Please use a PC Browser to access Register-Tadawul

Concerns Over AI Bubble Loom! Can NVIDIA's Q3 Earnings Dispel Doubts? Citi Urges: Buy!

NVIDIA Corporation NVDA | 191.13 187.30 | -0.72% -2.00% Pre |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 330.56 327.23 | -2.65% -1.01% Pre |

ARM Holdings PLC Sponsored ADR ARM | 105.36 103.62 | -2.83% -1.65% Pre |

QUALCOMM Incorporated QCOM | 151.59 149.91 | -0.41% -1.11% Pre |

Broadcom Limited AVGO | 331.30 324.94 | +0.17% -1.92% Pre |

NVIDIA Corporation(NVDA.US), the world's highest-valued publicly traded company, is set to release its third-quarter report for the fiscal year 2026 after the market closes on Wednesday, November 19, Eastern Time.

Driven by strong demand for artificial intelligence (AI) chips, Bloomberg's consensus estimates for Nvidia's Q3 are:

- Revenue of $54.97 billion, a year-on-year increase of 56.1%

- Adjusted net profit of $36.15 billion, up 55.3% from the previous year

- Adjusted earnings per share of $1.20, a year-on-year rise of 53.1%

Bubble Concerns Loom: Barclays Says Market Caution Before Earnings is Justified

Reflecting on Nvidia's performance over the past 10 quarters, the company has consistently exceeded earnings-per-share expectations. The average stock price fluctuation on earnings days was ±7.2%, with a maximum increase of 24.39% and a maximum decrease of 8.48%. The probability of a stock price rise on earnings days was 50%. Options signals suggest post-earnings volatility, with the market expecting fluctuations of ±7.7%.

On October 28, Jensen Huang provided a staggering forecast of $500 billion in revenue and 20 million GPUs over two years at the GTC conference, briefly pushing Nvidia's market cap above $5 trillion. However, recent warnings from Wall Street's notable bears about an AI bubble have raised concerns about the high valuations of AI-led stocks. Nvidia's stock fell over 6% in November but remains up more than 40% for the year.

Is the AI bubble about to burst? The debate is heating up. U.S. tech giants are betting on AI's future, with Alphabet, Meta Platforms, and Microsoft collectively spending $78 billion last quarter, an 89% year-on-year increase. This massive investment has sparked concerns on Wall Street. Major banks like RBC and Bank of America have issued warnings, intensifying anxiety over an AI bubble.

The latest 13F reports show SoftBank and Peter Thiel have liquidated Nvidia holdings, while Bridgewater and Citigroup have reduced theirs. Barclays notes that market caution before the earnings report is justified, as this report will be crucial in verifying whether the AI supercycle and related spending remain on track.

In the fiscal year 2026 Q2, Nvidia's revenue was $46.743 billion, a 56% year-on-year increase. Adjusted earnings per share were $1.05, up 54% from the previous year. The company previously guided Q3 revenue at $54 billion, but analysts have generally raised expectations, posing dual pressures of "high baseline + high expectations."

Key Metrics for Investors to Watch Ahead of Nvidia’s Earnings Report

With the market closely watching whether Nvidia’s earnings can support a return to its $5 trillion market capitalization amid growing debates over AI’s future, investors are urged to focus on key financial data and guidance. Particular attention should be paid to the growth rate of its data center business and the performance of its operations in China.

- Blackwell Chips as the Core Growth Driver

Morgan Stanley highlights that Nvidia’s Blackwell chips remain the top choice for AI applications, with strong demand signals for Vera Rubin chips. While competitors are showing enthusiasm, this reflects both technological progress and the robust demand in the AI chip market.

The data center segment is expected to continue its strong growth trajectory, driven by rising demand for generative AI and large language models powered by Nvidia’s Blackwell architecture GPUs. Major cloud service providers and consumer internet firms are fueling this demand. According to institutional projections, Nvidia’s data center revenue for Q3 is estimated to reach $48.04 billion, a year-on-year growth of 56.1%.

