Please use a PC Browser to access Register-Tadawul

Chevron's ESOP Stock Offering Might Change The Case For Investing In CVX

Chevron Corporation CVX | 147.07 | -1.82% |

- Earlier this week, Chevron Corporation filed a shelf registration for a US$188.60 million common stock offering tied to its Employee Stock Ownership Plan (ESOP), offering 1,245,841 shares.

- This type of ESOP-related filing may influence expectations about future equity dilution and signals an ongoing focus on employee ownership within the company.

- We’ll explore how Chevron’s ESOP-related share offer could influence its investment outlook and capital structure considerations.

Chevron Investment Narrative Recap

To own shares in Chevron, investors need to believe in the company's ability to sustain cash flows amid a shifting energy landscape and heightened policy headwinds. This week's US$188.6 million ESOP-linked stock offering does not appear likely to materially alter the most important short-term catalysts, such as progress on the Hess acquisition, or the major risk from further reductions in capital spending, though it may contribute incrementally to short-term equity dilution.

One recent announcement that stands out is Chevron's intention to cut capital expenditure by US$2 billion while targeting up to US$3 billion in structural cost savings. These efforts align directly with the company's push to preserve margins and stabilize earnings in a volatile market, an issue that remains front and center for shareholders following the ESOP offering.

By contrast, it's just as important for investors to be mindful of ongoing risks from California regulations that could squeeze refining margins in ways that...

Chevron's outlook anticipates $184.0 billion in revenue and $18.9 billion in earnings by 2028. This reflects a -1.9% annual revenue decline and a $3.2 billion increase in earnings from the current $15.7 billion level.

Exploring Other Perspectives

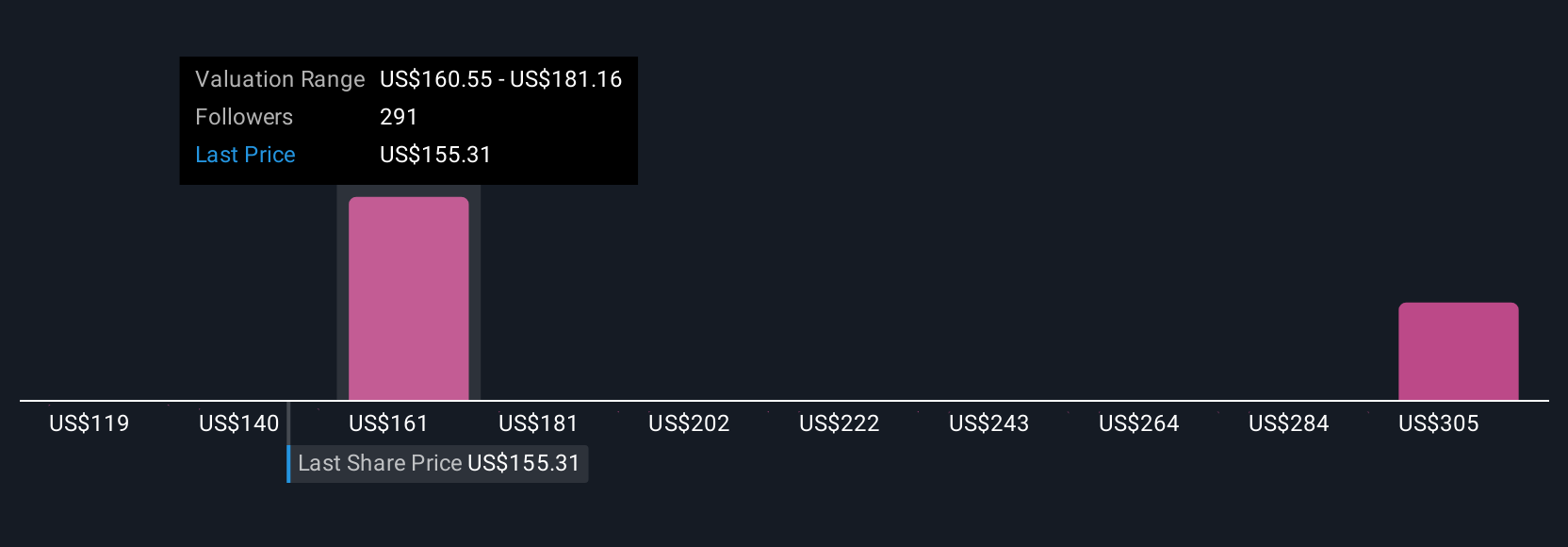

The Simply Wall St Community's 27 fair value estimates for Chevron range widely from US$119 to US$656 per share, reflecting considerable differences in opinion. With margin pressures from state policies still looming, take the time to check multiple viewpoints on Chevron's outlook.

Build Your Own Chevron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chevron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chevron's overall financial health at a glance.

No Opportunity In Chevron?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.