Please use a PC Browser to access Register-Tadawul

Can Mobileye’s Recent 11% Rally Shift Its Valuation Outlook for 2025?

Mobileye MBLY | 11.70 | -1.10% |

Thinking about what to do with Mobileye Global stock? You are not alone. It is a name that catches the eye for investors anywhere near autonomous driving or next-gen mobility conversations. Over the past month, the stock has popped up by 11.2%. While that does not erase the year-to-date drop of 23.4%, it is a strong signal that the mood is shifting. Just last week, there was a smaller lift of 0.6%, suggesting that market sentiment may be slowly rebuilding after a tougher few months. Meanwhile, looking further back, Mobileye Global has delivered a 19.1% gain over the last year, showing it has the potential to rebound strongly when the stars align.

What is behind the latest moves? As confidence grows in the company’s ability to navigate regulatory shifts and the race among automakers to add advanced driver-assistance tech heats up, investors are recalibrating both the opportunity and the risks in play. However, when it comes to valuation, things are less clear-cut. By our metrics, Mobileye Global scores a 2 out of 6 on major undervaluation checks. It passes a couple, but there are still questions as to whether the stock is truly a bargain or priced for perfection.

In the next section, we will break down how different valuation approaches assess Mobileye Global and where the stock might look attractive or not. And stick around, because there is an even more revealing way to look at this company’s value that many investors overlook.

Mobileye Global scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mobileye Global Discounted Cash Flow (DCF) Analysis

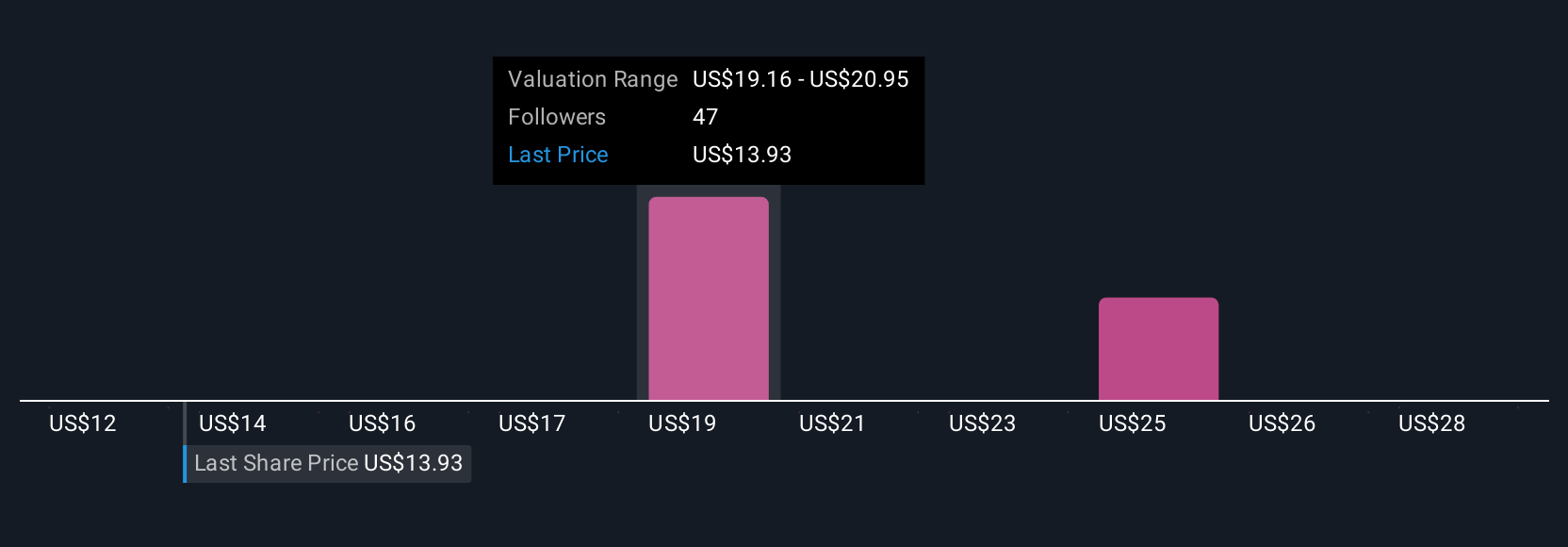

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows, then discounting those back to their value today. For Mobileye Global, the current Free Cash Flow stands at $562.7 million. Analysts have provided detailed forecasts through the next five years, with a projection that Free Cash Flow could reach $918.3 million by 2029. Beyond that, Simply Wall St extrapolates further and models annual growth into the next decade. These projections serve to estimate the company's value if it continues on its current growth trajectory.

