Please use a PC Browser to access Register-Tadawul

Brookdale Senior Living Inc.'s (NYSE:BKD) 35% Share Price Surge Not Quite Adding Up

Brookdale Senior Living Inc. BKD | 14.90 | -0.33% |

Despite an already strong run, Brookdale Senior Living Inc. (NYSE:BKD) shares have been powering on, with a gain of 35% in the last thirty days. The last month tops off a massive increase of 205% in the last year.

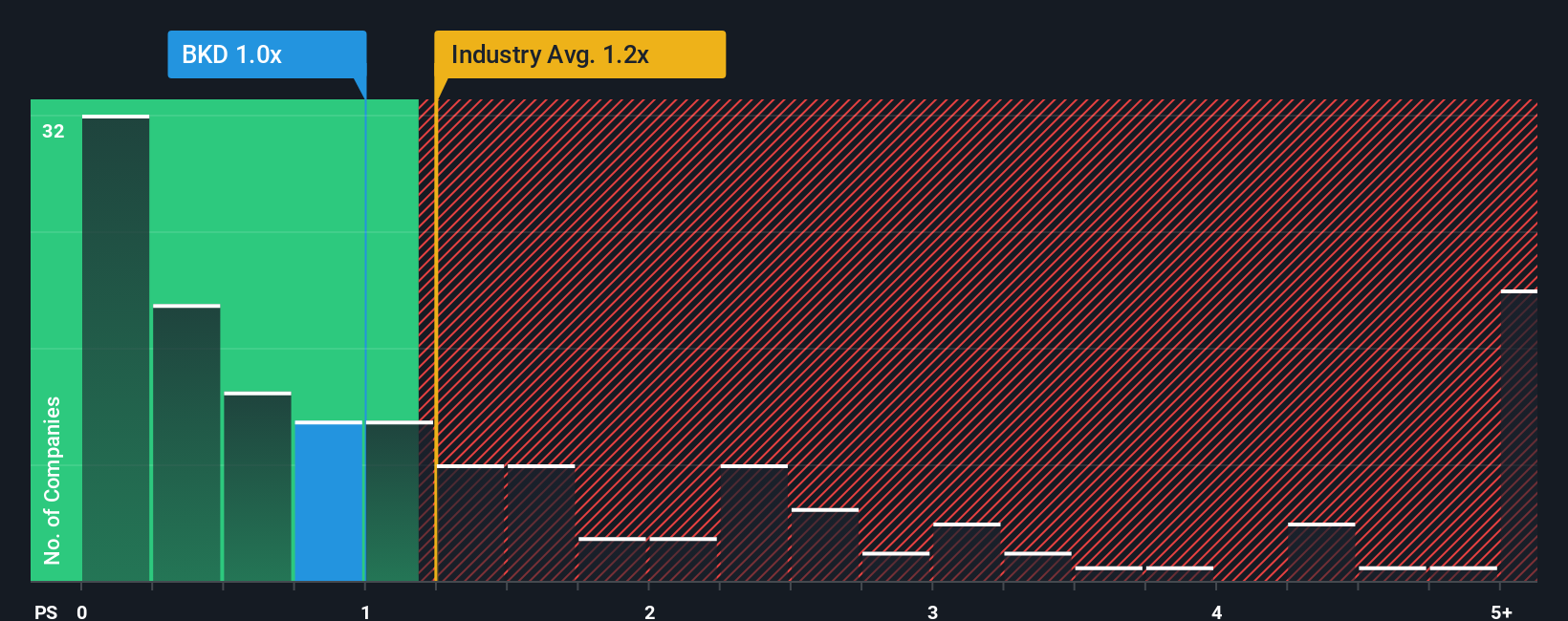

Although its price has surged higher, you could still be forgiven for feeling indifferent about Brookdale Senior Living's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United States is also close to 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Brookdale Senior Living's Recent Performance Look Like?

Recent times haven't been great for Brookdale Senior Living as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Brookdale Senior Living.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Brookdale Senior Living's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.3% last year. Revenue has also lifted 21% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 0.9% during the coming year according to the three analysts following the company. With the industry predicted to deliver 4.6% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Brookdale Senior Living is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Its shares have lifted substantially and now Brookdale Senior Living's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Brookdale Senior Living's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Brookdale Senior Living, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.