Please use a PC Browser to access Register-Tadawul

Cadence Design Systems (CDNS): Assessing Valuation After New AI Launches and Expanded TSMC Collaboration

Cadence Design Systems, Inc. CDNS | 283.52 | +4.95% |

Cadence Design Systems (CDNS) has been in the spotlight lately with the launch of its AI-powered ROCS X platform and expanded collaborations with leaders such as TSMC. These initiatives reflect the company’s growing presence in AI and chip design innovation.

Cadence Design Systems’ flurry of new AI-powered products and expanded partnerships with TSMC have sparked enthusiasm among investors, supporting a notable run in both the company’s financial results and market sentiment. This is reflected in a robust 30.6% total shareholder return over the past year, as well as an impressive upward trajectory over the longer term, signaling that market momentum around Cadence's growth story has continued to build.

If the surge in design automation and AI infrastructure has you curious, now’s a great time to discover See the full list for free.

With the stock up more than 30% in the past year and strong growth signals from new partnerships and technologies, the key question remains: Is Cadence Design Systems an undervalued opportunity, or is the market already pricing in future gains?

Most Popular Narrative: 6% Undervalued

With Cadence Design Systems closing at $347.24, the most widely followed valuation narrative sets fair value higher at $370.84 per share. This creates a debate over what is fueling the recent confidence in Cadence’s future prospects.

Cadence's strategic investments in AI-driven design and verification tools are expected to drive future revenue growth, as the company reports increasing adoption of its AI-enabled offerings, such as the Cadence Cerebrus AI solution and SimAI, which have shown significant performance improvements for customers.

Want to know why analysts think this price target might just be the start? This valuation is built on aggressive assumptions about growth, margins, and a powerful profit multiple that is more common in market leaders. Uncover the forecasts and industry shifts that could make or break this call in the full narrative.

Result: Fair Value of $370.84 (UNDERVALUED)

However, risks remain. Geopolitical tensions and heightened competition could unexpectedly disrupt Cadence’s ability to sustain its impressive growth trajectory.

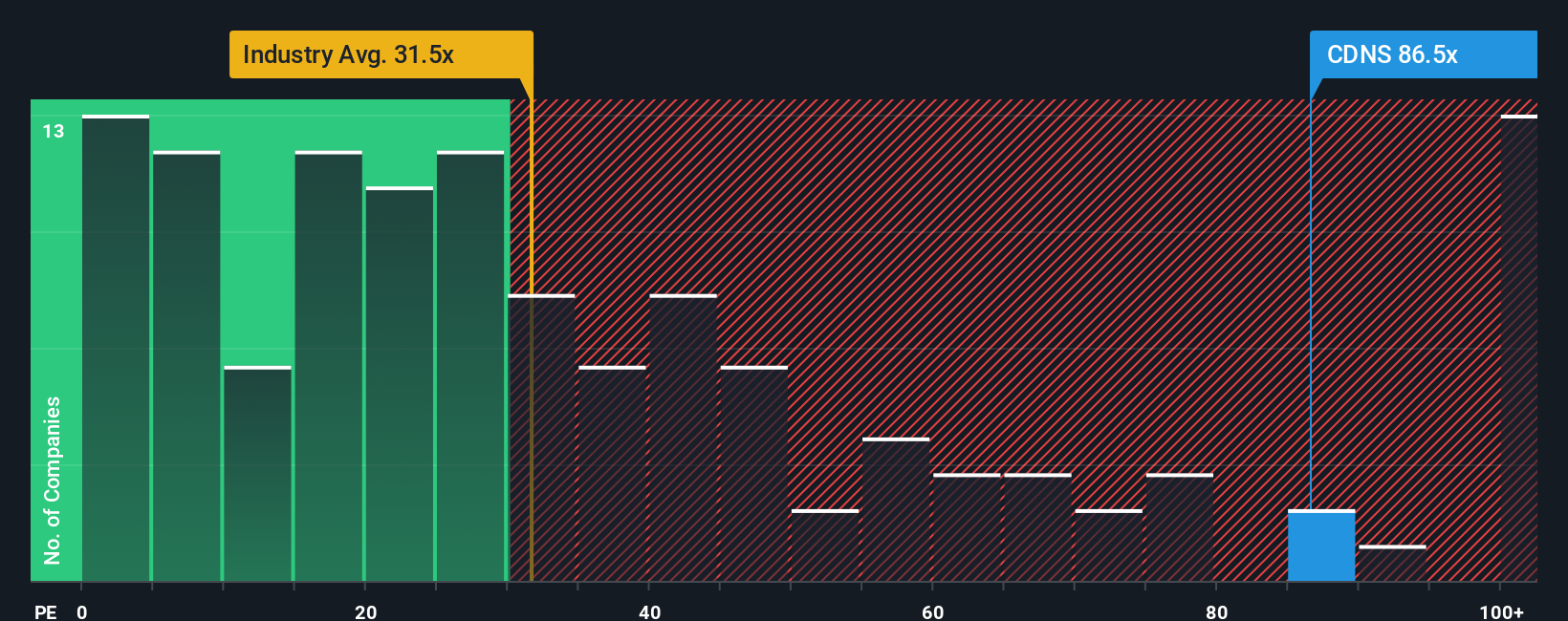

Another View: High Price Tag by Market Multiples

While analyst forecasts suggest Cadence is undervalued based on future growth, a closer look at its price-to-earnings ratio offers a different perspective. Cadence trades at 93.5 times earnings, which is significantly higher than both the US Software industry average of 35.6 and the peer average of 67. The fair ratio, which the market could ultimately calibrate to, stands at 42.5. This sizable gap indicates that investors are currently paying a major premium for Cadence’s growth story or perhaps discounting risk. Will the fundamentals catch up, or is this a valuation risk too big to ignore?

Build Your Own Cadence Design Systems Narrative

If you see the numbers differently, or want to dive deeper, you can shape your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Cadence Design Systems.

Looking for More Investment Ideas?

Don’t just settle for one perspective. Give yourself a real edge by tapping into new opportunities in fast-growing sectors and trending market themes, all at your fingertips.

- Capitalize on the AI boom by checking out the leaders and innovators among these 24 AI penny stocks making waves in automation, robotics, and next-generation software.

- Maximize your portfolio's income potential with these 19 dividend stocks with yields > 3% offering reliable payouts and growth, even when the rest of the market is uncertain.

- Catch the next emerging tech success with these 3568 penny stocks with strong financials identified for their strong financial profiles and big-leap potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.