Please use a PC Browser to access Register-Tadawul

CACI International (CACI) Q2 EPS Dip Tests Bullish High Earnings Quality Narrative

CACI International Inc Class A CACI | 586.03 | -0.87% |

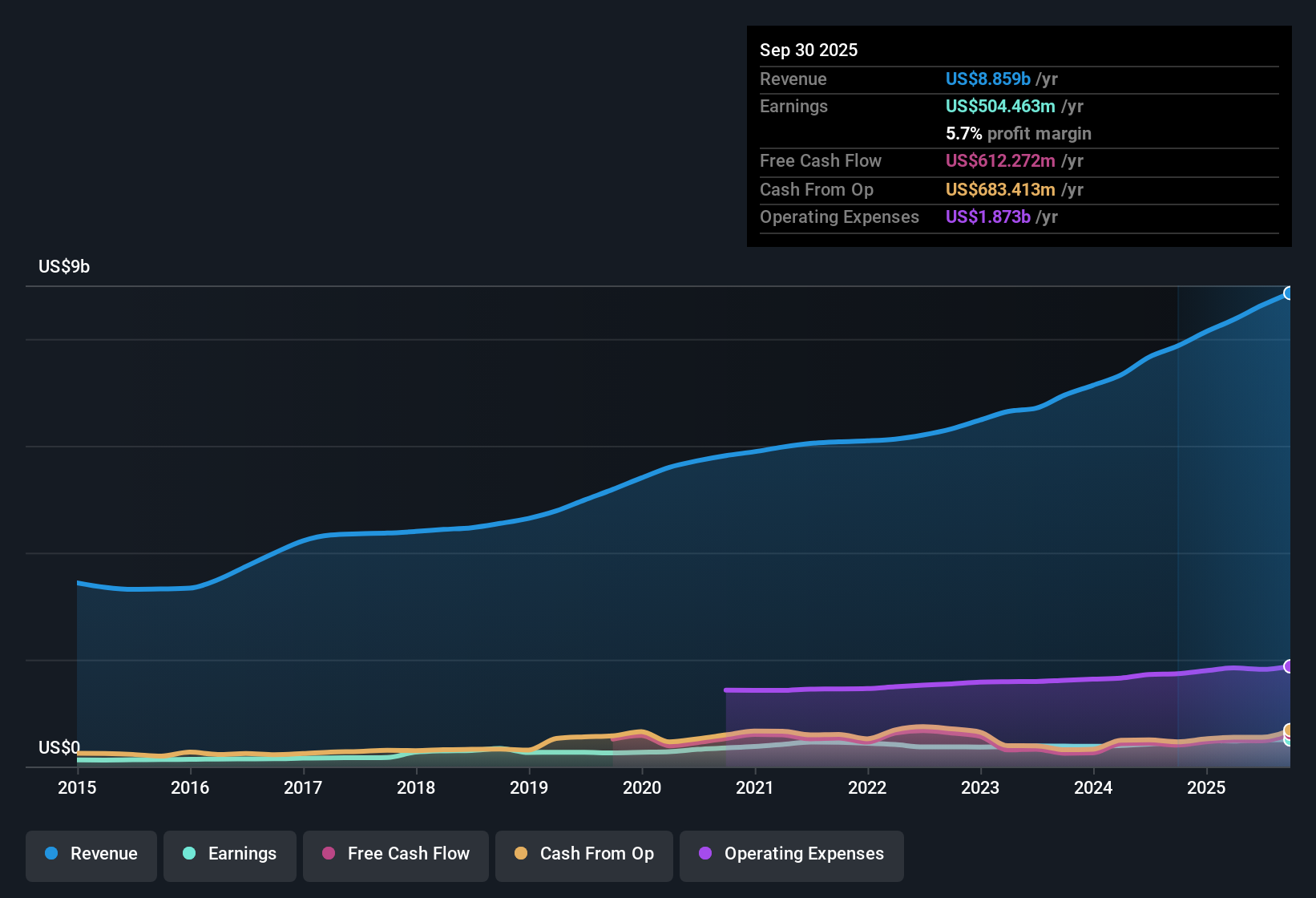

CACI International (CACI) has just posted Q2 2026 results that included total revenue of US$2.2b and basic EPS of US$5.61, alongside trailing twelve month revenue of US$9.0b and EPS of US$23.47. Over the past few quarters, the company has seen revenue move from US$2.1b in Q2 2025 to US$2.3b in Q4 2025 and EPS range between US$4.90 and US$7.18, giving investors a clearer view of how recent profit trends compare with the latest quarter. With a trailing net margin sitting in the mid single digits and earnings quality described as high, the new numbers give investors plenty to weigh around the sustainability of current profitability.

See our full analysis for CACI International.With the headline figures set, the next step is to see how these results line up against the widely held narratives about CACI, highlighting where the story is being confirmed and where expectations might need a reset.

TTM profit at US$518 million with margin holding near 5.8%

- On a trailing twelve month basis, CACI earned US$518.38 million of net income on US$9.0b of revenue, which works out to a 5.8% net margin compared with 5.9% a year earlier.

- What stands out for a bullish view is that trailing EPS reached US$23.47 while one year earnings growth of 8% runs ahead of the 5 year 4.4% pace. At the same time, the margin is still in the mid single digits, which keeps profit quality in focus rather than framing CACI as a high margin story.

- Supporters who point to high quality earnings get some backing from the consistent margin near 6% and the US$9.0b revenue base, which together show a relatively steady earnings engine rather than large swings.

- At the same time, the modest gap between 5.8% and 5.9% margin means the bullish case leans more on the gradual earnings build over several years than on any sharp shift in profitability in the latest period.

Revenue nears US$9.0b with TTM growth running ahead of 5 year earnings pace

- Trailing twelve month revenue reached US$8,978.846 million versus US$7,866.574 million five quarters earlier, while TTM EPS moved from US$20.37 to US$23.47 and one year earnings growth of 8% sits above the 5 year 4.4% annual rate mentioned in the analysis.

