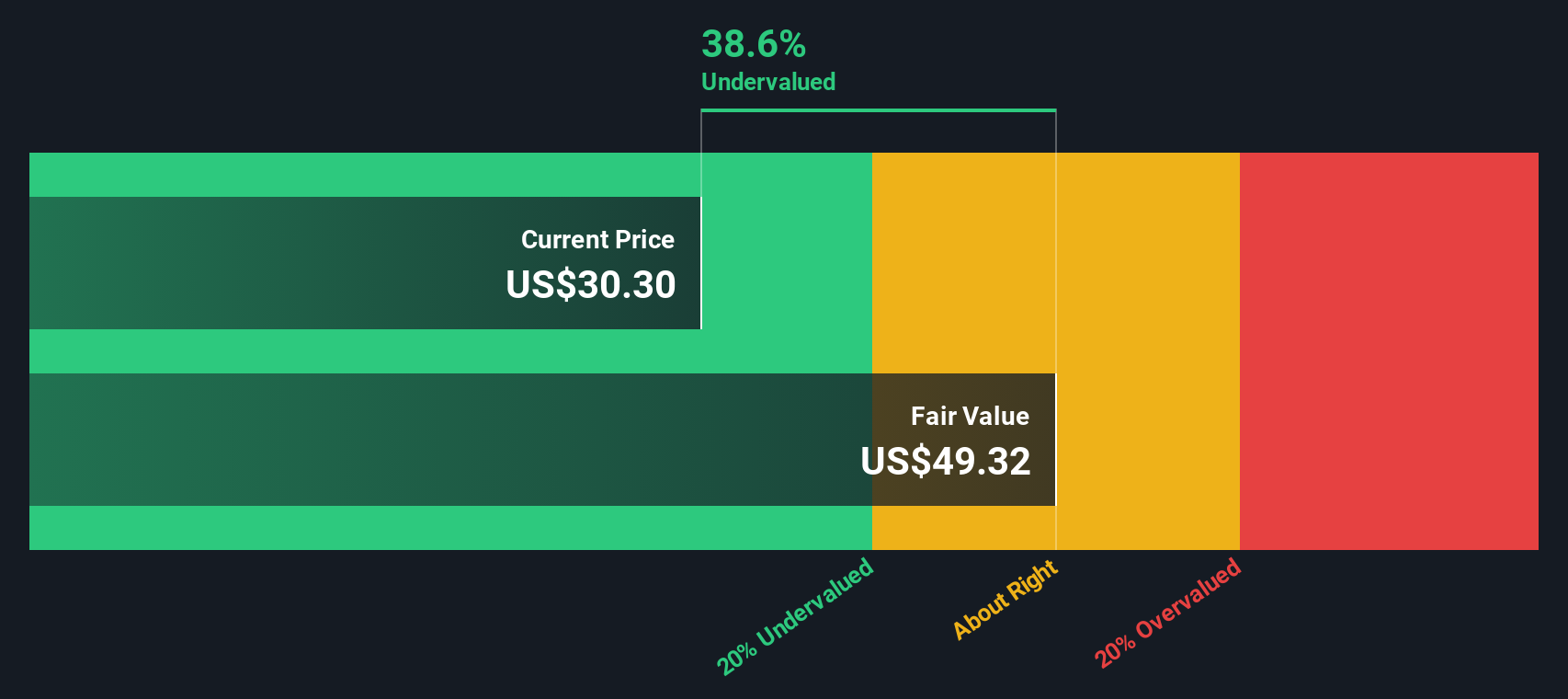

Looking at Box through the lens of our DCF model offers a different perspective. This reinforces the view that the shares could still be undervalued by the market. However, do these long-term cash flow forecasts tell the whole story? Evolving industry forces could shift the picture.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Box Narrative

If you want to test a different view or dig into Box’s numbers yourself, you can easily build your own thesis in just a few minutes. Do it your way.

A great starting point for your Box research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Ways to Grow Your Portfolio?

The smartest investors always have their eye on fresh opportunities. Don’t let today's real movers pass you by. Let’s strengthen your watchlist with tested ideas from our handpicked screeners below.

- Supercharge your returns by targeting companies with robust cash flows using our search for undervalued stocks based on cash flows, where value is hiding in plain sight.

- Spot technology game-changers early and ride the wave of innovation by investigating trailblazers in artificial intelligence through our collection of AI penny stocks.

- Secure steady income and build long-term confidence by tapping into our lineup of dividend stocks with yields > 3% that consistently reward their shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.