Please use a PC Browser to access Register-Tadawul

CompoSecure And 2 Other Stocks That May Be Trading Below Estimated Value

CompoSecure, Inc. - Class A Common Stock CMPO | 20.22 | -1.22% |

As the U.S. market navigates a landscape marked by anticipation of Federal Reserve interest rate cuts and fluctuating indices, investors are keenly observing potential opportunities amidst the volatility. In this context, identifying stocks that may be trading below their estimated value can offer a strategic edge, particularly when market conditions suggest shifts in monetary policy and economic projections.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VTEX (VTEX) | $4.20 | $8.38 | 49.9% |

| Pinnacle Financial Partners (PNFP) | $94.65 | $186.59 | 49.3% |

| Phibro Animal Health (PAHC) | $39.01 | $77.67 | 49.8% |

| Northwest Bancshares (NWBI) | $12.31 | $24.41 | 49.6% |

| Niagen Bioscience (NAGE) | $9.49 | $18.64 | 49.1% |

| Investar Holding (ISTR) | $22.62 | $44.92 | 49.6% |

| Horizon Bancorp (HBNC) | $16.13 | $31.80 | 49.3% |

| Glaukos (GKOS) | $82.35 | $161.37 | 49% |

| Exact Sciences (EXAS) | $52.94 | $103.18 | 48.7% |

| AGNC Investment (AGNC) | $10.13 | $20.23 | 49.9% |

Let's explore several standout options from the results in the screener.

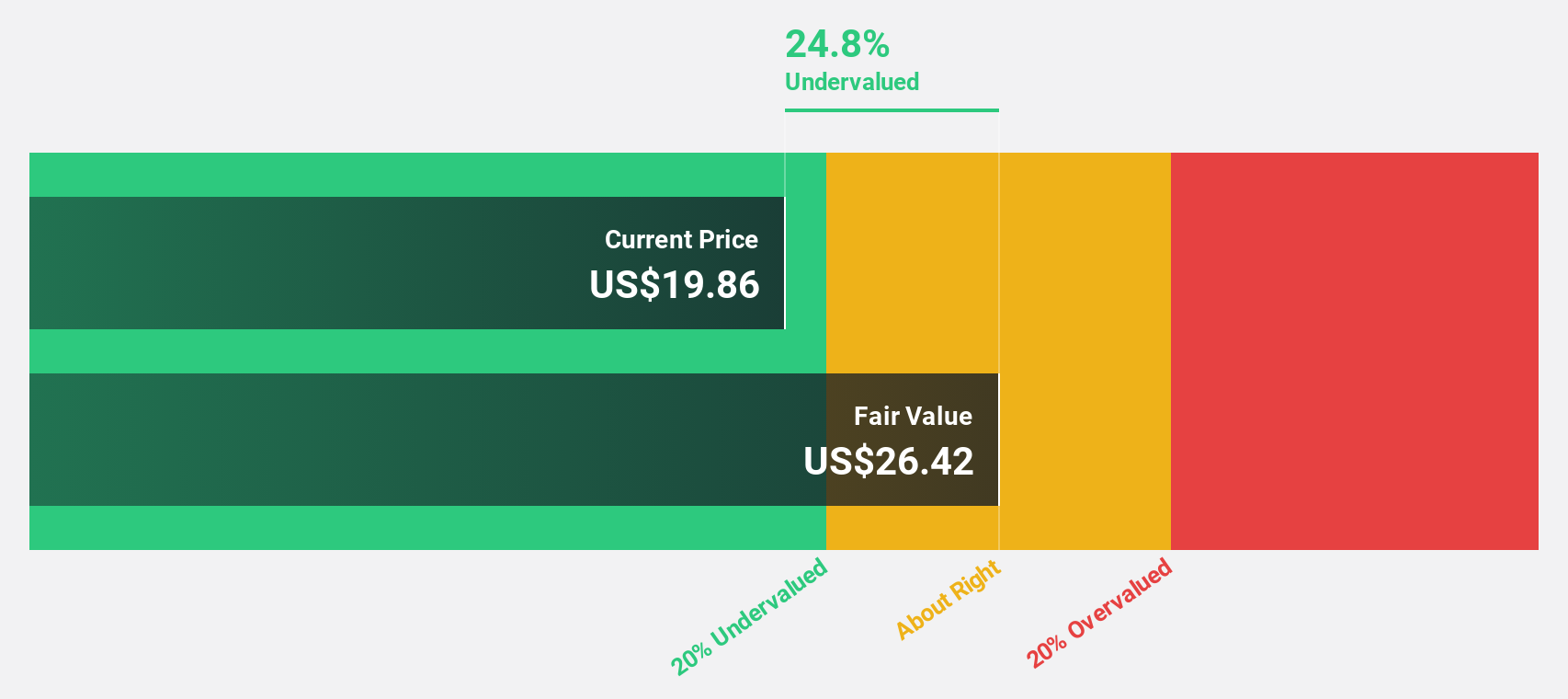

CompoSecure (CMPO)

Overview: CompoSecure, Inc. designs and manufactures metal, composite, and proprietary financial transaction cards both in the United States and internationally, with a market cap of $1.99 billion.

