Please use a PC Browser to access Register-Tadawul

Cohen & Steers (CNS): A Fresh Look at Valuation After Recent Share Price Decline

Cohen & Steers, Inc. CNS | 62.84 | +0.48% |

Cohen & Steers (CNS) has had a year that might catch your attention if you are following asset managers. There has not been a specific company-triggered event to explain recent moves, but anytime a stock shifts meaningfully, investors start to wonder if the market is trying to send a signal, whether subtle or significant. This presents an interesting moment to re-examine Cohen & Steers’s valuation and future outlook.

Looking at the bigger picture, Cohen & Steers’s stock has declined about 22% year to date, with losses extending over the past month as well. While the stock delivered a sharp reversal from five-year gains of 50% to a near 20% loss over the past year, its long-term three-year performance is still mildly positive. There have not been any game-changing headlines or financial reports in recent weeks, so the negative momentum stands out against the company’s annual revenue and net income growth.

So with shares pulling back despite underlying business growth, is this a rare buying window opening up or is the market already bracing for weaker days ahead?

Most Popular Narrative: 3.7% Undervalued

The most widely followed narrative suggests that Cohen & Steers is trading at a modest discount to its fair value. This narrative factors in key drivers such as future earnings growth and the outlook for global investor demand in real assets.

Ongoing investments in global distribution, particularly in Asia-Pacific and Europe, and recent foreign office upgrades are expected to drive international client inflows and scale. There is potential for margin expansion as global business grows.

Want to know why analysts are holding tight to their price targets? There is a financial master plan here, rooted in ambitious earnings growth and major profit expansion. Find out which surprising assumptions could tip the scales and why the next phase of Cohen & Steers could be a game changer. The logic might not be what you expect.

Result: Fair Value of $74.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent outflows from large clients or rising costs related to global expansion could challenge the company’s growth and put pressure on margins in the quarters ahead.

Find out about the key risks to this Cohen & Steers narrative.Another View: Discounted Cash Flow Paints a Different Picture

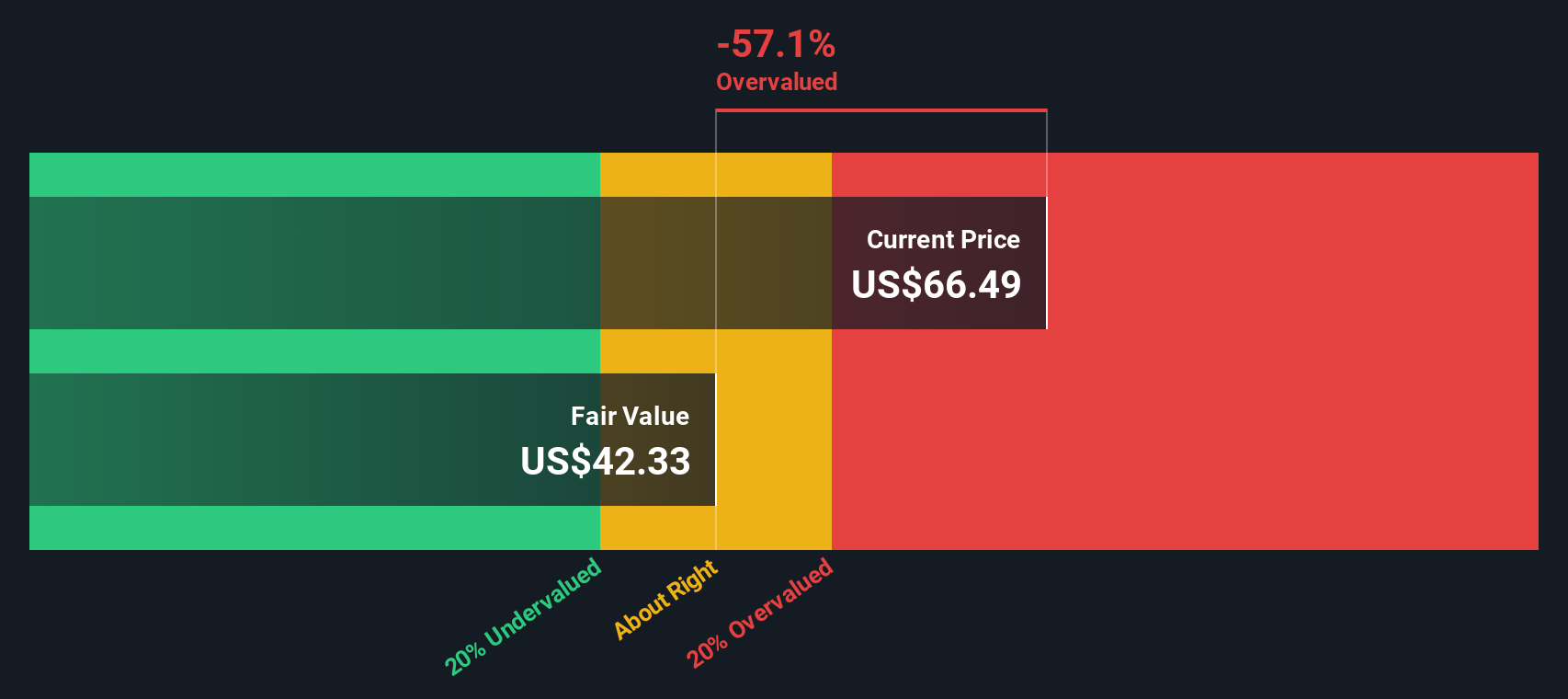

Our SWS DCF model offers a sharp counterpoint and suggests Cohen & Steers could be overvalued relative to its cash flow expectations. Could the market be too optimistic about the company's long-term fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cohen & Steers Narrative

If you feel there is more to the story or want to reach your own conclusions, it takes just a few minutes to build a unique take and see where the data leads. Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Ways to Strengthen Your Portfolio?

Spotting the right idea can make all the difference. Seize your advantage by using unique stock screens that surface fresh opportunities others might overlook. Now is the perfect time to start before market momentum shifts.

- Maximize steady returns by checking out companies offering dividend stocks with yields > 3% and find those with yields that help your portfolio work harder.

- Catch the next big tech wave by searching for AI penny stocks shaping tomorrow’s innovation through artificial intelligence breakthroughs.

- Get ahead of the crowd and unlock potential value by browsing undervalued stocks based on cash flows to uncover stocks that could be trading below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.