Please use a PC Browser to access Register-Tadawul

CarMax (KMX) Valuation Revisited After Earnings Miss, Loan Loss Surprise, and Analyst Downgrades

CarMax, Inc. KMX | 40.63 | -0.71% |

CarMax (KMX) shares dropped sharply after the company’s second quarter results. Revenue and profit declined more than expected, with management attributing the underperformance to weaker used car sales, higher loan losses, and increased competition.

The 20% single-day plunge in CarMax's share price after Q2 earnings was dramatic, reflecting shaken investor confidence following weaker-than-expected financials, rising loan losses, and management’s abruptly cautious outlook. While the share price has since stabilized near its 52-week lows, recent events including index removal and ongoing legal investigations point to fading momentum. Looking longer term, the total shareholder return has been negative for the past year and remains under pressure across three- and five-year periods. This underscores how recent volatility sits atop years of tepid performance.

If this shake-up has you wondering what else might be on the move, it could be a good time to expand your search and discover fast growing stocks with high insider ownership.

With the stock plunging to 52-week lows and analysts trimming their price targets, investors are left to weigh whether CarMax shares now represent an undervalued turnaround story or if the market is fairly pricing in muted growth ahead.

Most Popular Narrative: 39.7% Undervalued

The most widely followed narrative points to a fair value that is nearly 40% above CarMax's last close, highlighting a significant gap between current price and forward-looking assumptions. This helps explain why many believe CarMax’s challenges may already be priced in, while operational catalysts could fuel a re-rating.

Expansion in the company's vehicle sourcing capabilities, particularly through dealer channels and improved consumer experience, is intended to support unit volume growth and improve gross profit margins by lowering vehicle acquisition costs. CarMax's initiative to broaden its full credit spectrum lending capabilities through CarMax Auto Finance (CAF) is expected to increase CAF income and net interest margins over time. This initiative aims to capture more sales and improve financing income, impacting earnings positively.

Want to know what powers that lofty valuation? The secret sauce is in the company’s push for new revenue streams and margin expansion. One bullish forecast stands out, with big profit growth riding entirely on strategic shifts that few expect. Ready to see which numbers rewrite CarMax’s story? Explore the ambitious projections behind this fair value.

Result: Fair Value of $76.93 (UNDERVALUED)

However, weakening wholesale margins and rising risks from expanding credit operations could pressure profitability. This may potentially derail even the most optimistic outlooks for CarMax.

Another View: What Do Market Ratios Tell Us?

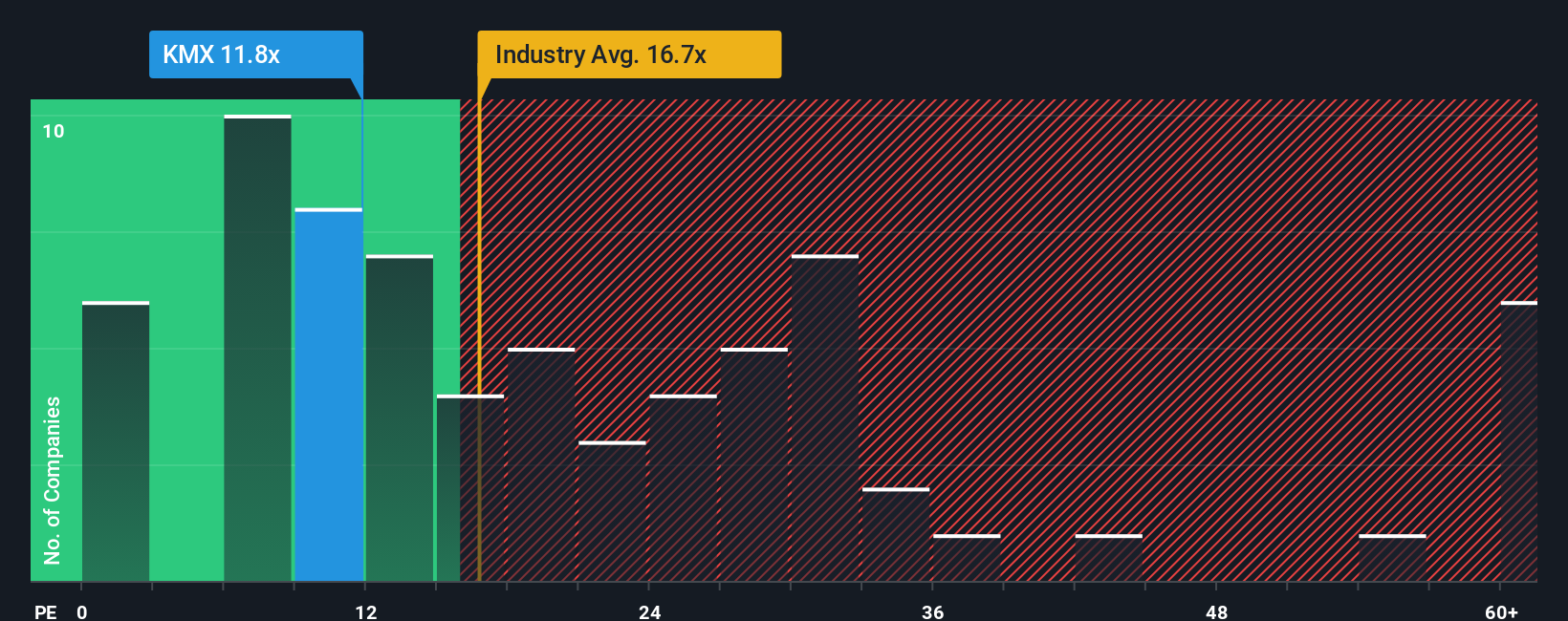

While analyst forecasts suggest CarMax is undervalued, market ratios paint a more complex picture. CarMax’s price-to-earnings ratio of 13.1x is higher than the peer average of 12.5x, but it remains well below the industry average of 17.2x and the fair ratio of 18.9x. This leaves investors pondering whether the company is a hidden value or still exposed to valuation risk if expectations slip.

Build Your Own CarMax Narrative

If you have a different perspective or want to dig into the details yourself, it takes just a few minutes to shape your own view of CarMax. Do it your way

A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Waiting on just one stock could mean missing the perfect opportunity. Take control of your portfolio and catch the next breakout with these smart alternatives:

- Capitalize on generous returns by targeting consistent income with these 19 dividend stocks with yields > 3% offering yields above 3%.

- Position yourself at the forefront of technology by backing breakthrough innovators with these 24 AI penny stocks who are shaping tomorrow’s digital landscape.

- Maximize upside potential with these 901 undervalued stocks based on cash flows trading below their fair value, before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.