Please use a PC Browser to access Register-Tadawul

Cadence Design Systems (CDNS): Assessing Valuation Following New AI and Digital Twin Advances Unveiled at OCP Global Summit

Cadence Design Systems, Inc. CDNS | 323.22 | -3.64% |

Cadence Design Systems (CDNS) drew attention at the recent OCP Global Summit by partnering with Alcor Micro and Jmem Tek to unveil digital twin design solutions for AI and high-performance computing servers. Investors are taking notice because this industry collaboration highlights Cadence’s role in next-generation chip integration.

Recent momentum for Cadence Design Systems reflects growing attention on its partnerships and digital twin innovations. A Relative Strength Rating upgrade highlights the positive trend. While the share price has cooled slightly in the last month, a robust 26.2% total shareholder return over the past year and a notable 191% five-year result indicate confidence remains high.

If breaking through with next-gen chip design has you hunting for more, it could be the perfect time to discover See the full list for free.

With shares up more than 190% over five years and innovations drawing new attention, the central question for investors emerges: Is Cadence Design Systems trading at a bargain, or has the market already factored in all its future growth?

Most Popular Narrative: 12% Undervalued

With Cadence Design Systems closing at $326.12 and the most-followed narrative suggesting a fair value of $370.84, market pricing trails these growth-driven projections. This keeps investor focus sharply tuned to the narrative’s bullish logic and underlying assumptions.

Cadence's strategic investments in AI-driven design and verification tools are expected to drive future revenue growth, as the company reports increasing adoption of its AI-enabled offerings, such as the Cadence Cerebrus AI solution and SimAI, which have shown significant performance improvements for customers.

What’s the secret sauce behind this narrative’s premium? There is a bold set of financial bets on profit and revenue expansion, plus confidence in record-margin projections. Get the inside story and see which numbers are redefining what “fair value” means for Cadence’s future prospects.

Result: Fair Value of $370.84 (UNDERVALUED)

However, persistent export restrictions or unexpected weakness in AI hardware demand could quickly challenge Cadence’s bullish outlook and pressure future growth expectations.

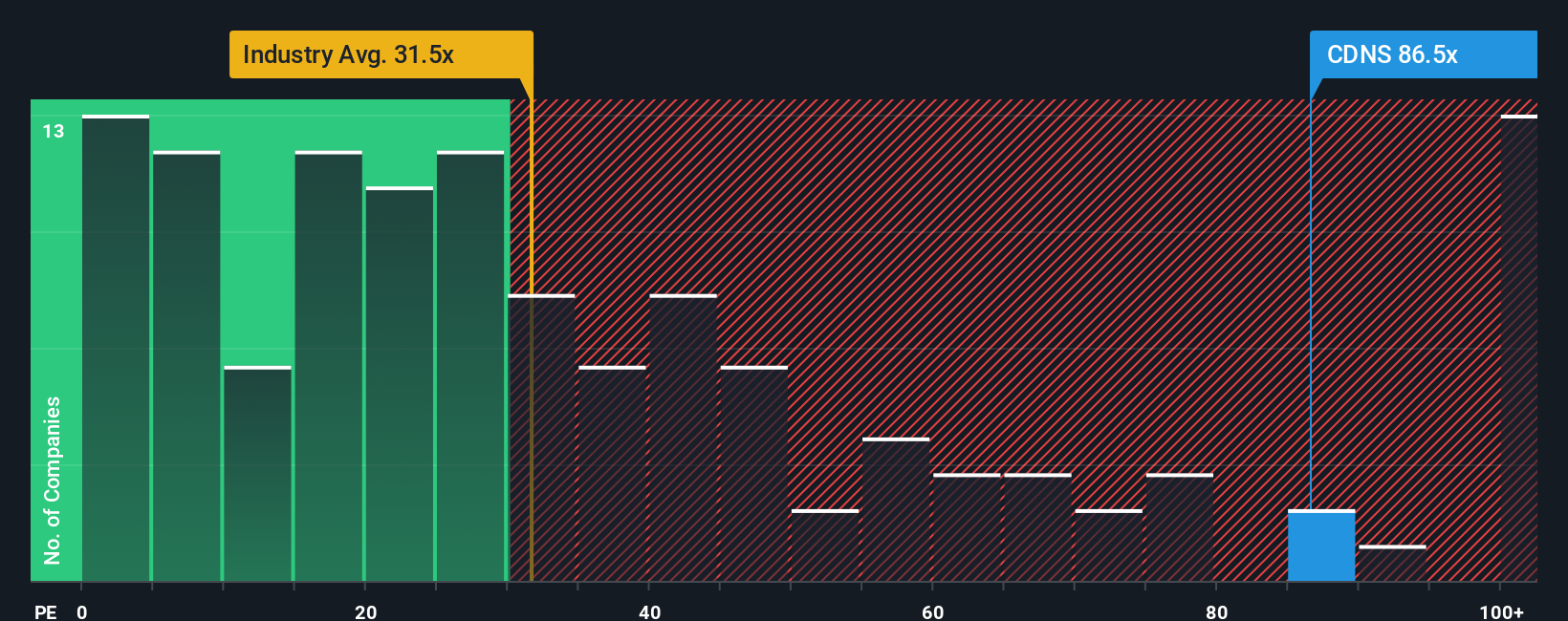

Another View: Price-to-Earnings Raises Caution

While the analyst consensus narrative points to upside, a look at Cadence’s current price-to-earnings ratio tells a different story. Trading at 87.8x earnings, it stands well above the US software industry average of 34.9x and the peer average of 64.5x. The company’s fair ratio is estimated at just 42.2x, which suggests shares may be priced for a lot of perfection and beyond.

Build Your Own Cadence Design Systems Narrative

If the consensus narrative leaves you unconvinced or you’re the type who trusts your own take on the data, you can build your version in just minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Cadence Design Systems.

Looking for More Investment Ideas?

Why limit your portfolio to one story? Upgrade your investing game and get ahead by checking out unique opportunities you might have missed elsewhere.

- Spot promising growth potential with these 24 AI penny stocks as artificial intelligence reshapes entire industries and unlocks new market leaders.

- Start compounding your returns by tapping into high-yield opportunities through these 18 dividend stocks with yields > 3%, featuring companies that reward shareholders with strong and reliable payouts.

- Catch the wave early and position yourself among innovators by seeking out breakthroughs in computing and technology featured in these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.