- Supply and Demand Signals Show Accelerated Growth

Morgan Stanley’s industry survey reveals that both Nvidia’s customers and suppliers are signaling accelerated demand growth in Q3, countering the prevailing market view that Nvidia’s growth metrics may have peaked.

On the customer side, cloud service providers have collectively raised capital expenditure forecasts for Q3 to $142 billion, with the four largest hyperscale cloud players each increasing spending by over $20 billion. Compared to 2025’s dollar growth, the current increase stands at $115 billion, up by $60 billion from just a quarter ago.

- High Gross Margins Expected to Persist

In terms of profitability, UBS predicts Nvidia’s gross margin for fiscal Q3 2026 will remain around 73.5%, with Q4 gross margins expected to range between 74.5% and 75%. Despite rising costs for memory chips and other components, UBS believes Nvidia can maintain an average gross margin of 70% for the full fiscal year 2026, supported by sustained strong demand for high-performance GPUs.

- Key Focus Areas: Export Restrictions and Customer Concentration Risks

Ahead of the earnings report, market debates around Nvidia are expected to center on two critical issues:

1. Impact of U.S. Export Restrictions on China:

Analysts at UBS note that the impact of U.S. government restrictions on exports to China appears to have stabilized following the Trump administration’s decision to prohibit certain exports. The key question now is how Nvidia plans to handle its B30 inventory amid these restrictions.

2. Risks from AI Customer Concentration:

Another concern is whether limitations faced by Nvidia’s major AI customers—such as power supply, memory chip availability, or funding constraints—could hinder Nvidia’s profitability growth. UBS expects the earnings call to focus heavily on the pace of AI infrastructure deployment and the risks associated with customer concentration.

Investors will be closely monitoring Nvidia’s ability to navigate these challenges while maintaining its leadership in the AI chip market.

Major Banks Bullish on Nvidia Ahead of Earnings: Citigroup Says “Buy! Bubble Claims Don’t Hold Up”