- Bulls arguing for a steady compounder case see that combination of US$9.0b revenue, 8% recent earnings growth, and forecast growth of about 10.1% for earnings and 6.5% for revenue as reinforcing the idea of continued expansion, although the latest quarter EPS of US$5.61 is below the recent Q4 2025 figure of US$7.18 so the path has not been in a straight line.

- The sequence from Q2 2025 revenue of US$2,099.809 million to Q2 2026 revenue of US$2,220.097 million helps that bullish story by showing the top line moving higher across several reported periods.

- However, the Q2 2026 net income of US$123.855 million compared with US$157.855 million in Q4 2025 illustrates that quarterly profit can still swing, which gives bulls numbers to monitor when they talk about long term compounding.

P/E of 27.9x, debt and insider selling keep valuation debate alive

- CACI trades at a trailing P/E of 27.9x versus a peer average of 38x and a US Professional Services industry average of 24.2x, while the current share price of US$655.46 sits about 11.2% below a DCF fair value of US$738.12 according to the analysis data.

- Skeptics point out that the higher than industry P/E, elevated debt level, and recent insider selling temper the 11.2% DCF gap. They also lean heavily on the fact that forecast earnings and revenue growth of 10.1% and 6.5% are below the broader US market forecasts, so the valuation is being asked to work harder without faster growth to back it up.

- The comparison of a 27.9x P/E to the 24.2x industry average is the key number bears flag, as it suggests CACI is not outright cheap relative to the wider Professional Services group even though it sits below direct peers on this metric.

- When you add in the commentary that the balance sheet carries a high level of debt and that there has been insider selling in the last three months, cautious investors see reasons to question how much weight to give to the DCF fair value of US$738.12 versus the current market pricing.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CACI International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

CACI’s premium P/E relative to its industry, high debt load, and recent insider selling leave some investors questioning how much safety is built into the current valuation.

If those pressure points make you cautious, use our solid balance sheet and fundamentals stocks screener (389 results) to quickly focus on companies with stronger balance sheets that may better match your risk comfort today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.