Please use a PC Browser to access Register-Tadawul

Circle Internet Group (NYSE:CRCL): Exploring Valuation After Recent Market Swings

Circle CRCL | 76.58 | -8.26% |

Circle Internet Group (NYSE:CRCL) has been moving in ways that give investors something to talk about, even without any headline-grabbing event. Sometimes a lack of big news can be just as intriguing, as it prompts the age-old question: is the stock’s recent behavior a sign of something more, or simply market noise? Investors are left reading the tea leaves, trying to connect the dots between market sentiment and real business fundamentals.

Looking at the numbers, Circle’s stock shows both swings and resilience. The share price dipped almost 6% yesterday but rebounded over 9% in the past week, though it remains down around 16% for the month and 17% in the past 3 months. Still, year-to-date gains of over 50% suggest that momentum, while choppy, has not faded entirely. While there have been no dramatic developments recently, Circle’s reported annual revenue growth of 29% and an impressive surge in net income growth are still in focus for investors tracking its potential over time.

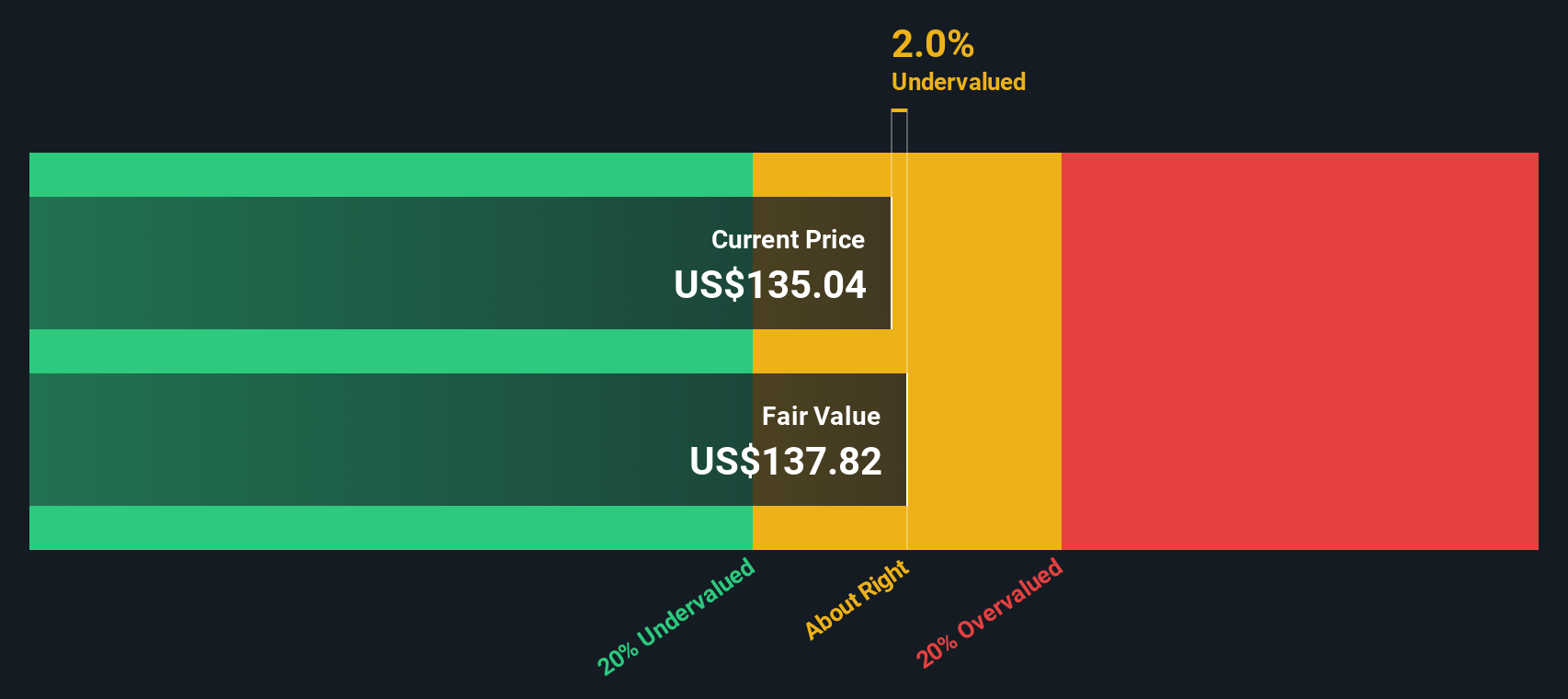

With this kind of market action, is Circle Internet Group now trading at a discount, or has the market already priced in what is coming next?

Most Popular Narrative: 2.6% Overvalued

According to the most widely followed narrative by BlackGoat, Circle (CRCL) is currently trading above what is considered a fair value. Investors are watching closely as recent market enthusiasm has pushed the stock higher than the underlying business developments may warrant.

Circle’s valuation quickly became a product of hype and extreme optimism, with little regard for regulatory, structural, or macro risks. I've reduced my estimates and fair value and while still optimistic, the price of today is well above what I believe would be a fair value for Circle.

Think this narrative is just another hot take? Think again. The real driver behind this fair value projection may surprise you. It hinges on bullish expectations for rapid sales growth, improving profitability, and a future profit ratio that defies market norms. Want to see the exact assumptions and what could make this stock’s story explode or unravel? This narrative’s detailed breakdown reveals much more under the surface.

Result: Fair Value of $122.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a decline in interest rates or an increase in distribution costs could quickly shift sentiment, challenging the current valuation and creating heightened uncertainty for Circle’s shares.

Find out about the key risks to this Circle Internet Group narrative.Another View: DCF Model Offers a Different Angle

While the market seems to believe Circle’s shares are pricey based on sales, our DCF model tells a more optimistic story. In fact, it shows shares could actually be undervalued. Could the fundamentals reveal hidden value?

Build Your Own Circle Internet Group Narrative

If you have your own perspective or want to dig deeper into the numbers, you can create a custom analysis in just a few minutes. Do it your way

A great starting point for your Circle Internet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Stock Picks You Shouldn’t Miss?

Don’t let your next big opportunity slip by. Take charge of your research and uncover promising investments tailored to your unique goals by using these focused strategies:

- Grow your portfolio’s future potential by sizing up small companies with momentum and strong balance sheets using our penny stocks with strong financials.

- Start capitalizing on the artificial intelligence revolution by finding leading-edge innovators and profitable disruptors through the AI penny stocks.

- Lock in steady payouts and financial stability by finding opportunities among companies offering yields above 3% via the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.