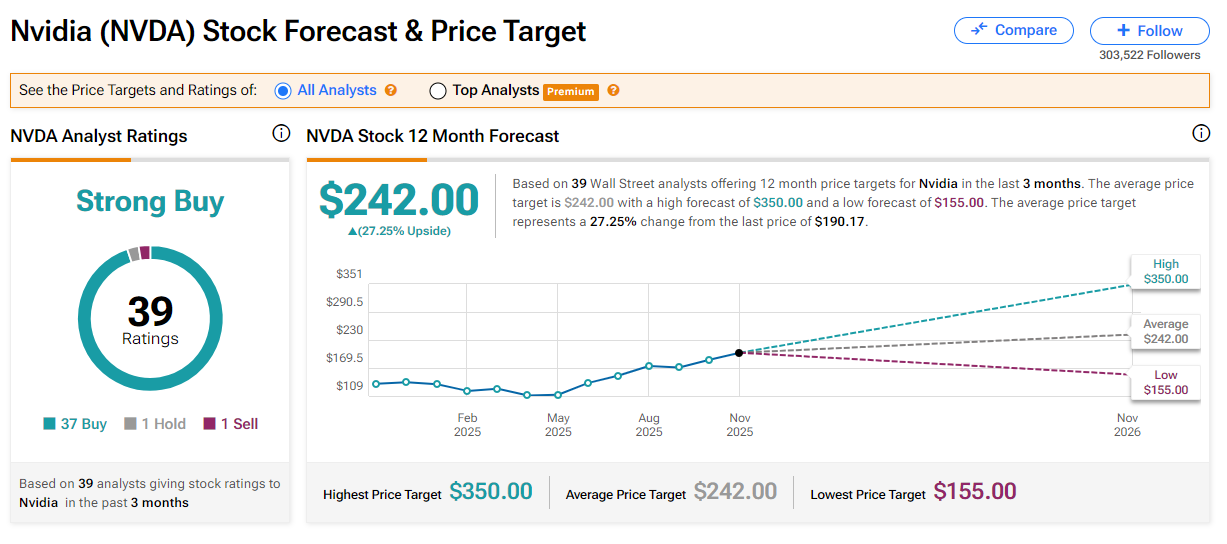

According to the latest data from TipRanks, multiple major banks have raised their price targets for Nvidia ahead of its earnings report, with nearly 90% of tracked analysts assigning a “Buy” rating. The current Wall Street average price target for Nvidia is $242, indicating an upside potential of 23%, with the highest price target at $350 per share.

- Goldman Sachs: Raises Price Target to $240, Expects Q3 Earnings to Beat Expectations

Goldman Sachs issued a research note stating that Nvidia’s third fiscal quarter, ending in late October, is expected to beat market expectations, with the stock’s reaction largely dependent on the magnitude of its guidance revision.

The bank highlighted four key areas likely to take center stage during the earnings call: supplementary details on the $500 billion data center revenue forecast, OpenAI’s 2026 deployment plans, Rubin’s 2026 mass production timeline, and the potential resumption of business in China. Goldman reiterated its “Buy” rating, raised revenue and non-GAAP EPS estimates for fiscal years 2026 to 2028 by an average of 12%, and increased its price target to $240.

- Citigroup: “Buy! AI Demand Far Outstrips Supply, Bubble Claims Are Baseless”

Citigroup expects Nvidia’s November 19 earnings report to deliver a strong performance, featuring revenue exceeding expectations and upward guidance revisions. The firm maintained its “Buy” rating and raised its price target to $220.

Citigroup emphasized that Nvidia’s growth is constrained not by weak AI demand but rather by supply chain bottlenecks, such as CoWoS packaging limitations. The firm dismissed concerns about an AI bubble, arguing that the demand for Nvidia’s GPUs remains robust and far exceeds current supply capabilities.

Notably, Citigroup initiated a “30-day short-term bullish” outlook on Nvidia, betting on a strong earnings report that will showcase revenue surpassing expectations and guidance revisions.

- UBS: Nvidia’s Q3 Likely to Beat Expectations, Focus on Export Restrictions and Customer Concentration Risks

UBS released a report predicting that Nvidia will once again deliver better-than-expected Q3 results, despite challenges posed by U.S. export restrictions to China. The firm estimates Nvidia’s Q3 revenue will reach $56 billion, surpassing the company’s own guidance of $54 billion. UBS maintained its “Buy” rating and set a price target of $235.

UBS forecasts Nvidia’s GPU production to grow approximately 30% quarter-over-quarter in Q3 and anticipates that as supply chains stabilize and AI server rack deployments accelerate, Nvidia’s total chip shipments could reach 10 million units between 2024 and 2026.

Focus on Related Investment Opportunities

As Nvidia's Q3 earnings report approaches, here are some related stocks worth considering:

Industry and Stocks

| Industry | Stocks |

|---|---|

| Chip Manufacturers | Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) QUALCOMM Incorporated(QCOM.US) |

| Semiconductor Equipment | Applied Materials, Inc.(AMAT.US) Lam Research Corporation(LRCX.US) |

| Utilities/Power | |

| Servers | |

| Software | Microsoft Corporation(MSFT.US) |

| Data Storage | Pure Storage, Inc. Class A(PSTG.US) Western Digital Corporation(WDC.US) Seagate Technology PLC(STX.US) |

| Networking | |

| Thermal Management/Cooling | |

| Copper/Fiber Optics |

Nvidia-related ETFs

| Type | ETF |

|---|---|

| Leveraged Long ETFs | T-Rex 2X Long NVIDIA Daily Target ETF(NVDX.US) |

| Inverse ETFs | Direxion Shares ETF Trust Direxion Daily NVDA Bear 1X Shares(NVDD.US) |

Are you optimistic about Nvidia's performance this quarter? Share your thoughts and join the discussion!