Please use a PC Browser to access Register-Tadawul

Breaking News | Tesla Soars 9%+ Pre-Bell on Musk's China Visit. How Far Can This Rally Go?

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

Baidu, Inc. Sponsored ADR Class A BIDU | 125.01 | -2.57% |

NIO NIO | 5.03 | -1.95% |

XPENG INC. XPEV | 18.99 | -1.04% |

Lucid LCID | 12.54 | -2.26% |

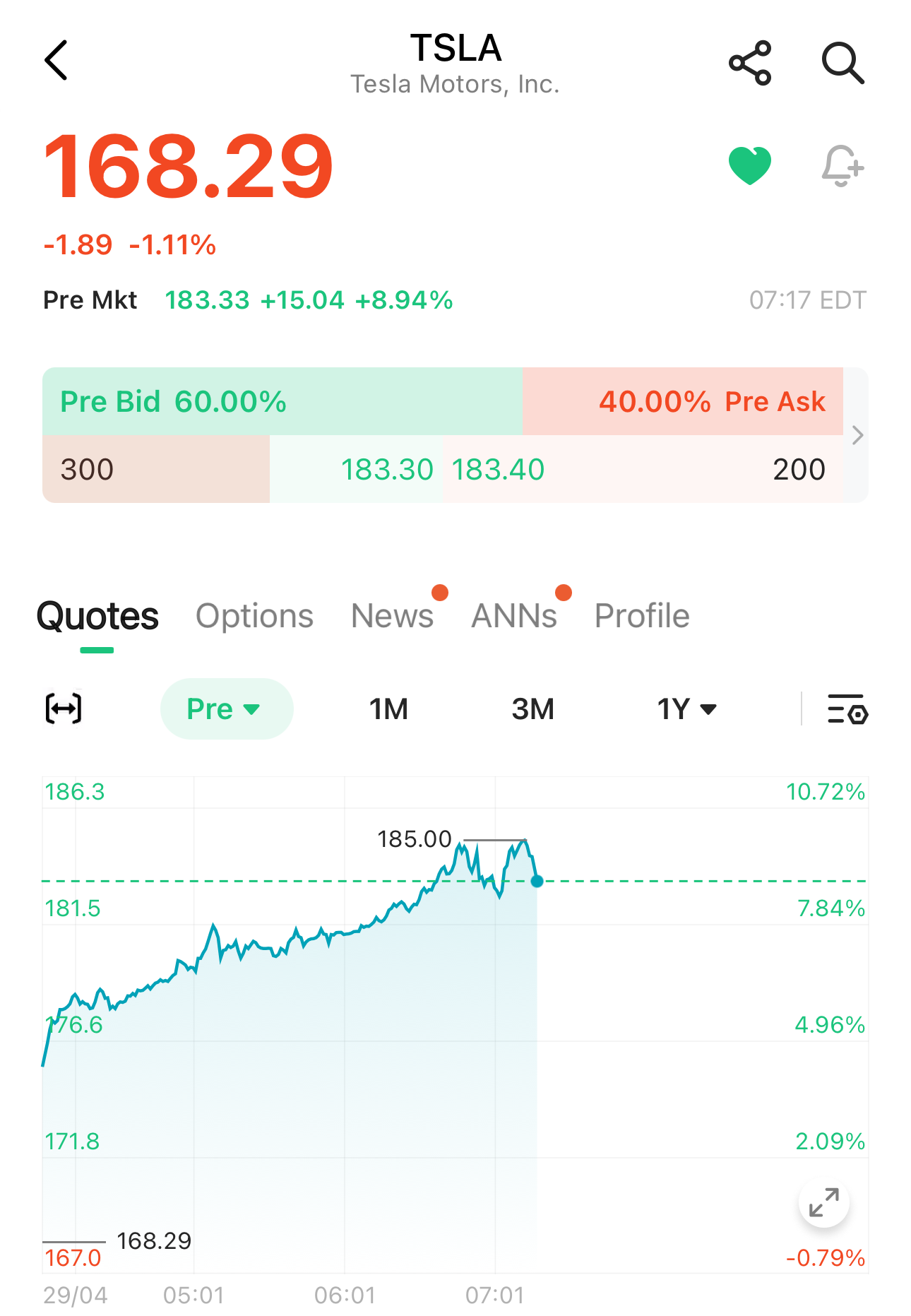

Tesla Motors, Inc.(TSLA.US) CEO Elon Musk's visit to China has drawn high attention from investors in the capital markets, with Tesla's stock price rising 9.58% pre-market as of 07:07 am ET.