Operations: Revenue segments for the company include the design and manufacture of metal, composite, and proprietary financial transaction cards in both domestic and international markets.

Estimated Discount To Fair Value: 29.1%

CompoSecure is trading at US$19.41, significantly below its estimated fair value of US$27.38, indicating potential undervaluation based on cash flows. Despite recent earnings challenges and insider selling, the company forecasts robust annual revenue growth of 25.9%, outpacing the broader U.S. market's growth rate of 9.7%. Additionally, CompoSecure's innovative Arculus product enhances its position in the crypto payments space by integrating blockchain with traditional payment systems without requiring new hardware investments for merchants and POS providers.

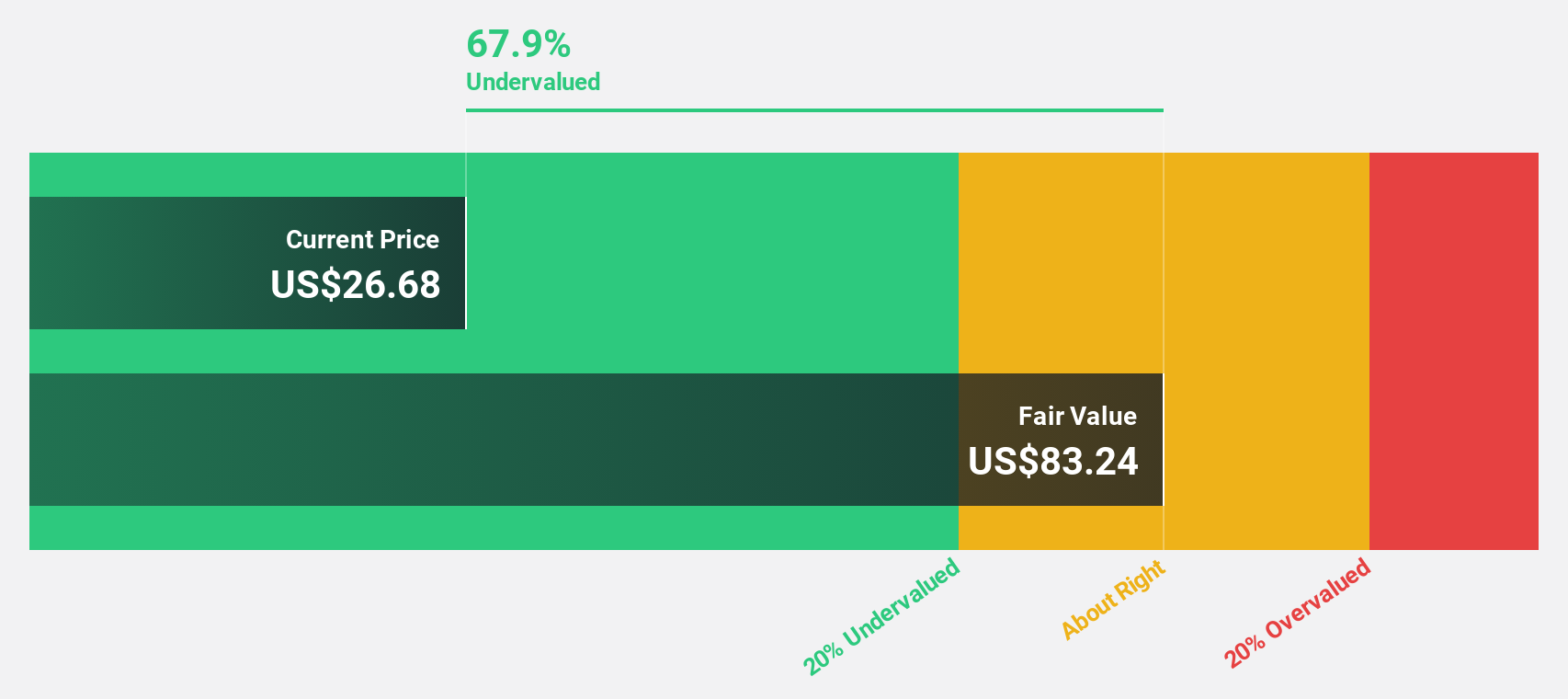

BKV (BKV)

Overview: BKV Corporation is engaged in the production and sale of natural gas from the Barnett Shale in Texas and the Marcellus Shale in Pennsylvania, with a market cap of approximately $1.83 billion.

