Please use a PC Browser to access Register-Tadawul

CME Group (CME): Assessing Valuation After Launch of New Options Analytics Suite

CME Group Inc. Class A CME | 273.55 | +0.88% |

If you have been following CME Group (CME), you probably noticed the announcement about their new suite of analytics tools for options market data. This is more than a minor tech upgrade. The launch delivers real-time and historical insights across all major asset classes, responding to client calls for greater access to the "Greeks" and implied volatility. With options trading volumes hitting fresh records, CME Group is clearly leaning into the momentum and addressing what traders and risk managers are calling out for most.

This announcement follows a period of steady growth for CME Group. Options contracts hit an annual average daily volume of 5.5 million in 2024 and increased to 5.6 million in the first half of 2025. The stock has gained 26% over the past year and is up 13% for the year to date, reflecting market recognition of the company’s ability to innovate and capture demand from institutional and retail clients seeking advanced data solutions. Combined with consistent revenue and profit growth in the latest annual reports, the positive stock momentum suggests that this strategic move may be more significant than some expect.

The question remains whether the market is rewarding CME’s innovation too quickly or if there is a real opportunity at current prices for investors who see further upside in this data-driven landscape.

Most Popular Narrative: 7% Undervalued

According to the most widely followed narrative, CME Group is viewed as undervalued by 7% based on forward-looking financial projections and market expectations.

The rapid acceleration of retail engagement, highlighted by a 56% increase in new retail traders and five consecutive quarters of double-digit retail client acquisition growth, diversifies CME's client base and supports both volume and transaction-based revenue growth.

Eager to unravel the financial drivers behind this bullish view? The most talked-about narrative is betting on profitability and efficiency upgrades that could put markets on notice. Find out which key assumptions, hidden in plain sight, are shaping the case for CME's next leap in value.

Result: Fair Value of $282.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if global volatility drops or if decentralized finance accelerates, CME’s growth projections could be challenged and narrative expectations may need adjustment.

Find out about the key risks to this CME Group narrative.Another View: SWS DCF Model Suggests a Different Story

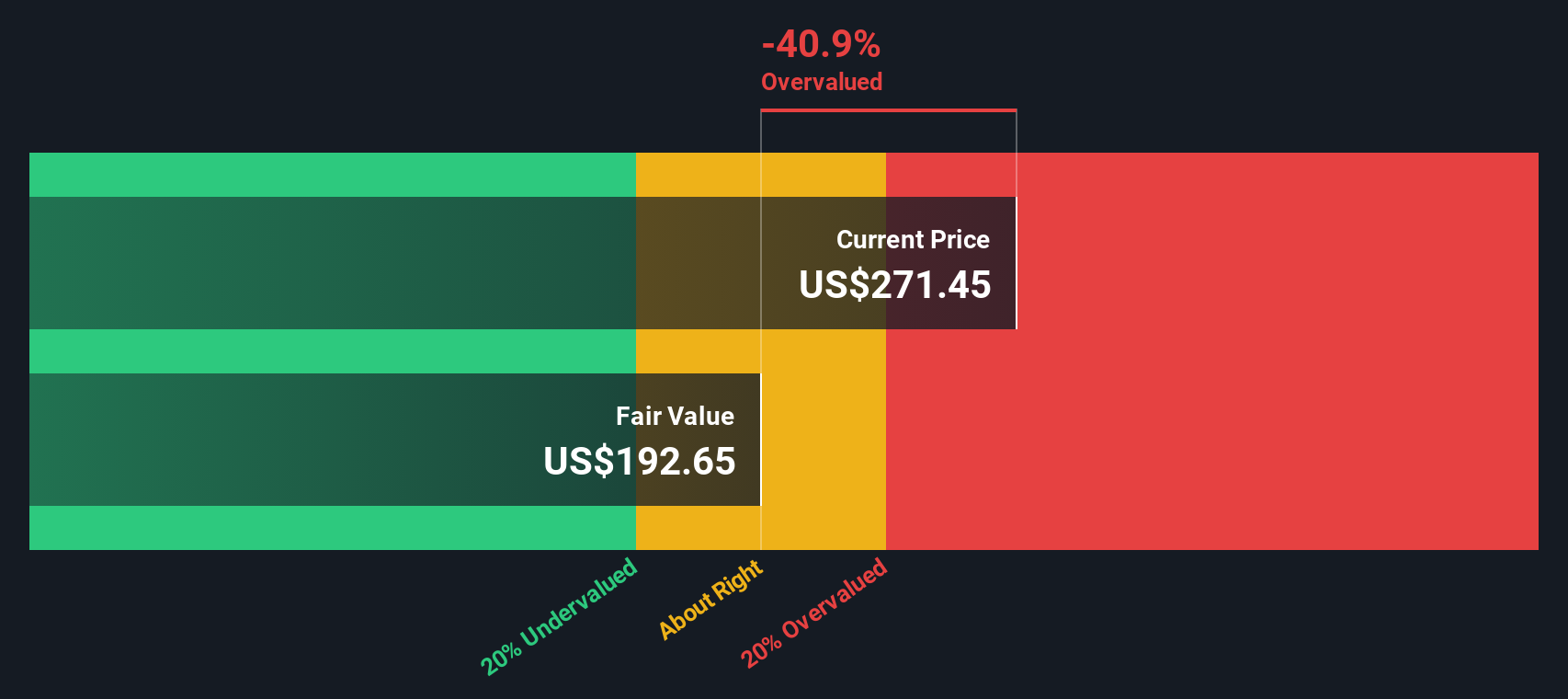

While many see value based on future earning potential, our DCF model arrives at a sharply different conclusion. It indicates CME might be overvalued at current prices. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CME Group Narrative

If you see things differently or want to dive into the numbers on your own terms, you can build a fresh perspective in just a few minutes. Do it your way

A great starting point for your CME Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just wait on the sidelines while opportunities pass you by. Discover additional ways to enhance your portfolio with these exciting new themes, handpicked for forward-thinking investors:

- Unlock the potential of companies pioneering artificial intelligence breakthroughs by checking out the latest AI penny stocks to ride the next wave of innovation.

- Get ahead of the crowd and spot undervalued gems primed for growth with our in-depth undervalued stocks based on cash flows research.

- Fuel your passive income strategy and explore a handpicked selection of dividend stocks with yields > 3% that continue to deliver strong yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.