What Happened: A High-Profile Visit

According to Chinese media reports, at the invitation of the China Council for the Promotion of International Trade (C'CPIT), on the afternoon of April 28, 2024, Elon Musk, the CEO of Tesla, arrived in Beijing.

Musk was received by Chinese Premier Li Qiang, who said that Tesla's development in China is a successful example of China-US economic and trade cooperation. Musk also held talks with C'CPIT Chairman Ren Hongbin, exchanging views on future cooperation.

Optimism on FSD's Entry

The news immediately drove a 6% rise in the stock price of Baidu, Inc. Sponsored ADR Class A(BIDU.US), which is rumored to be the local partner for FSD high-precision maps.

At the same time, concept stocks related to Tesla in Hong Kong, such as advanced driver assistance systems (ADAS) and autonomous driving (AD) supplier Nexteer, as well as steering column, DP-EPS, R-EPS, smart steering system, and steer-by-wire system supplier Zhejiang Shibao, also saw stock price increases on the same day.

Is FSD Musk's Goal?

Daniel Ives, an analyst at Wedbush Securities, said that Musk's visit to China is "to cut the ribbon on the long-awaited FSD software rollout and get permissions/approvals to transmit data overseas." The analyst called this visit a "watershed moment" for Tesla, stating that Tesla's long-term valuation story depends on FSD and autonomous driving, and a key missing piece of the puzzle is Tesla providing FSD in China, which now appears to be imminent.

This view seems to be supported by evidence. Right after Musk's meeting with Premier Li, the China Association of Automobile Manufacturers and the National Computer Network Emergency Technical Handling Coordination Center jointly issued a notice stating that all models produced at Tesla's Shanghai Gigafactory meet compliance requirements.

According to Chinese media interpretation, the core reason for the delay in Tesla's FSD full self-driving software being rolled out in the Chinese mainland market is the issue of data security, and this time passing the authoritative data security test may lay the foundation for Tesla to advance FSD's entry into the Chinese market.

Although Tesla responded on April 28 that there is currently no timetable for FSD's entry into China, media reports say the description of the Chinese official FSD purchase page has been changed from "coming soon" to "about to be launched."

Impact on Valuation

Users and investors are highly concerned about whether FSD can enter China.

On April 20, a user asked Musk on a social platform, "I look forward to Tesla FSD coming to China soon. When can it be realized? When can the HW3.0 system be used with 3D modelling images? When can the new reverse assist feature be pushed to Tesla HW3.0 owners in China?"

Musk replied, "This may be realized very soon."

For users, Tesla FSD V12 has begun to accelerate its deployment in North America, and the brand-new "end-to-end" architecture has to some extent proven the driving assistance capabilities and user experience of FSD. Faced with the huge Chinese market, FSD gaining broader market space and being accessible to more users, Tesla may also embrace its own "ChatGPT moment."

And Tesla needs such a moment.

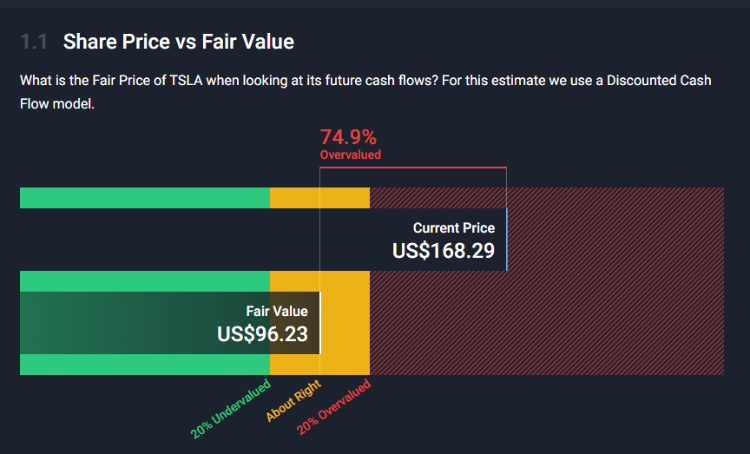

Old-fashioned Wall Street seems unconvinced about Tesla's prospects, with the stock price derived from cash flow analysis significantly higher than its fair value discounted from expected cash flows.

From January 1, 2022, to April 29, 2024 pre-market, Tesla's stock price has fallen 52.23% in this range, and its position as the global electric vehicle sales champion is also being threatened by competitors. An increase in profit, or at least a convincing story about profit growth, can provide good support for valuation.

But, "how much support?" the question would be.

Let's do a little bit of math.

Assuming the acceptance of assisted driving in the Chinese market is generally similar.

