Please use a PC Browser to access Register-Tadawul

Cohu, Inc. (NASDAQ:COHU) Surges 25% Yet Its Low P/S Is No Reason For Excitement

Cohu, Inc. COHU | 28.54 | -2.79% |

Cohu, Inc. (NASDAQ:COHU) shares have continued their recent momentum with a 25% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

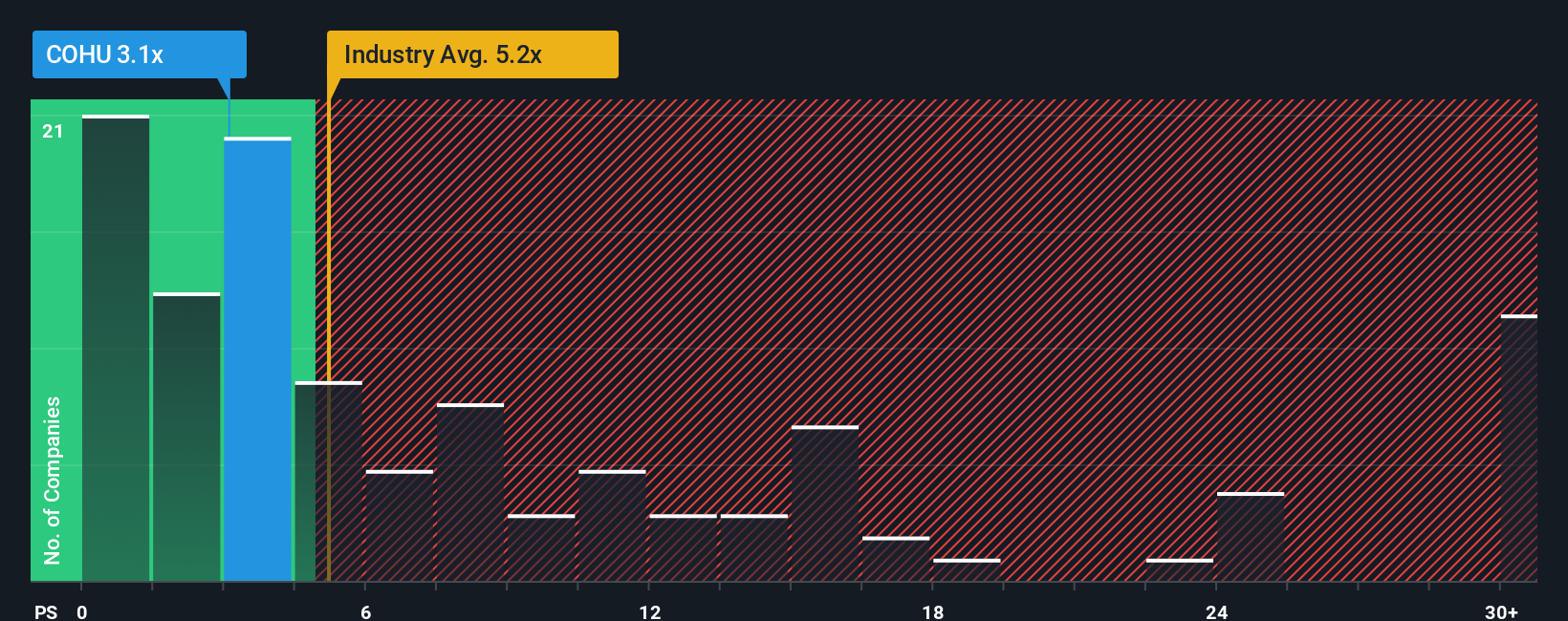

In spite of the firm bounce in price, Cohu may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 5.4x and even P/S higher than 14x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Cohu Has Been Performing

While the industry has experienced revenue growth lately, Cohu's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cohu will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cohu's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.6% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 48% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the five analysts following the company. With the industry predicted to deliver 45% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Cohu's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Cohu's P/S

Despite Cohu's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Cohu's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Cohu with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.