Operations: The company's revenue is primarily generated from its Oil & Gas - Exploration & Production segment, which amounts to $756.80 million.

Estimated Discount To Fair Value: 35.3%

BKV Corporation is trading at US$22.12, well below its estimated fair value of US$34.18, highlighting potential undervaluation based on cash flows. The company reported strong revenue growth to US$322.04 million in Q2 2025 from US$136.2 million a year ago and achieved a net income of US$104.57 million compared to a loss previously, despite being dropped from several Russell growth indices recently. BKV's ongoing carbon capture projects further bolster its strategic initiatives in sustainable energy solutions.

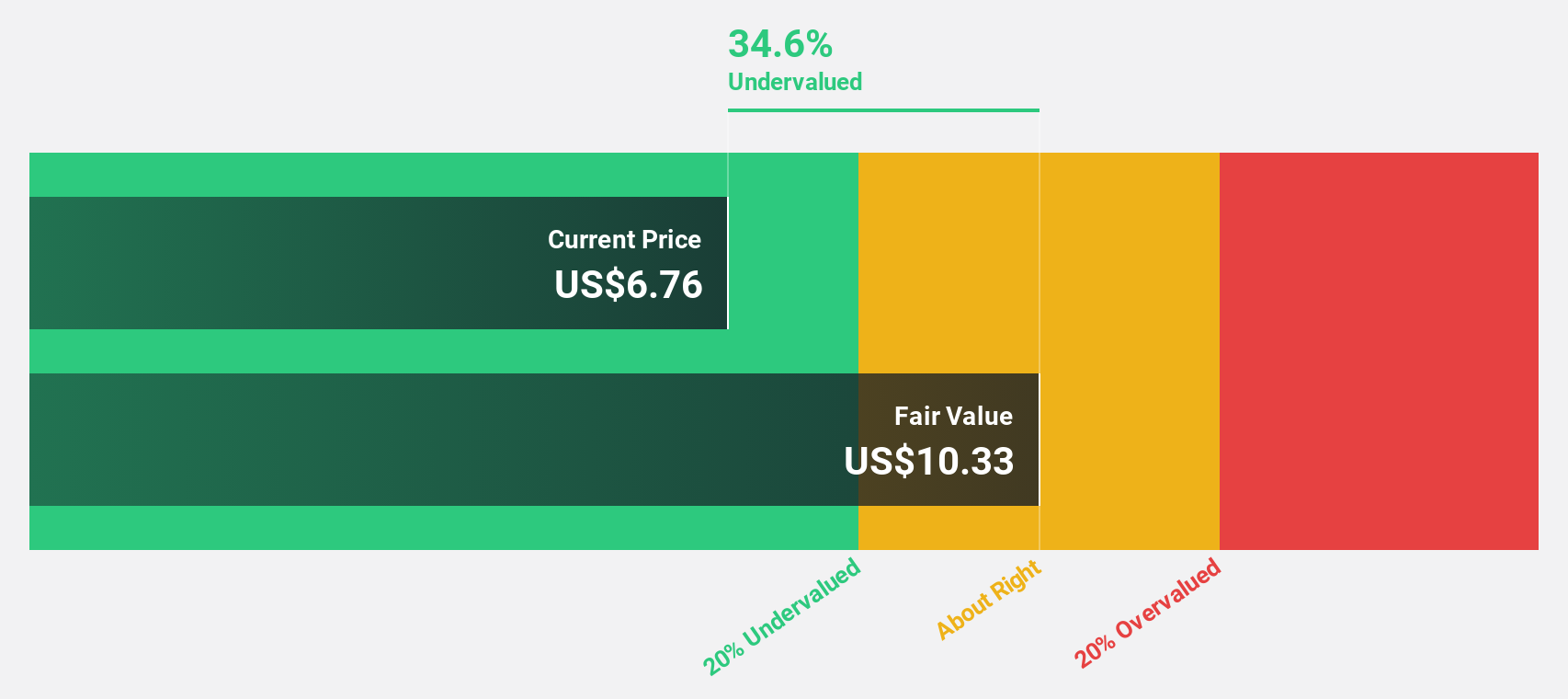

VTEX (VTEX)

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $753.33 million.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $230.50 million.

Estimated Discount To Fair Value: 49.9%

VTEX, priced at US$4.2, trades significantly below its fair value estimate of US$8.38, indicating undervaluation based on cash flows. Despite a dip in net income to US$2.99 million for Q2 2025 from US$6.57 million a year ago, earnings are projected to grow over 40% annually, outpacing the broader market's growth rate. Recent enhancements in B2B capabilities and an active share repurchase program further support its strategic positioning and potential long-term value creation.

Next Steps

- Delve into our full catalog of 192 Undervalued US Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.