Please use a PC Browser to access Register-Tadawul

Compass Diversified (NYSE:CODI) Held Back By Insufficient Growth Even After Shares Climb 28%

Compass Diversified Holdings CODI | 7.57 | +4.99% |

The Compass Diversified (NYSE:CODI) share price has done very well over the last month, posting an excellent gain of 28%. But the last month did very little to improve the 66% share price decline over the last year.

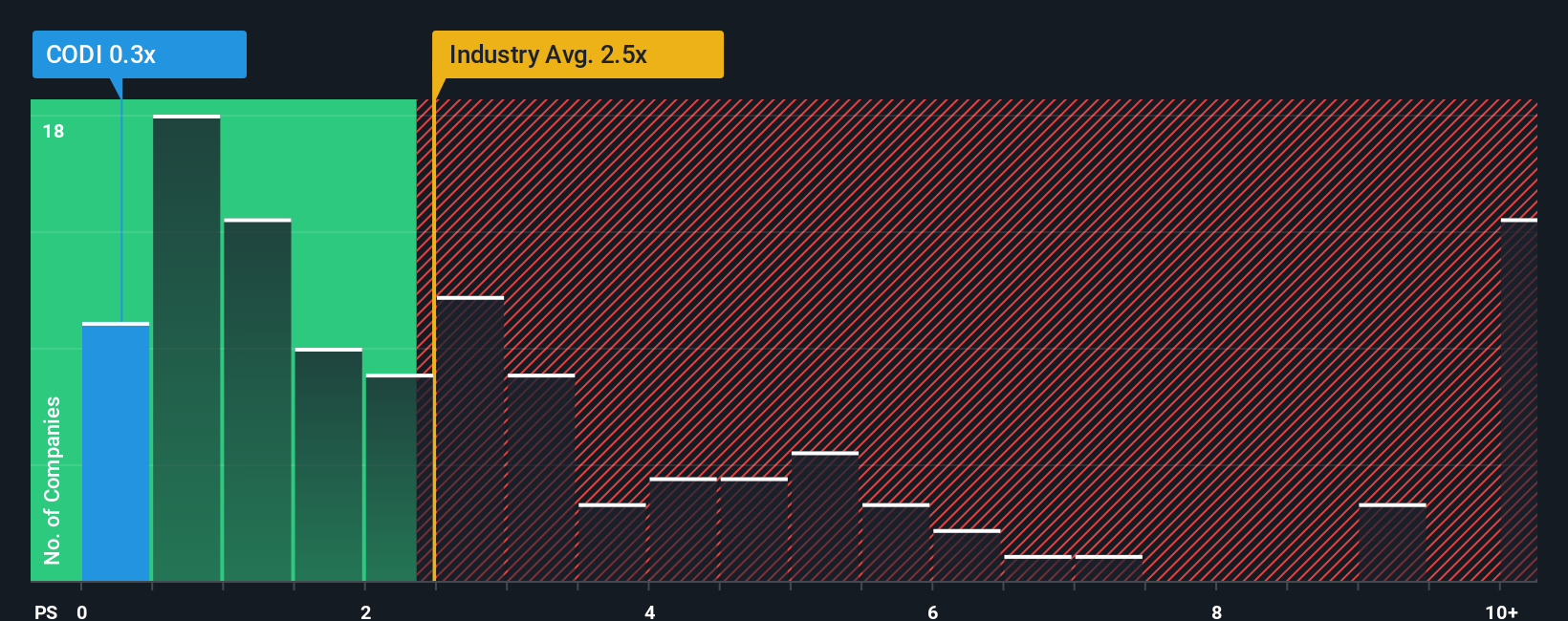

Although its price has surged higher, Compass Diversified may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Diversified Financial industry in the United States have P/S ratios greater than 2.5x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Compass Diversified's P/S Mean For Shareholders?

Recent times have been advantageous for Compass Diversified as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Compass Diversified.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Compass Diversified's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 12% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.8% as estimated by the three analysts watching the company. With the industry predicted to deliver 6.6% growth, that's a disappointing outcome.

With this information, we are not surprised that Compass Diversified is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Compass Diversified's P/S

Compass Diversified's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Compass Diversified maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

If these risks are making you reconsider your opinion on Compass Diversified, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.