Please use a PC Browser to access Register-Tadawul

Caesars Entertainment, Inc.'s (NASDAQ:CZR) Revenues Are Not Doing Enough For Some Investors

Caesars Entertainment Corporation CZR | 23.82 | -0.77% |

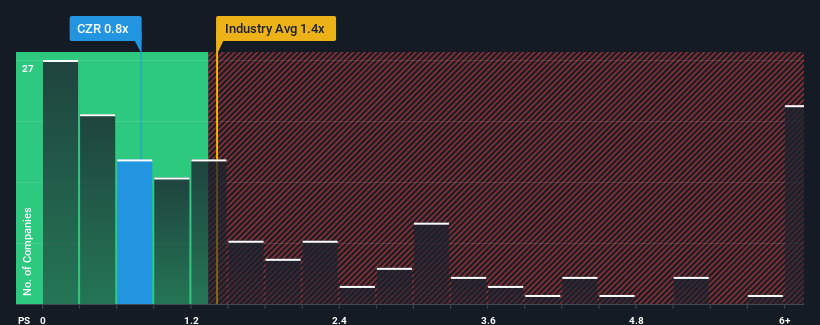

With a price-to-sales (or "P/S") ratio of 0.8x Caesars Entertainment, Inc. (NASDAQ:CZR) may be sending bullish signals at the moment, given that almost half of all the Hospitality companies in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Caesars Entertainment Performed Recently?

Caesars Entertainment could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Caesars Entertainment.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Caesars Entertainment's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 56% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 3.7% per year over the next three years. That's shaping up to be materially lower than the 12% per year growth forecast for the broader industry.

With this information, we can see why Caesars Entertainment is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Caesars Entertainment's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Caesars Entertainment's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Caesars Entertainment with six simple checks on some of these key factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.