Based on these cash flow forecasts, the DCF calculation arrives at an intrinsic value of $23.27 per share for Mobileye Global. With the current stock price sitting around 34.1% below this fair value estimate, the DCF model suggests the stock is significantly undervalued compared to its projected future performance.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mobileye Global is undervalued by 34.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

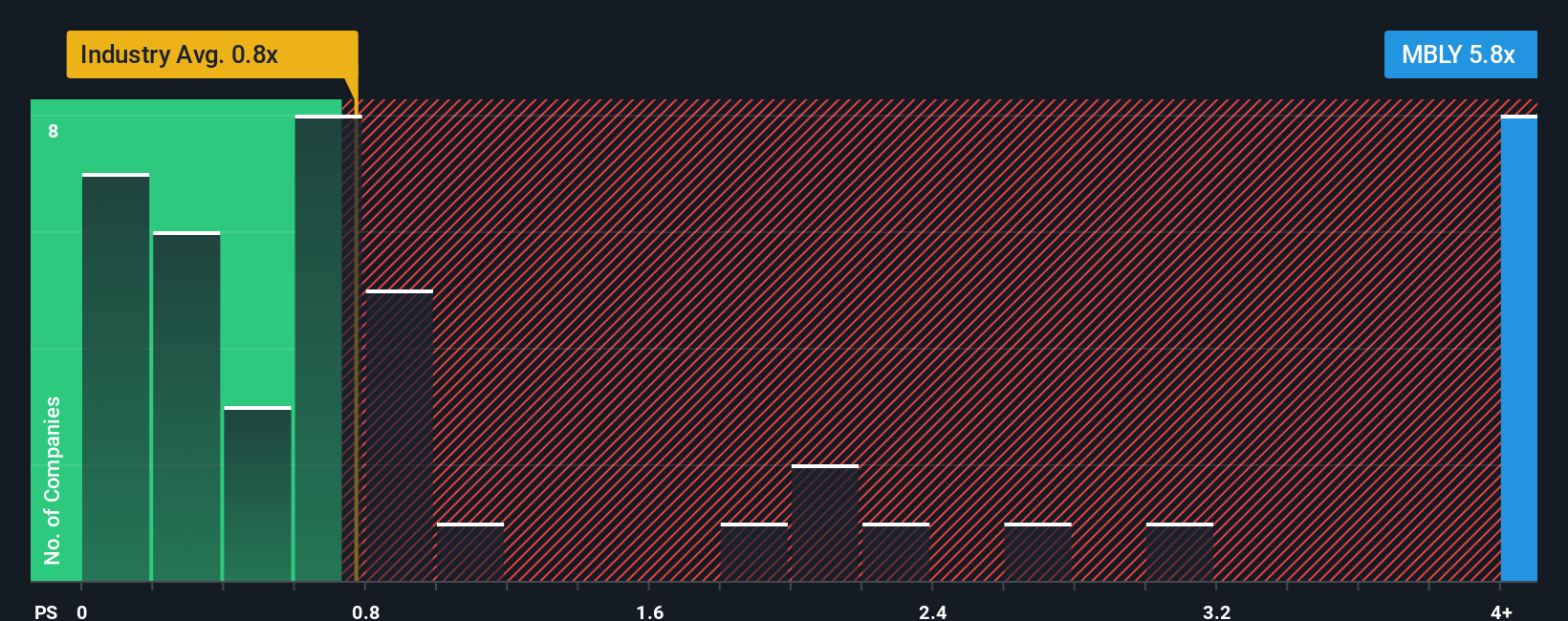

Approach 2: Mobileye Global Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a useful metric for valuing growth-oriented companies like Mobileye Global, especially when earnings are volatile or negative. It reflects how much investors are willing to pay for each dollar of revenue and is often preferred for companies in fast-evolving industries where profits may lag behind sales growth.

Growth expectations and risk levels play a significant role in determining what a “normal” or fair P/S ratio should be. Investors tend to pay higher multiples for companies with faster expected growth and lower business risk, while more mature or riskier firms typically trade at lower multiples.

Currently, Mobileye Global trades at a P/S ratio of 6.46x. This stands well above both the Auto Components industry average of 0.69x and the peer average of 1.43x. However, Simply Wall St’s Fair Ratio for Mobileye, which dynamically adjusts for factors such as expected growth, profitability, size, and sector risk, is 4.56x. While industry and peer comparisons offer some context, the Fair Ratio is a far more nuanced benchmark for investors because it is tailored to the company’s unique characteristics rather than just broad group averages.

Given that Mobileye’s current P/S multiple is materially above both the industry average and its Fair Ratio, the stock appears overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mobileye Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful tool that lets you lay out your own story behind the numbers by combining your expectations for Mobileye Global’s future revenue, earnings, and margins with your idea of fair value.

Instead of just accepting static ratios or analyst price targets, Narratives connect the company’s big-picture story to an actual financial forecast, helping you see how your assumptions could translate into today’s valuation. On Simply Wall St's Community page, used by millions of investors, you can explore and create these Narratives easily with no complex spreadsheets required.

Narratives help you make smarter buy or sell decisions by showing if your fair value is above or below the current share price. They are always up to date, automatically reflecting new information like company announcements or earnings reports so you never miss a key shift in the story.

For example, when looking at Mobileye Global, one investor's Narrative might be optimistic, forecasting industry-leading robotaxi growth and new OEM deals, resulting in a fair value as high as $31.10. Another might take a more cautious view, worried about competition and tariffs, with a conservative fair value at just $12.00. Narratives let you compare your own perspective side by side with others and act confidently on your convictions.

Do you think there's more to the story for Mobileye Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.