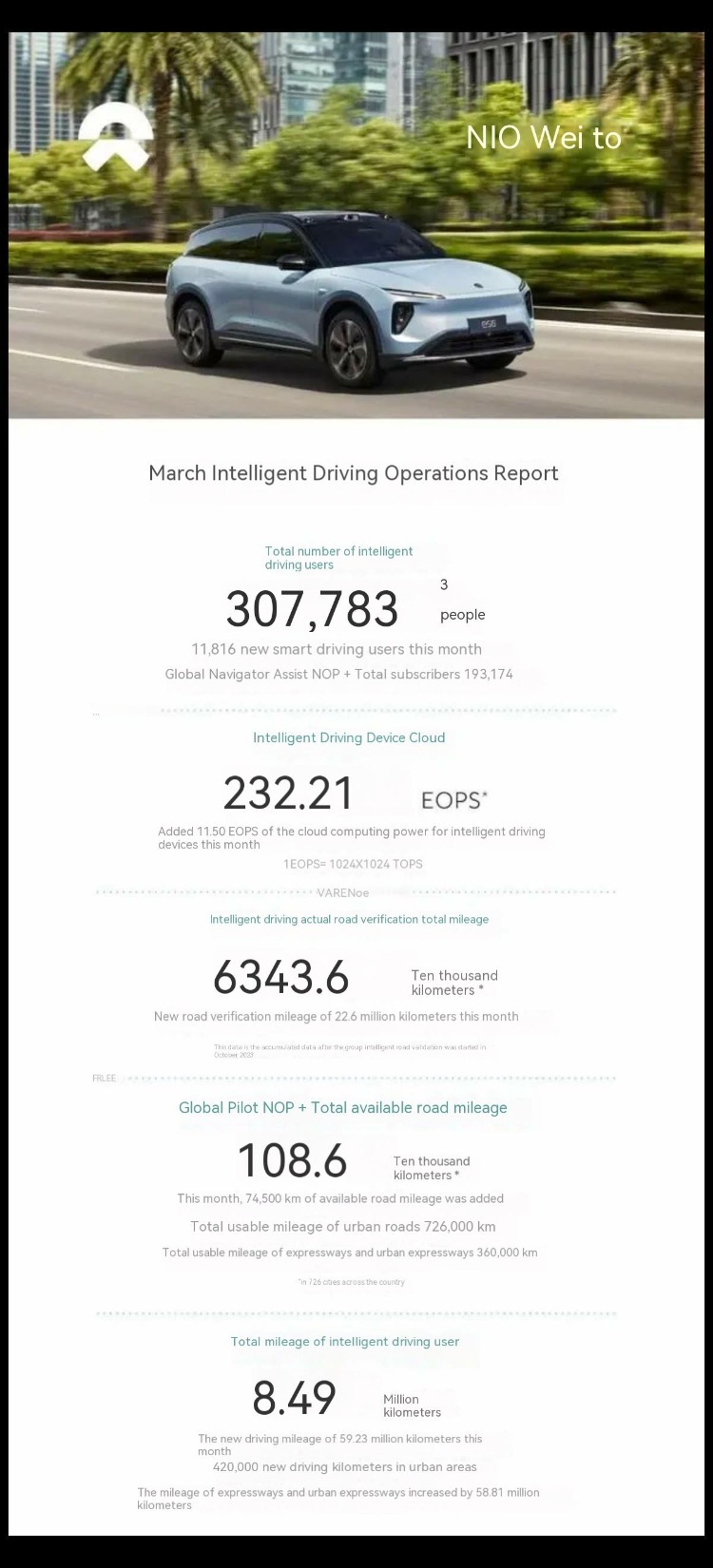

As of March 2024, NIO(NIO.US) had cumulatively sold 482,736 new energy vehicles in the Chinese market, with a total of 307,783 smart driving users that month, of which 193,174 were users of the full-domain navigation assistance NOP+, representing a penetration rate of nearly 40%.

As of April 2024, the Chinese market has about 1.7 million Tesla owners (the vehicle ownership will be greater than this number), then a 40% penetration rate would mean about 680,000 FSD sales. So the retail price of the FSD service in China is estimated to stand at CNY 64,000, which is about US$8,800 based on the exchange rate on April 29, 2024. Then the revenue from 680,000 FSD sales would be CNY 43.52 billion, or US$5.984 billion. This figure represents about 6.18% growth compared to the total revenue of US$96.773 billion in FY2023.

Considering that the profit margin of the FSD business is higher than what optimistic institutional investors believe, with the deferred revenue portion of FSD having a gross margin as high as 90%, and the growth potential of the new business, the actual profit improvement may be even higher.